Why Teledyne Technologies (TDY) Is Up 6.2% After Analysts Raise 2025 Earnings Outlook and What's Next

Reviewed by Simply Wall St

- Teledyne Technologies recently saw increased optimism from analysts regarding its earnings prospects for the June 2025 quarter, with new estimates now above the consensus forecast.

- This shift signals a growing consensus that Teledyne may benefit from improved quarterly performance, despite some lingering caution among market observers.

- With analysts raising their near-term outlook, we'll explore how this renewed optimism could influence Teledyne's longer-term investment narrative.

Teledyne Technologies Investment Narrative Recap

To be a Teledyne shareholder, you need confidence in the company’s ability to generate reliable growth by leveraging both defense and commercial technology markets, balanced against risk factors such as tariff-driven cost increases and international exposure. The latest analyst earnings upgrades for June 2025 may support the narrative of resilience, but they do not materially alter the biggest near-term catalyst, expanding defense contracts, nor do they fully address the ongoing concern regarding supply chain cost volatility. One recent announcement closely linked to these catalysts is Teledyne FLIR Defense’s successful placement of the Black Hornet 4 drone on the Blue UAS List, boosting its credentials for military procurement opportunities. Continued momentum in securing technology contracts could support revenue resilience, but questions remain about how quickly these wins translate into meaningful earnings growth due to factors like integration challenges and ongoing operating cost risks. Yet, in contrast to rising optimism, investors should be aware of ongoing pressures from tariffs and potential cost increases...

Read the full narrative on Teledyne Technologies (it's free!)

Teledyne Technologies' outlook anticipates $6.8 billion in revenue and $1.1 billion in earnings by 2028. This scenario assumes a 5.5% annual revenue growth rate and a $270.7 million increase in earnings from the current $829.3 million.

Exploring Other Perspectives

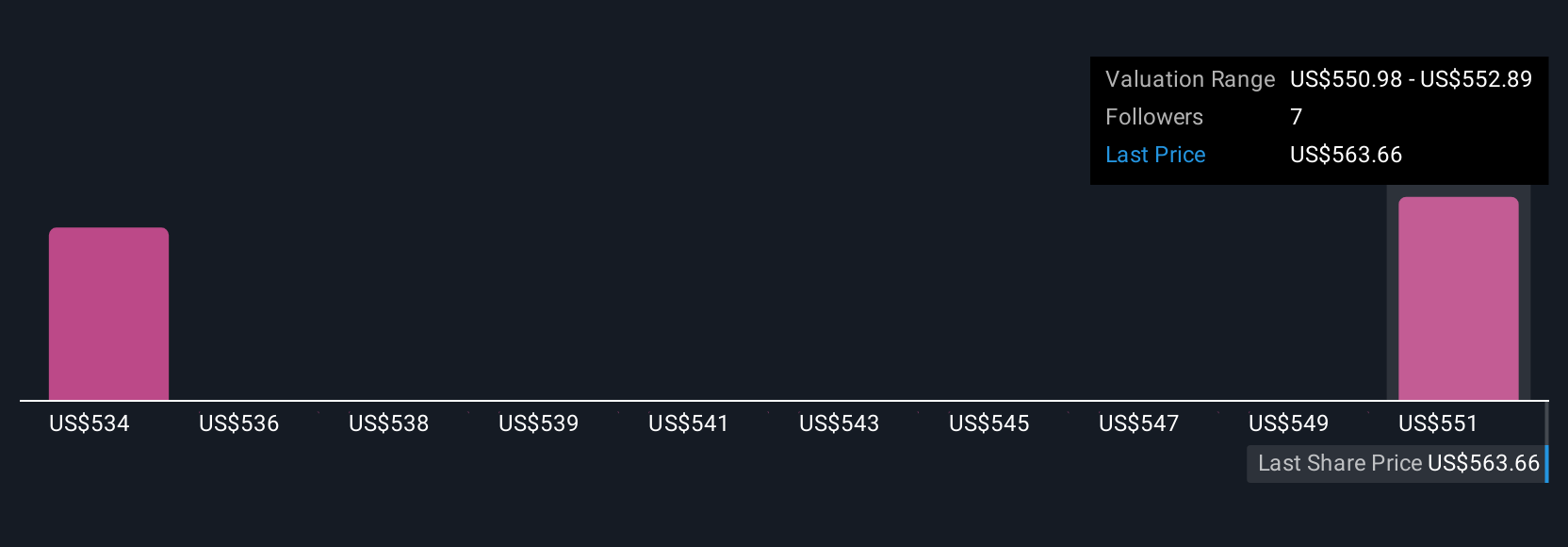

Simply Wall St Community members provided 2 fair value estimates for Teledyne, ranging from US$533.64 to US$552.89 per share. While many see room for growth through new defense contracts, cost risks tied to tariffs and global volatility remain a key consideration for future company performance.

Build Your Own Teledyne Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teledyne Technologies research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teledyne Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teledyne Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives