- United States

- /

- Communications

- /

- NYSE:UI

Ubiquiti (UI): Evaluating Valuation After Strong Earnings Growth and Dividend Boost

Reviewed by Simply Wall St

Ubiquiti (UI) just revealed strong first-quarter results, showing impressive jumps in both sales and net income compared to last year. In addition, the board has announced a higher quarterly cash dividend for shareholders.

See our latest analysis for Ubiquiti.

Ubiquiti’s strong first-quarter earnings and a newly boosted dividend have been the main headlines in recent weeks, but the stock itself has had a wild ride. After rapid gains earlier this year, culminating in a year-to-date share price return of nearly 66%, shares have pulled back sharply over the past month as short-term traders took profits. However, the company’s 1-year total shareholder return of nearly 68% and 5-year total return of 139% still point to excellent long-term wealth creation and a business with enduring momentum.

If you’re curious what else investors are following as this momentum shifts, now might be the right time to discover fast growing stocks with high insider ownership

With such strong financials fueling momentum and a recently boosted dividend, the real question is whether Ubiquiti’s current share price still offers room for upside or if the market is already crediting the company’s future growth potential.

Price-to-Earnings of 42.7x: Is it justified?

Ubiquiti is currently valued at a price-to-earnings (P/E) ratio of 42.7x, placing its shares at a premium relative to the latest share price of $558.56 and both industry and fair value benchmarks.

The P/E ratio tells investors how much they are paying for each dollar of company earnings. Since technology companies often trade at elevated P/E multiples due to strong growth potential, it is an important gauge of how future profitability expectations are priced in.

Ubiquiti’s P/E ratio exceeds both the US Communications industry average (31.9x) and the estimated fair P/E (41.9x), suggesting the market is assigning a higher value to its profits than its typical peers and even its own fair price. Investors appear to be pricing in sustained or accelerating profit growth, especially after Ubiquiti’s recent surge in earnings. However, this premium leaves little room for disappointment if growth slows.

Explore the SWS fair ratio for Ubiquiti

Result: Price-to-Earnings of 42.7x (OVERVALUED)

However, a lofty valuation and recent share price volatility mean that any earnings disappointment or market shift could quickly test investor confidence.

Find out about the key risks to this Ubiquiti narrative.

Another View: What Does the DCF Model Say?

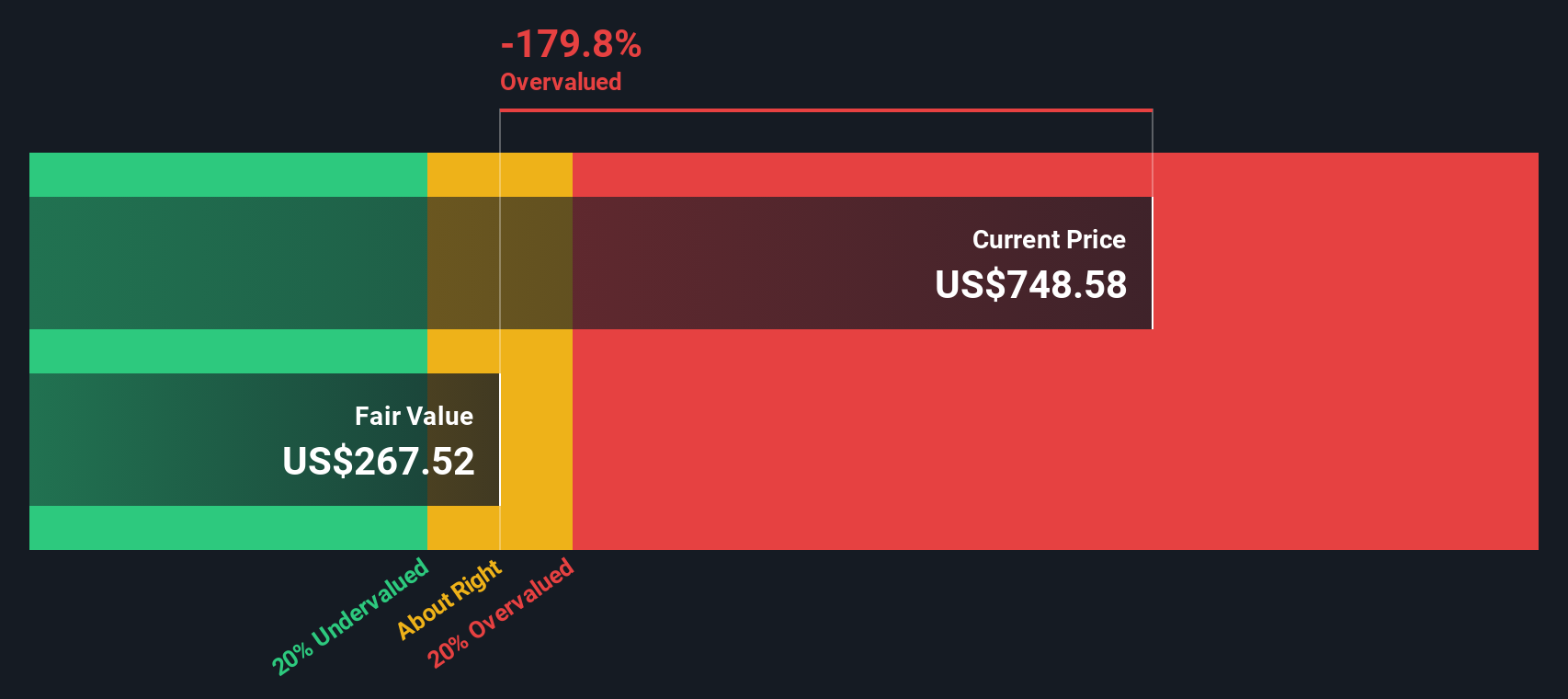

While Ubiquiti looks richly valued on earnings, our SWS DCF model provides a very different perspective. According to this approach, the current share price of $558.56 is well above the estimated fair value of $142.95. This suggests the stock is significantly overvalued. Could the market be too optimistic about Ubiquiti’s long-term growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ubiquiti for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ubiquiti Narrative

If you think there’s more to the story or simply want to dig into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Ubiquiti research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big opportunity pass by. Equip yourself with the right investment tools and uncover standout stocks perfectly matched to your goals.

- Unlock the potential of stable income streams by accessing these 16 dividend stocks with yields > 3%, which offers yields above 3% and strong fundamentals.

- Seize growth before the crowd by checking out these 894 undervalued stocks based on cash flows, featuring stocks priced attractively by their cash flows.

- Get ahead of financial innovation by exploring these 82 cryptocurrency and blockchain stocks, focused on businesses driving progress in blockchain and digital currency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers in North America, Europe, the Middle East, Africa, Asia Pacific, South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives