TE Connectivity (TEL): Market Optimism on AI Drives New Highs—But Is the Valuation Justified?

Reviewed by Kshitija Bhandaru

TE Connectivity (TEL) reached fresh highs as interest surged across companies linked to artificial intelligence trends. The recent rally seems driven by investors gravitating toward firms that are well positioned in future-facing tech sectors.

See our latest analysis for TE Connectivity.

Momentum has definitely been picking up for TE Connectivity this year, with the share price notching new highs and a steady positive trend reflecting investors’ growing optimism around its tech and AI exposure. Looking back, the stock’s total shareholder return over the past year has been solid, hinting at both near-term market enthusiasm and confidence in its long-term growth story.

If you’re in the mood to uncover more companies riding the tech and AI innovation trend, it’s worth checking out our curated See the full list for free..

With shares reaching record territory and optimism running high, the big question remains: is TE Connectivity now trading at a premium, or could there still be meaningful upside for those considering an entry point?

Most Popular Narrative: Fairly Valued

TE Connectivity's last close price of $220.84 is very close to the narrative’s updated fair value estimate of $223.06. With both figures nearly aligned, the narrative performance puts current market pricing in sharp focus for investors gauging further upside.

TE Connectivity's rapid revenue growth in AI-driven data center infrastructure demonstrates the increasing global demand for high-performance connectivity. This is supported by a near tripling of AI-related revenue from $300M to over $800M in fiscal 2025. Continued investment and scaling suggest this trend will fuel further top-line growth and maintain above-segment margins.

Curious how ambitious projections about AI, automotive, and electrification are shaping this story? The real intrigue lies in the bold assumptions behind growth, margins, and what analysts think the company can deliver by 2028. Think you can guess which key estimates underpin this near match between the current share price and fair value? Only the narrative reveals the full picture.

Result: Fair Value of $223.06 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain volatility or an unexpected slowdown in key Asian markets could quickly challenge TE Connectivity’s positive outlook and growth expectations.

Find out about the key risks to this TE Connectivity narrative.

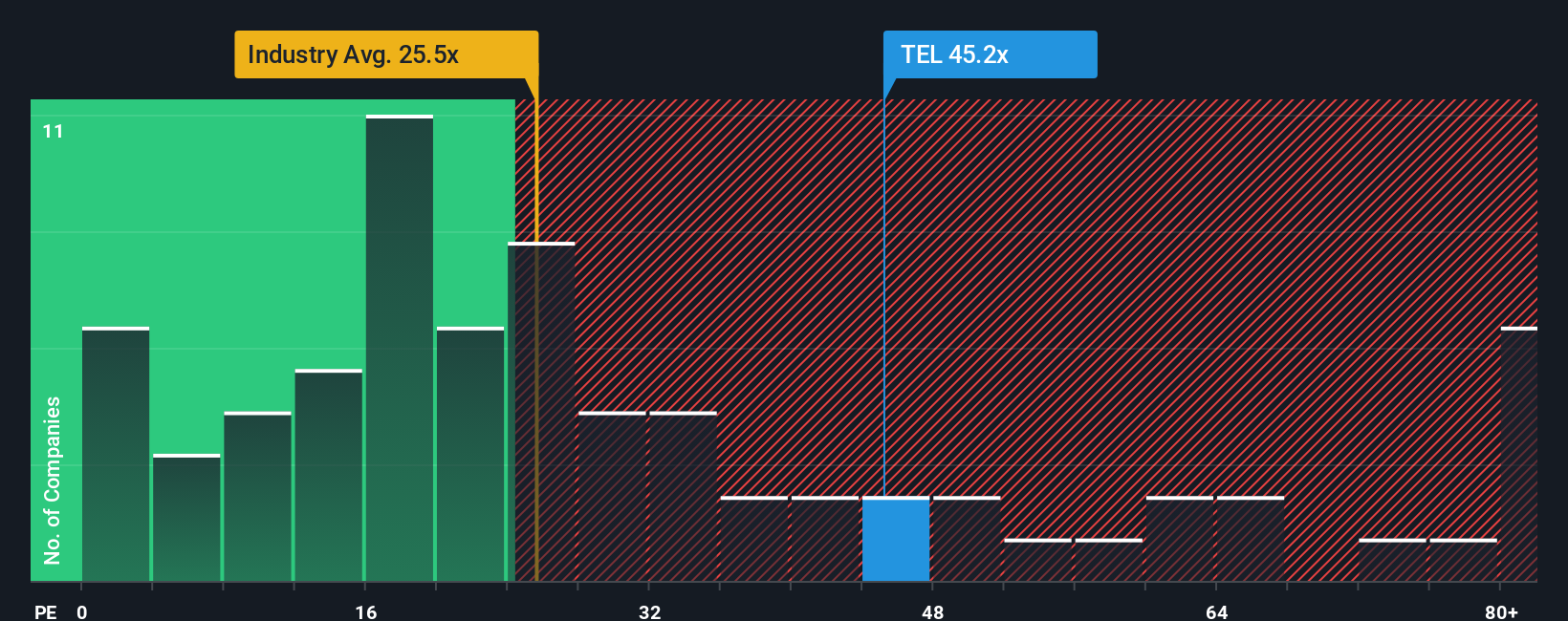

Another View: Multiples Bring Caution

Looking through a different lens, TE Connectivity trades at a price-to-earnings ratio of 44.8x, which is well above both the US Electronic industry average of 24.4x and its peer group average of 29.9x. Even compared to a fair ratio of 36.6x, shares look stretched. This gap suggests investors are paying a hefty premium, raising questions about whether future growth will fully justify the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TE Connectivity Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, crafting your own narrative takes just a few minutes. Do it your way.

A great starting point for your TE Connectivity research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for More Standout Investment Ideas?

Smart investors take action before opportunities become obvious. Use the Simply Wall Street Screener to get ahead. Don’t risk missing out on promising strategies and market movers.

- Tap into long-term growth by tracking stable dividend performers via these 19 dividend stocks with yields > 3%, and spot companies offering resilient yields above 3%.

- Unlock the future of healthcare by seeking out emerging technology leaders, and see how breakthroughs are reshaping medicine with these 31 healthcare AI stocks.

- Catch the next surge in digital assets by following the momentum of innovative businesses in these 78 cryptocurrency and blockchain stocks, where finance and blockchain intersect.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives