- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (PSTG): Assessing Valuation After Strong Monthly Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Pure Storage.

Pure Storage’s upbeat momentum has been building for a while, not just in the past month. With a 1-year total shareholder return of nearly 77% and notable share price gains since the start of the year, the company appears to be benefiting from growing optimism around its growth story and a shift in sentiment in the tech sector.

Tech’s hot streak continues, so if you’re interested in discovering more, check out See the full list for free..

With shares surpassing analyst targets and strong returns over multiple years, the big question for investors is whether Pure Storage still has room to run or if the company’s impressive growth is already factored into the price.

Most Popular Narrative: 10% Overvalued

Pure Storage’s current share price of $88.25 stands noticeably above the most popular narrative’s fair value estimate of $80.22. This gap raises crucial questions about the bold projections and optimistic assumptions that underpin recent investor enthusiasm.

Strategic wins and expanding co-engineering relationships with hyperscalers (e.g., Meta) are creating new high-margin royalty and software revenue streams. Ongoing early-stage engagements with additional hyperscalers signal potential for material upside to revenue and gross margin as cloud infrastructure investments scale.

What’s powering this premium? There is a narrative of big tech partnerships, recurring revenue ambitions, and high future margins that most investors never see. But are the projections behind these targets as ambitious as the hype? Dive into the full narrative to see how it all stacks up for Pure Storage.

Result: Fair Value of $80.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Pure Storage’s heavy focus on physical products and rising competition in cloud-native storage could pose challenges to the optimistic growth narrative ahead.

Find out about the key risks to this Pure Storage narrative.

Another View: Our DCF Model Sees Upside

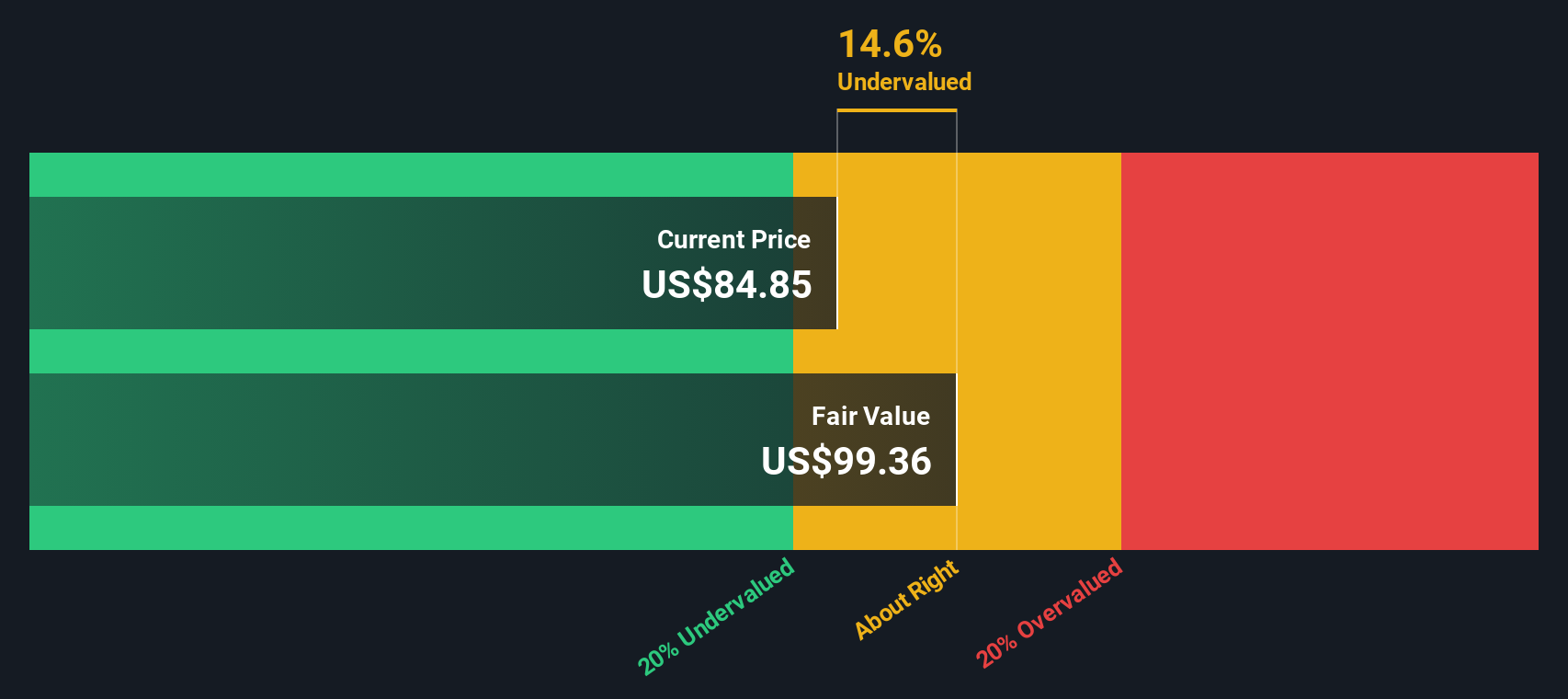

While many debate if Pure Storage is pricey based on analyst targets and typical market ratios, the Simply Wall St DCF model offers a different perspective. According to this method, shares are trading 14.3% below our estimated fair value of $102.95, suggesting potential room for upside. But does this model capture something others miss, or is it being too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pure Storage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pure Storage Narrative

If you have your own perspective or want to dive deep into the data, you can put together your own Pure Storage narrative in just a few minutes. Do it your way.

A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors don’t limit themselves to one opportunity. Open up new possibilities for your portfolio by checking out unique stock lists with strong potential before others catch on.

- Spot companies with high yields and steady payouts by reviewing these 19 dividend stocks with yields > 3% that consistently deliver impressive income streams.

- Get ahead of the curve by seeing these 78 cryptocurrency and blockchain stocks poised to benefit as digital assets and blockchain adoption ramp up worldwide.

- Find market opportunities hiding in plain sight with these 909 undervalued stocks based on cash flows, highlighting stocks trading for less than their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.