Teledyne Technologies (TDY) Margin Decline Challenges Bullish Narratives Despite Solid Growth Forecasts

Reviewed by Simply Wall St

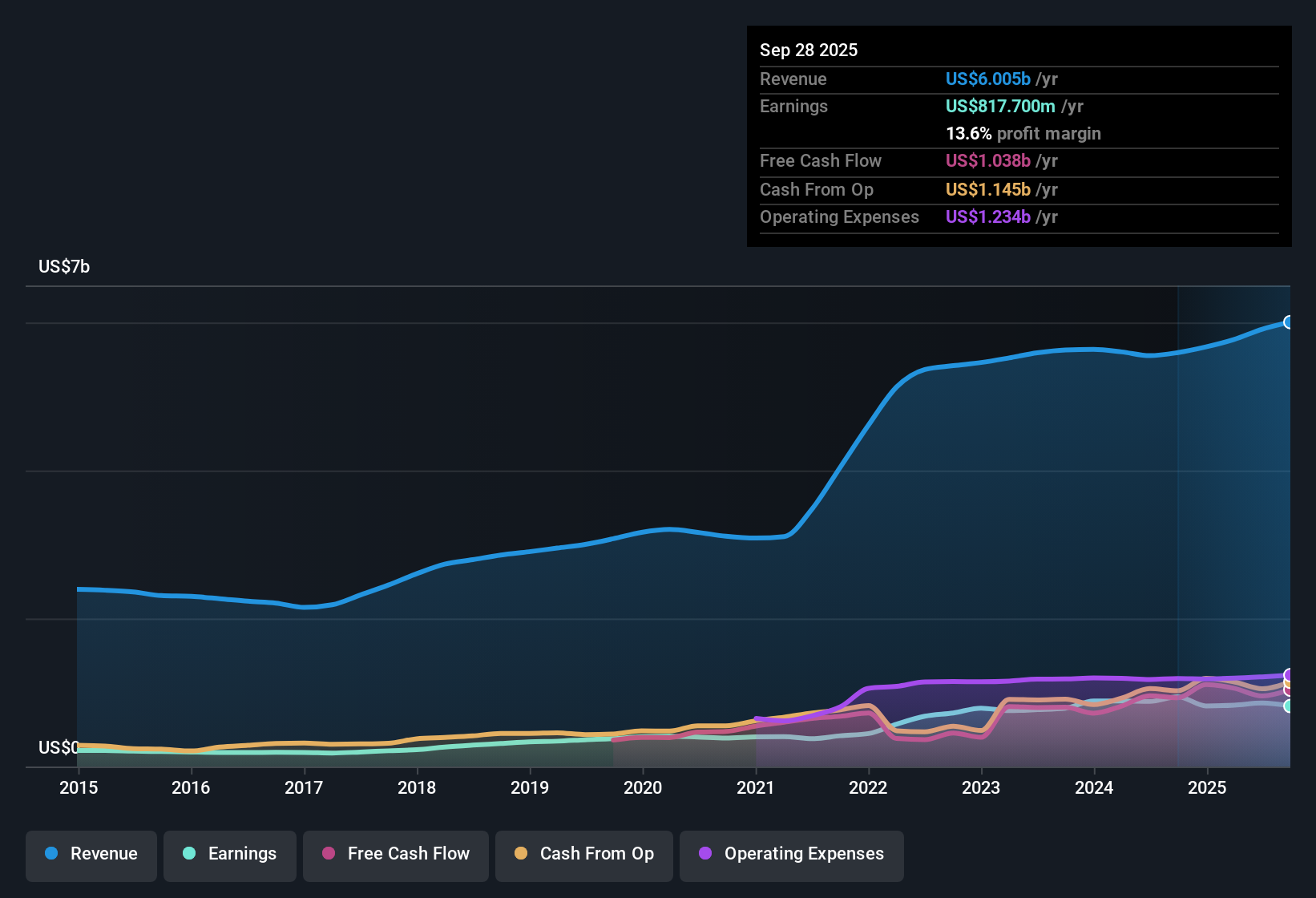

Teledyne Technologies (TDY) saw its annual revenue forecast climb by 5.2% per year, trailing the broader US market’s 10.1% pace. Earnings are now expected to grow at 11.78% annually, while the company’s net profit margin has slipped to 14.5% from 15.9% a year ago. Recent performance marks a departure from the robust 18.5% annualized profit growth achieved over the last five years. Trading below its estimated fair value and boasting a price-to-earnings ratio of 29.7x, Teledyne finds itself in a space where upside comes from steady, if modest, profit and revenue growth. Few risks have been identified and cautious optimism is reflected in investor sentiment.

See our full analysis for Teledyne Technologies.Up next, we compare these headline numbers with the most widely followed narratives to see which investor stories are reinforced and where the results may challenge consensus thinking.

See what the community is saying about Teledyne Technologies

Order Growth Drives Scale in Core Segments

- Analysts forecast that Teledyne's profit margin will climb from 14.5% currently to 16.2% within three years, while earnings are projected to reach $1.1 billion by September 2028, up from $859 million today.

- According to the analysts’ consensus view, robust demand for defense, aerospace, and marine instrumentation is fueling favorable order growth and supporting high-margin opportunities in key business lines.

- Order books benefit from sustained global defense and aerospace spending, with unmanned systems such as FLIR and marine vehicles contributing to long-cycle revenue visibility.

- The integration of recent acquisitions, especially FLIR, expands higher-margin offerings in thermal imaging and advanced sensors, reinforcing the case for ongoing operating leverage and scale.

Consensus forecasts see the company's evolving mix as lifting profitability, especially as big wins in defense and sensing tech support the case for steady long-term growth.

📊 Read the full Teledyne Technologies Consensus Narrative.

Cash Flow and Margin Volatility Remain Under Watch

- Operating and free cash flow both dropped materially year over year, pressured by higher income tax outflows and capital spending, reigniting debate over the durability of Teledyne’s improving profit margins.

