Announcing: Vishay Precision Group (NYSE:VPG) Stock Increased An Energizing 166% In The Last Three Years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Vishay Precision Group, Inc. (NYSE:VPG) share price has soared 166% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 18% gain in the last three months. But this could be related to the strong market, which is up 8.9% in the last three months.

See our latest analysis for Vishay Precision Group

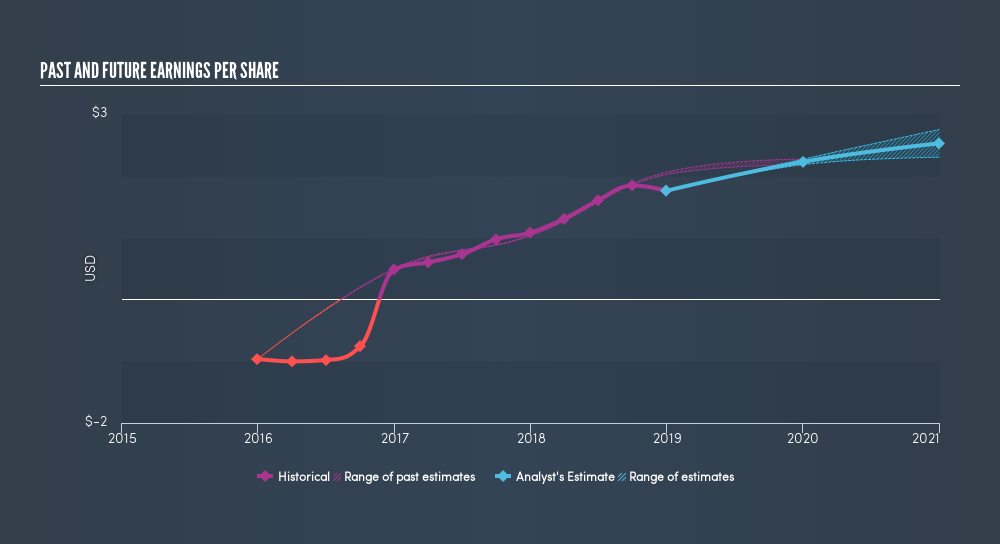

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Vishay Precision Group moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Vishay Precision Group has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

We're pleased to report that Vishay Precision Group shareholders have received a total shareholder return of 10% over one year. However, that falls short of the 16% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. If you would like to research Vishay Precision Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Vishay Precision Group may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:VPG

Vishay Precision Group

Operates in the precision measurement and sensing technologies in the United States, Europe, Israel, Asia, and Canada.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives