Is Teledyne Technologies (TDY) Now Undervalued After Its Recent Share Price Weakness?

Reviewed by Simply Wall St

Teledyne Technologies (TDY) has been drifting slightly lower over the past week, even though its longer term returns still look solid. Let us unpack what might be driving that hesitation.

See our latest analysis for Teledyne Technologies.

At around $502.82, the recent 7 day share price return of negative 3.88 percent and 90 day share price return of negative 11.07 percent suggest momentum has cooled, even though the 1 year total shareholder return of 8.14 percent still points to a respectable longer term outcome.

If Teledyne’s pause has you reassessing your watchlist, this could be a good moment to explore aerospace and defense stocks that are currently capturing more market momentum and interest.

With earnings still growing, shares trading at a discount to analyst targets, and a solid multiyear track record, is Teledyne now quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 19.3% Undervalued

Teledyne Technologies last closed at $502.82 versus a most popular narrative fair value of about $623, framing a sizable implied upside for patient holders.

Order trends remain favorable, with book-to-bill ratios exceeding 1.0 in key business lines, indicating a healthy pipeline and likely organic revenue acceleration as digitization and advanced data analytics drive demand for higher-performance imaging and sensing technologies.

Curious how steady mid single digit growth, rising margins, and a richer future earnings multiple can still add up to this valuation gap? The full narrative lays out a detailed path that challenges typical industrial playbooks and leans on assumptions more often reserved for faster growing tech names.

Result: Fair Value of $623.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer short cycle demand or persistent integration and margin pressures in acquired units could quickly challenge the assumptions behind today’s optimistic valuation gap.

Find out about the key risks to this Teledyne Technologies narrative.

Another Lens on Value

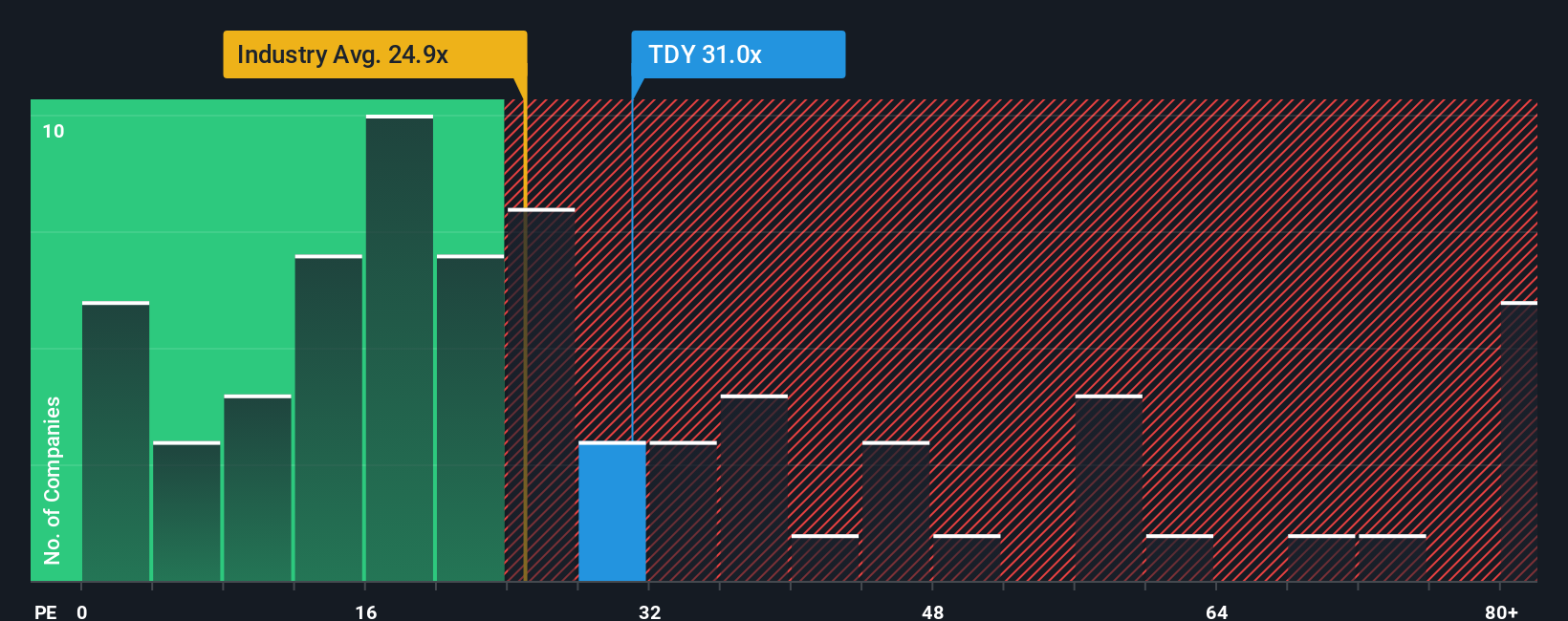

On earnings, Teledyne looks much less of a bargain. Its current P/E of 28.9 times is above the US Electronic industry’s 24.3 times and also above a fair ratio of 24.3 times, suggesting investors are already paying up and leaving less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teledyne Technologies Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a personalized view in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Teledyne Technologies.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to uncover fresh, data driven opportunities that others might miss.

- Explore potential mispricing by scanning these 914 undervalued stocks based on cash flows that strong cash flows suggest the market may be overlooking.

- Focus on structural growth trends by zeroing in on these 24 AI penny stocks that are positioned to benefit as intelligent automation spreads across different industries.

- Review these 13 dividend stocks with yields > 3% that may align with income focused strategies and could help increase the cash yield of your portfolio over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion