Are Vishay Intertechnology’s (VSH) New Product Launches a Turning Point for Its Growth Ambitions?

Reviewed by Sasha Jovanovic

- In recent days, Vishay Intertechnology announced an expanded product lineup, including the launch of the AEC-Q200 qualified LTA 50 power resistor for automotive applications and the DLA 04051 series polymer chip capacitors for aerospace and defense use, as well as a significant broadened offering of inductors and frequency control devices.

- This series of launches highlights Vishay’s focus on increasing its presence in high-growth markets by supporting critical applications across electric vehicles and AMS sectors, while continuing to invest in global manufacturing capacity and supply chain resilience.

- We'll consider how the launch of new automotive and aerospace components could reshape Vishay's long-term growth and market positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vishay Intertechnology Investment Narrative Recap

To be a Vishay Intertechnology shareholder today, an investor needs to have confidence that the company’s heavy investment in capacity, despite recent unprofitability and negative free cash flow, will ultimately drive a rebound in high-growth sectors like automotive and aerospace electronics. The launch of new qualified power resistors and capacitors supports potential design wins in critical markets, but these product expansions are unlikely to materially shift near-term margin recovery, the most important short-term catalyst, or alter the ongoing pressure on cash flows, which remains the biggest risk. Among the recent announcements, the introduction of the AEC-Q200 qualified LTA 50 power resistor stands out. With its automotive-grade reliability, the device specifically targets the accelerating electrification of vehicles, aligning closely with Vishay’s hopes for stronger momentum and improved product mix in the electric vehicle supply chain. But while new product launches generate optimism, investors should be mindful that continued cash flow pressures might mean...

Read the full narrative on Vishay Intertechnology (it's free!)

Vishay Intertechnology is projected to reach $3.5 billion in revenue and $587.0 million in earnings by 2028. This outlook relies on a 6.6% annual revenue growth rate and a $674.7 million increase in earnings from the current level of -$87.7 million.

Uncover how Vishay Intertechnology's forecasts yield a $14.00 fair value, a 15% downside to its current price.

Exploring Other Perspectives

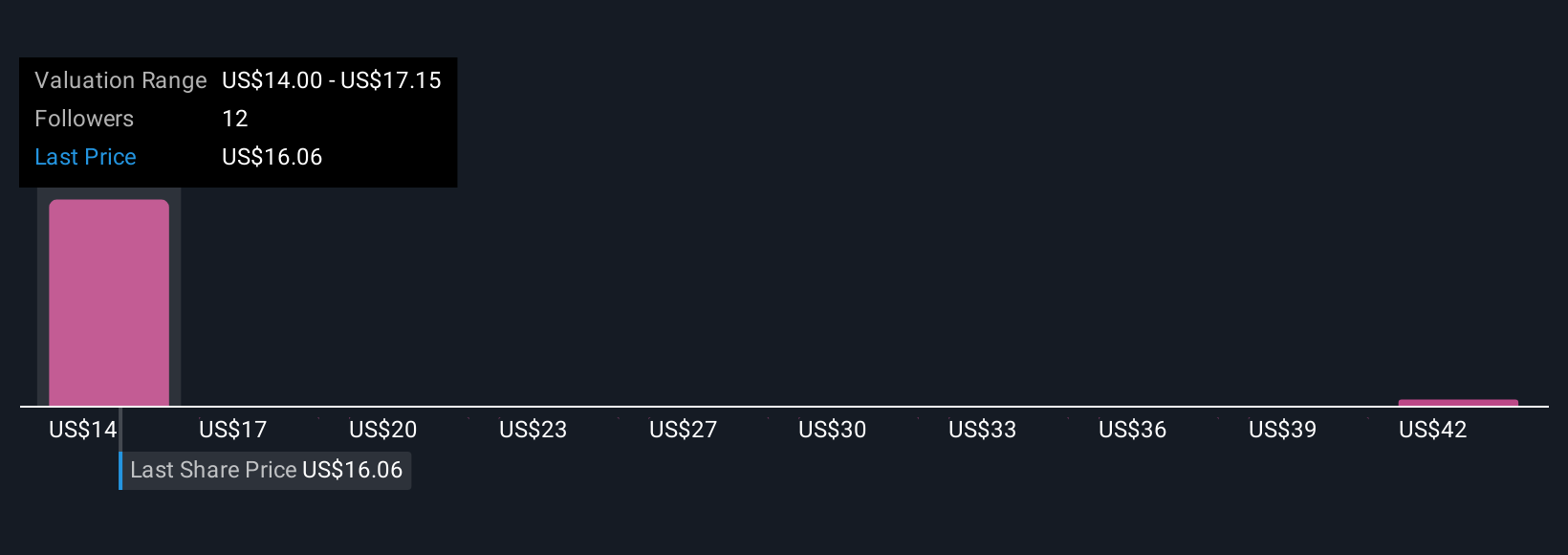

Community members have posted fair value estimates ranging from US$14 to US$45.54 across 3 perspectives in the Simply Wall St Community. This wide divergence stands in contrast to the current risk of ongoing negative free cash flow and illustrates just how differently market participants are weighing Vishay’s outlook.

Explore 3 other fair value estimates on Vishay Intertechnology - why the stock might be worth 15% less than the current price!

Build Your Own Vishay Intertechnology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vishay Intertechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vishay Intertechnology's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives