Is There Still Room for SYNNEX Shares After Strong 41% Rise in 2024?

Reviewed by Bailey Pemberton

Thinking about what to do with TD SYNNEX stock? You are definitely not alone. The company has quietly turned in a stellar performance, with its share price rising 2.7% in the last week, up nearly 12% over the last month, and soaring an impressive 40.8% year-to-date. Anyone holding since last year has seen a 44.2% return, and the five-year return sits at a remarkable 127.7%. Clearly, something is going right behind the scenes and the market has started to notice.

These kinds of numbers do not just happen by accident. Much of the recent momentum can be traced back to ongoing shifts in the technology distribution space, where TD SYNNEX is leveraging its scale and diversified portfolio to tap into new opportunities. Investors seem to be warming up to the company as broader tech confidence has returned and as global supply chain issues begin to ease, reducing perceived risks for major distributors like TD SYNNEX.

But with solid gains already in the books, the big question on everyone’s mind is whether the stock remains attractively priced or if the easy money has already been made. Based on a widely used set of six valuation checks, TD SYNNEX scores a strong 5, signaling the stock is undervalued in all but one measure. That feels promising, but let’s walk through what these valuation methods tell us about the stock and, more importantly, tease a smarter way to think about TD SYNNEX’s real worth as we go.

Approach 1: TD SYNNEX Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's dollars. This provides a present-day value for the business. This approach is especially popular for businesses like TD SYNNEX because it attempts to quantify the worth of all cash the company is expected to generate for shareholders over time.

For TD SYNNEX, the most recent reported Free Cash Flow stands at $472.5 million. Analyst estimates project a strong ramp-up in cash generation, forecasting annual Free Cash Flow to reach about $2.08 billion ten years from now, with the midpoint five-year estimate landing north of $1.3 billion. It is worth noting that analyst coverage typically extends out five years, and numbers beyond that are generated using reasonable extrapolations.

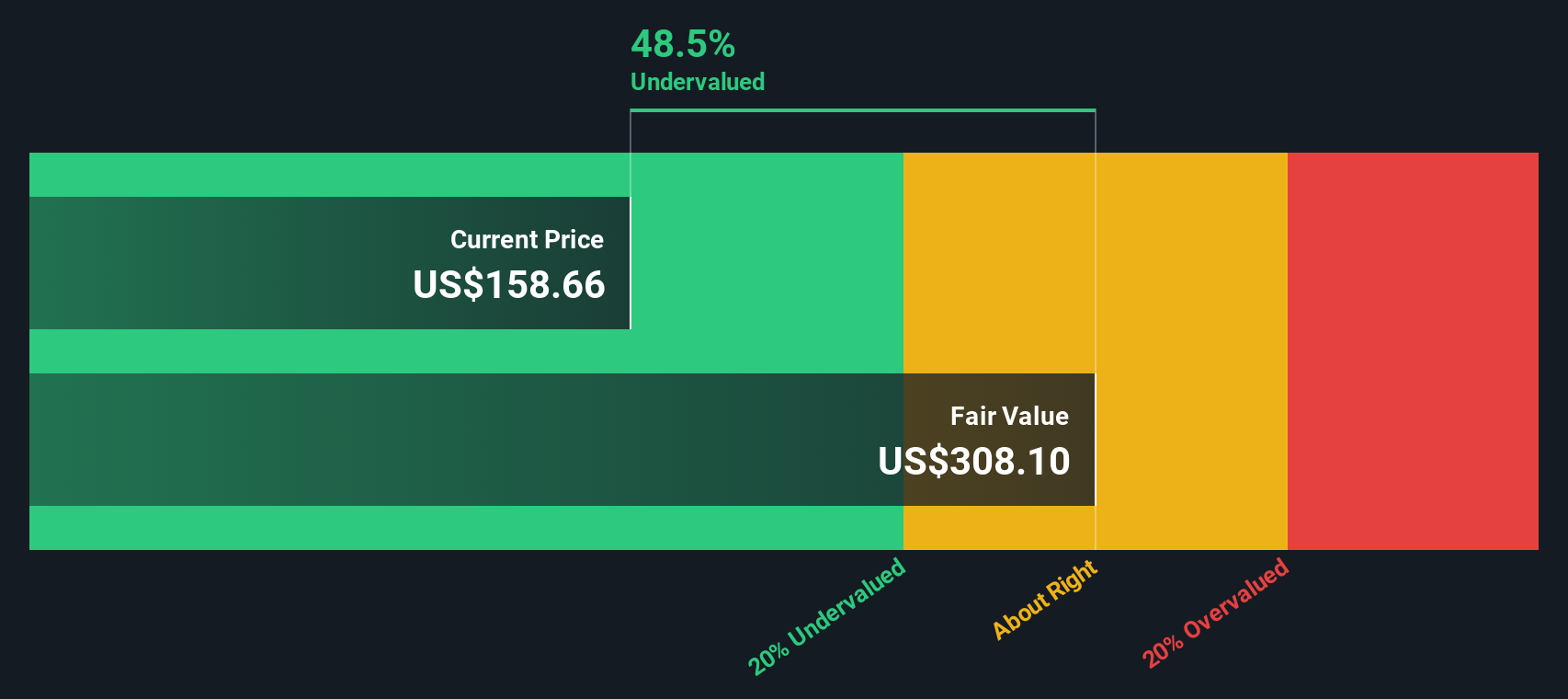

Using this two-stage DCF model, the calculated intrinsic value comes to $308.32 per share. Comparing this to current prices, the DCF model finds the stock is trading at a 46.8% discount to its estimated worth, clearly indicating undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TD SYNNEX is undervalued by 46.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: TD SYNNEX Price vs Earnings

For established, profitable companies like TD SYNNEX, the price-to-earnings (PE) ratio is a tried-and-true valuation tool. It measures how much investors are willing to pay for each dollar of the company’s earnings, offering a quick sense of whether a stock is expensive or cheap relative to its profits.

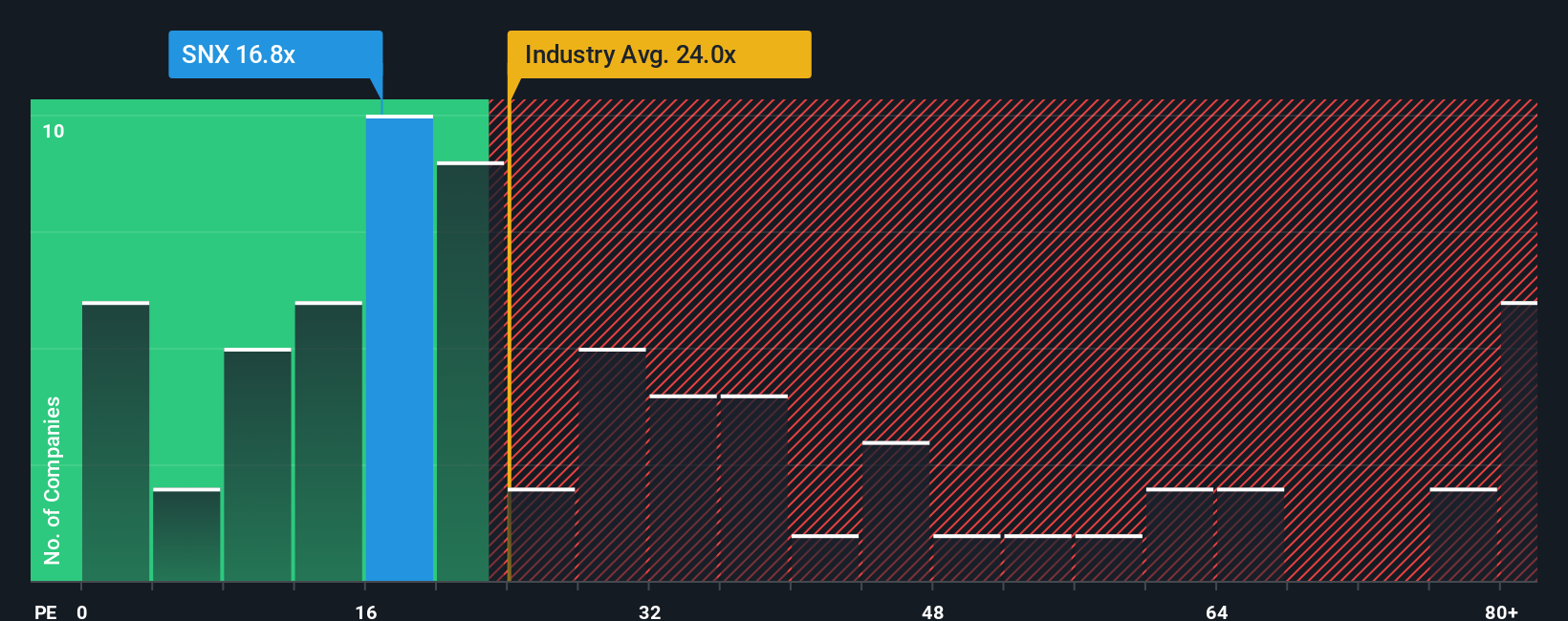

The "right" PE ratio depends not just on the company’s recent profits, but also on its expected growth, stability, and the risks it faces. Fast-growing or lower-risk companies tend to command higher multiples, while more mature or volatile firms trade at lower ones. That context is important when putting TD SYNNEX’s 17.4x PE ratio in perspective. Compared to the Electronic industry average of 24.4x and a peer group at 17.6x, TD SYNNEX appears attractively valued at first glance.

However, a more nuanced view comes from Simply Wall St’s Fair Ratio, which considers TD SYNNEX’s specific growth outlook, profit margins, industry environment, and overall risk profile. This approach goes beyond basic industry and peer comparisons to estimate a fair multiple for the business that accurately reflects its unique strengths and challenges. For TD SYNNEX, the Fair Ratio currently sits at 26.2x, suggesting the stock trades below what would be expected given its performance and outlook. This points toward the shares being undervalued relative to their fair multiple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TD SYNNEX Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful way for you to bring the story behind a company—your perspective on TD SYNNEX’s future—directly into your investment decisions. Instead of relying only on ratios or analyst estimates, Narratives let you outline your expectations for the company’s revenue, earnings, margins, and risk, and then automatically translate that story into a fair value using clear, customizable forecasts.

On Simply Wall St’s Community page, Narratives are quick and accessible for anyone. They are used by millions of investors to connect what’s happening in the real world with financial outcomes. This approach helps you decide if now is the right time to buy or sell by comparing your personalized Fair Value with the current Price, all while keeping your forecasts up-to-date as news or earnings change. Best of all, Narratives are updated instantly as soon as new events occur, so your insights are always current, not stale.

For example, the most optimistic investor might see TD SYNNEX as a big winner from accelerating digital transformation and set a fair value at $170. The most cautious investor could focus on margin risks and price the stock at just $140. Both stories are valid, and both are reflected transparently in the Narrative tool.

Do you think there's more to the story for TD SYNNEX? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TD SYNNEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNX

TD SYNNEX

Operates as a distributor and solutions aggregator for the information technology (IT) ecosystem.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives