Does TEL’s Energy Push and Earnings Beat Reshape the Bull Case for TE Connectivity (TEL)?

Reviewed by Sasha Jovanovic

- In recent months, TE Connectivity plc completed its acquisition of Richards Manufacturing Co. and reported quarterly results and guidance that surpassed earlier Wall Street expectations, reinforcing its role as a global supplier of connectors, sensors, and electronic components across transportation, industrial, and communications markets.

- The combination of the Richards Manufacturing deal and stronger-than-anticipated earnings has highlighted TE Connectivity’s efforts to broaden its energy-focused product portfolio and diversify revenue sources.

- Next, we’ll examine how the Richards Manufacturing acquisition and stronger earnings outlook could influence TE Connectivity’s existing investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

TE Connectivity Investment Narrative Recap

To own TE Connectivity, you have to believe in long term demand for high quality connectors, sensors, and energy infrastructure as AI, electrification, and industrial automation continue to spread. The Richards Manufacturing acquisition and stronger than expected results support the near term growth story in grid and energy applications, while integration execution and exposure to AI and Asian transportation markets remain key risks that the latest news does not fully resolve.

The recent Richards Manufacturing deal stands out as most relevant, because it directly reinforces TE Connectivity’s push into energy focused products and grid hardening, one of its clearest growth drivers. Coupled with earnings and guidance that exceeded earlier expectations, this acquisition adds weight to the idea that energy and industrial demand could help offset any softness in Western auto production and reduce reliance on a few high growth end markets.

Yet even with these positives, investors still need to watch how integration risk and shifting regional production trends could affect the company’s reliance on AI, energy, and Asian transportation...

Read the full narrative on TE Connectivity (it's free!)

TE Connectivity's narrative projects $20.3 billion revenue and $3.1 billion earnings by 2028.

Uncover how TE Connectivity's forecasts yield a $270.47 fair value, a 15% upside to its current price.

Exploring Other Perspectives

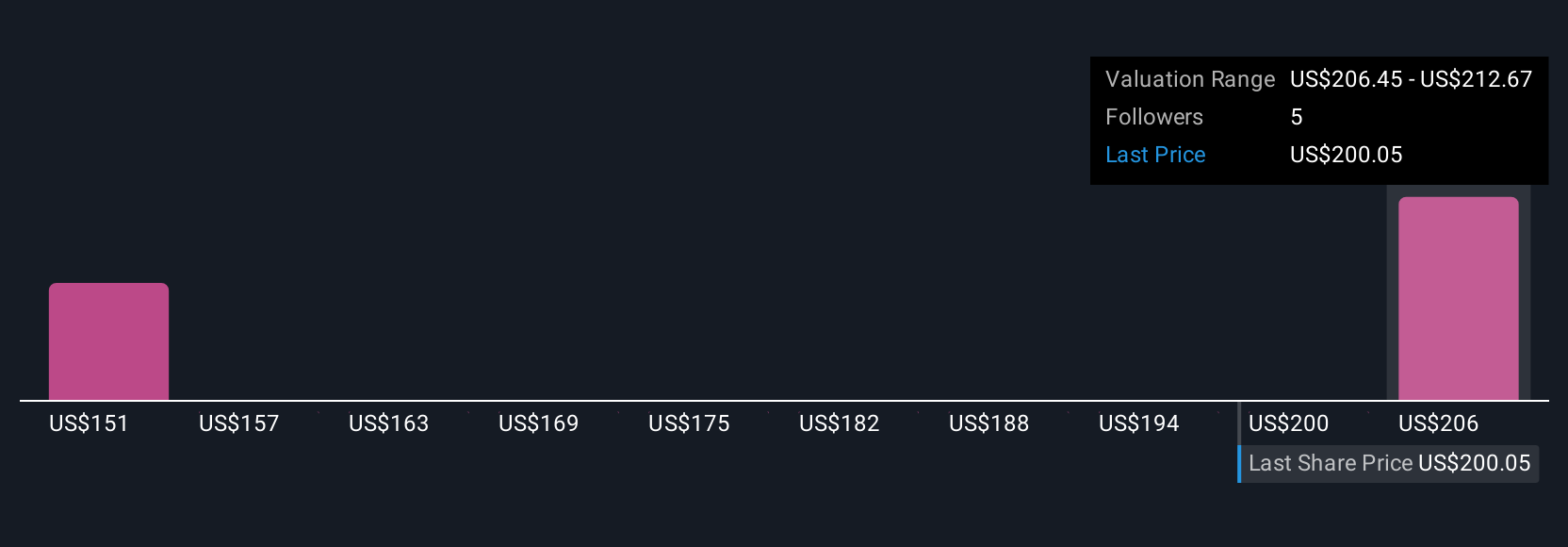

Two fair value estimates from the Simply Wall St Community span a wide range, from about US$188 to roughly US$270 per share, showing how far apart views on TE Connectivity can be. Against that backdrop, TE’s push into energy and grid hardening through the Richards Manufacturing acquisition raises important questions about how much future growth from these projects might matter for the business.

Explore 2 other fair value estimates on TE Connectivity - why the stock might be worth 20% less than the current price!

Build Your Own TE Connectivity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TE Connectivity research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free TE Connectivity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TE Connectivity's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026