Vontier (VNT): Assessing Valuation Following Consistent Share Price Gains and Steady Financial Performance

Reviewed by Simply Wall St

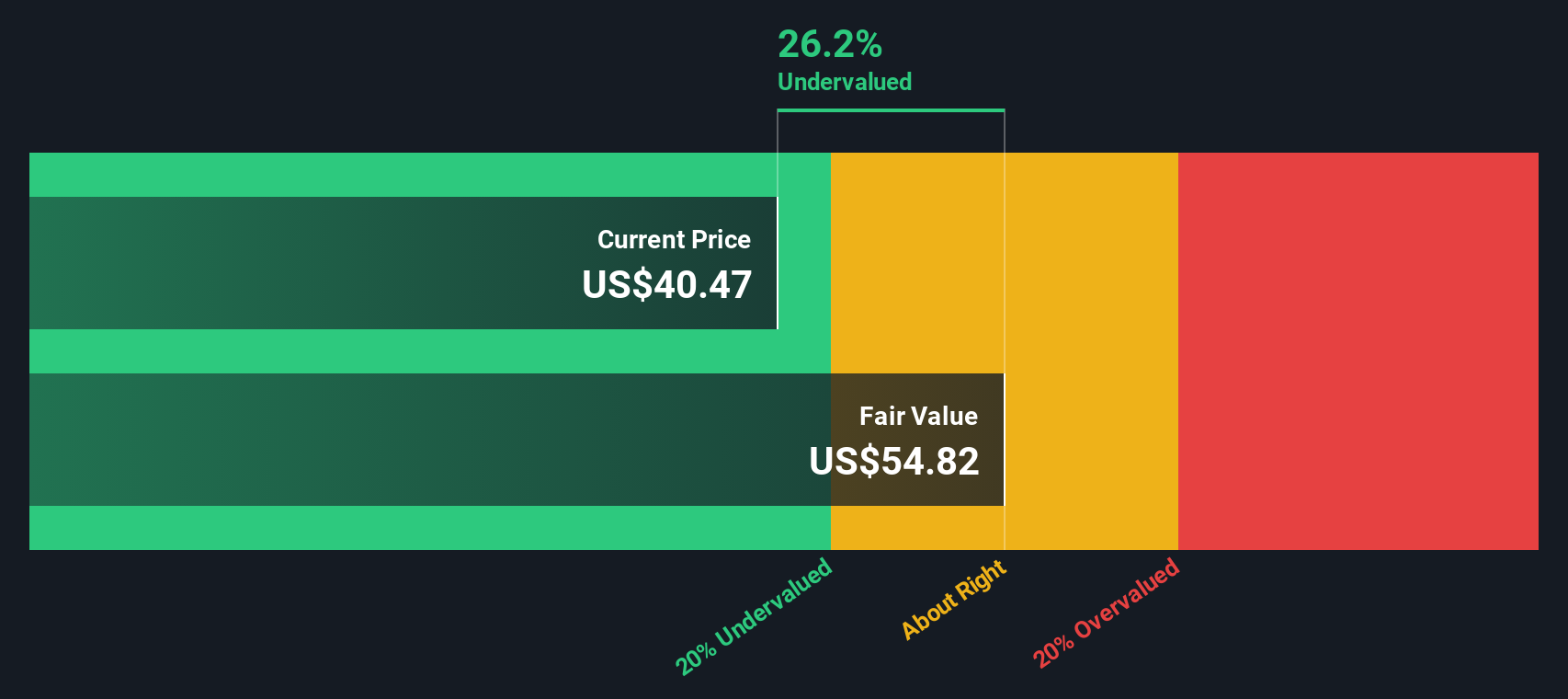

Most Popular Narrative: 21.2% Undervalued

According to the most-followed narrative, Vontier currently appears significantly undervalued by more than 20% compared to its estimated fair value. The analysis is based on management quality, long-term business system advantages, and the company’s ability to redeploy capital efficiently following its spinoff.

Vontier has inherited a proven business system of disciplined capital allocation and continuous improvement from its former parent companies, Danaher and Fortive. The spinoff from Fortive will allow Vontier to redeploy capital to its business because its former parent invested less than 5% of its total M&A capital in Vontier.

Wondering why Vontier’s fair value is significantly higher than the current share price? The narrative points to future growth estimates, healthy margins, and a profit multiple usually seen with industry standouts. Interested in the specific assumptions behind this outlook? Discover what is driving these numbers and how ambitious targets could influence the outcome.

Result: Fair Value of $54.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, core revenue growth has been sluggish, and disruption from electric vehicles could threaten Vontier’s retail fueling business in the long term.

Find out about the key risks to this Vontier narrative.Another View: SWS DCF Model Weighs In

While the most-followed narrative focuses on value created by management quality and business strengths, our DCF model also finds Vontier undervalued using a different approach. Could both methods be pointing to the same opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vontier for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vontier Narrative

If you see things differently or prefer diving into the data yourself, you can quickly build your own perspective in just a few minutes. Do it your way

A great starting point for your Vontier research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass you by. The Simply Wall Street Screener puts curated stock ideas at your fingertips, so you never miss what’s next in the market.

- Tap into the world of emerging technologies with quantum computing stocks to see which companies are fueling breakthroughs in quantum computing and innovation.

- Spot funds flowing to high-yield companies using dividend stocks with yields > 3%, where stable businesses are rewarding shareholders with attractive dividend payouts above 3%.

- Seize a value edge by hunting for the market’s hidden gems through undervalued stocks based on cash flows to uncover stocks trading at notably attractive cash flow valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNT

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives