- United States

- /

- Communications

- /

- NYSE:UI

After Leaping 25% Ubiquiti Inc. (NYSE:UI) Shares Are Not Flying Under The Radar

Ubiquiti Inc. (NYSE:UI) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. The annual gain comes to 208% following the latest surge, making investors sit up and take notice.

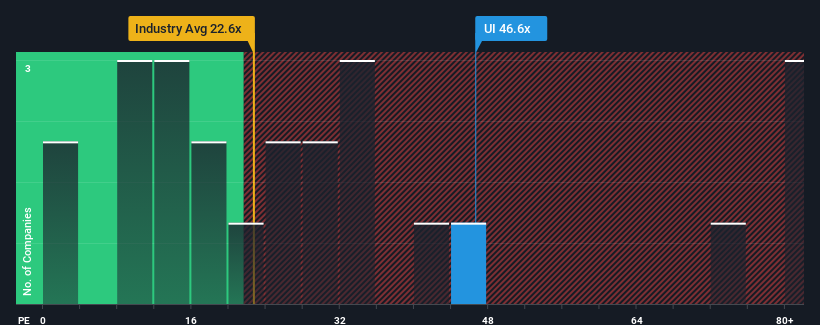

After such a large jump in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Ubiquiti as a stock to avoid entirely with its 46.6x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about Ubiquiti. View them for free.With earnings growth that's superior to most other companies of late, Ubiquiti has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Ubiquiti

Is There Enough Growth For Ubiquiti?

The only time you'd be truly comfortable seeing a P/E as steep as Ubiquiti's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 20% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 26% over the next year. Meanwhile, the rest of the market is forecast to only expand by 13%, which is noticeably less attractive.

In light of this, it's understandable that Ubiquiti's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Ubiquiti's P/E?

The strong share price surge has got Ubiquiti's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Ubiquiti's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Ubiquiti that you should be aware of.

If these risks are making you reconsider your opinion on Ubiquiti, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers in North America, Europe, the Middle East, Africa, Asia Pacific, South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026