- The consensus narrative points out that, while disciplined M&A and operational execution have delivered margin gains in some segments, persistent trade, supply chain, and integration headwinds could weigh on margins going forward.

- Recently acquired segments such as Aerospace and Defense Electronics, DALSA, and e2v have experienced year-over-year margin declines, posing a test for further integration benefits.

- Bears highlight that continued cost inflation and exposure to $700 million in imported, tariff-sensitive materials could force further margin compression if not addressed with pricing or supply chain shifts.

Valuation Discount Versus Peers, With Modest Upside to Target

- Teledyne currently trades at a price-to-earnings ratio of 29.7x, notably lower than its peer average, above the US electronics industry average of 23.9x, and sits just below its DCF fair value of $543.89; the current share price is $543.73, while the analysts’ consensus price target stands at $617.45.

- Under the analysts’ consensus view, the stock’s reasonable valuation relative to peers is underpinned by expectations of sustained EPS growth, margin expansion, and successful integration of acquisitions, but assumes that 2028 earnings justify a price-to-earnings ratio of 32.9x, a premium to the broader industry.

- Consensus highlights a required leap in profit margins from today’s 14.5% to 16.2%, and for shares outstanding to rise just 0.61% annually, in order to meet projections for $1.1 billion earnings.

- With the current price closely hugging DCF fair value, further upside depends on Teledyne hitting those heightened profitability and growth assumptions. Otherwise, the valuation advantage could erode quickly relative to sector rivals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Teledyne Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you spot something others missed? Share your viewpoint and shape the conversation by crafting a personalized take in under three minutes. Do it your way

A great starting point for your Teledyne Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Teledyne faces pressure from declining cash flow and margin volatility. This raises questions about the sustainability of its recent profitability gains.

If choppy cash flow worries you, target stable growth stocks screener (2094 results) to focus on companies proving steady earnings and consistent growth regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives