- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Does Recent Pure Storage Rally Signal More Room for Growth in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Pure Storage stock? You are certainly not alone right now. This is a company that has been on a remarkable run, and it is no surprise investors are looking for both reason and reassurance before making their next move. Over just the last week, the stock rose 5.4%, and in the past month it’s gained 9.7%. Stretch that out to a year, and you will see a return of 69.6%. Looking even further back, the numbers are jaw-dropping, with a five-year return of 394.5%. These kinds of gains tend to sharpen the conversation around risk, reward, and where the value lies today.

Growth has clearly been on Pure Storage’s side, but a new phase seems to be kicking in as the market weighs recent developments in the enterprise storage sector and shifting investor sentiment toward tech infrastructure. With those trends, the key question is not simply, “Is it too late?” Instead, investors may be asking, “What is Pure Storage truly worth now?”

If you are eyeing the numbers, you might have seen Pure Storage’s valuation score sits at 2 out of 6, which means it is currently considered undervalued by two traditional metrics. That is a modest result and it sets up an examination of how different valuation checks measure Pure Storage, and importantly, whether those tools are enough to capture the full story. Toward the end, an alternative way to think about valuation will be shared that could provide additional insight for decision-making.

Pure Storage scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Pure Storage Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model forecasts a company’s future cash flows and discounts them to today’s value. This aims to estimate what the business is truly worth now. This method is widely used for companies like Pure Storage, where growth and cash generation are crucial to valuation.

For Pure Storage, the most recent reported Free Cash Flow stands at $560.89 Million. Analysts project significant growth over the coming years, with estimated Free Cash Flow reaching $1.55 Billion by 2030. The first five years of these projections are based on analyst estimates, while forecasts beyond this period are extrapolated by Simply Wall St. This approach is intended to balance expert opinion and long-range growth expectations for the business.

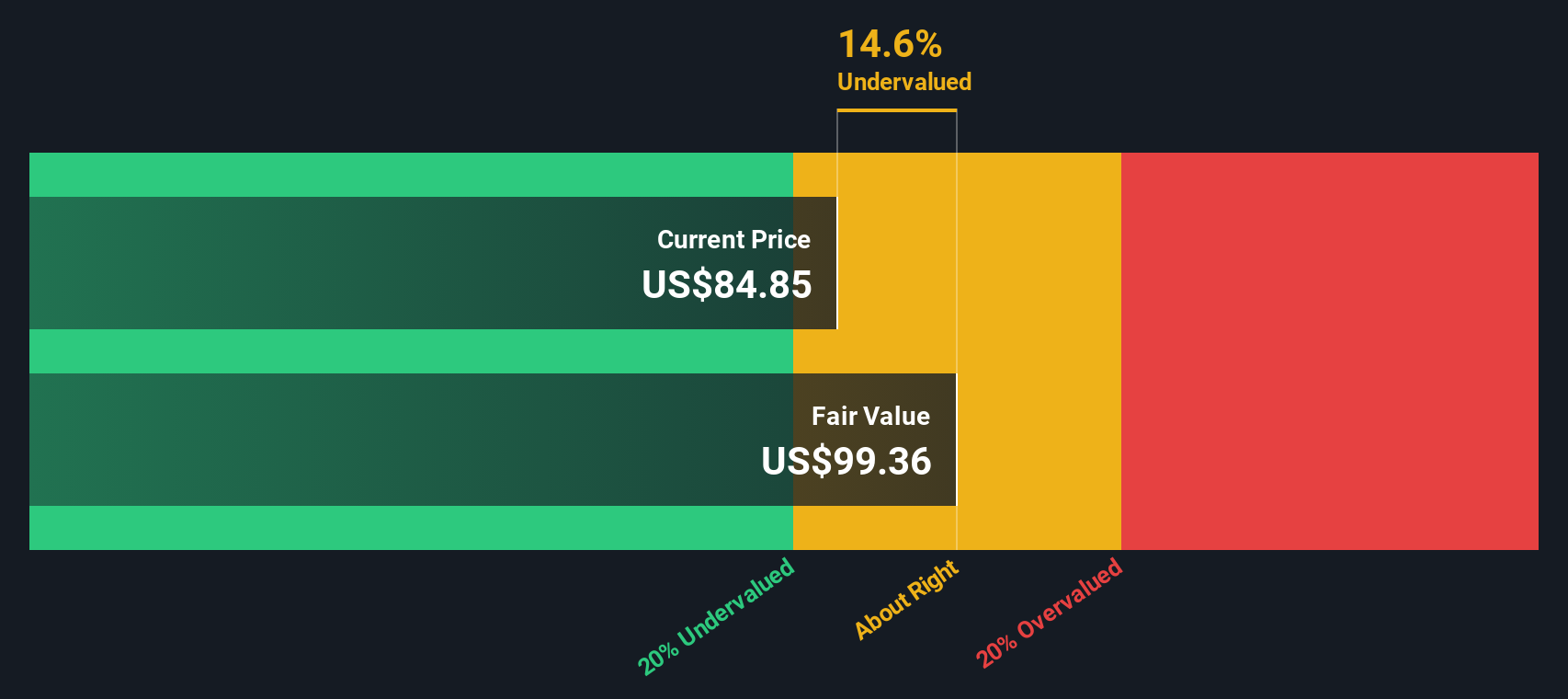

Applying this model, Pure Storage’s estimated intrinsic value is $102.82 per share. This figure is 15.5% above where the stock trades right now. According to the DCF analysis, Pure Storage stock appears to be undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pure Storage is undervalued by 15.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pure Storage Price vs Sales

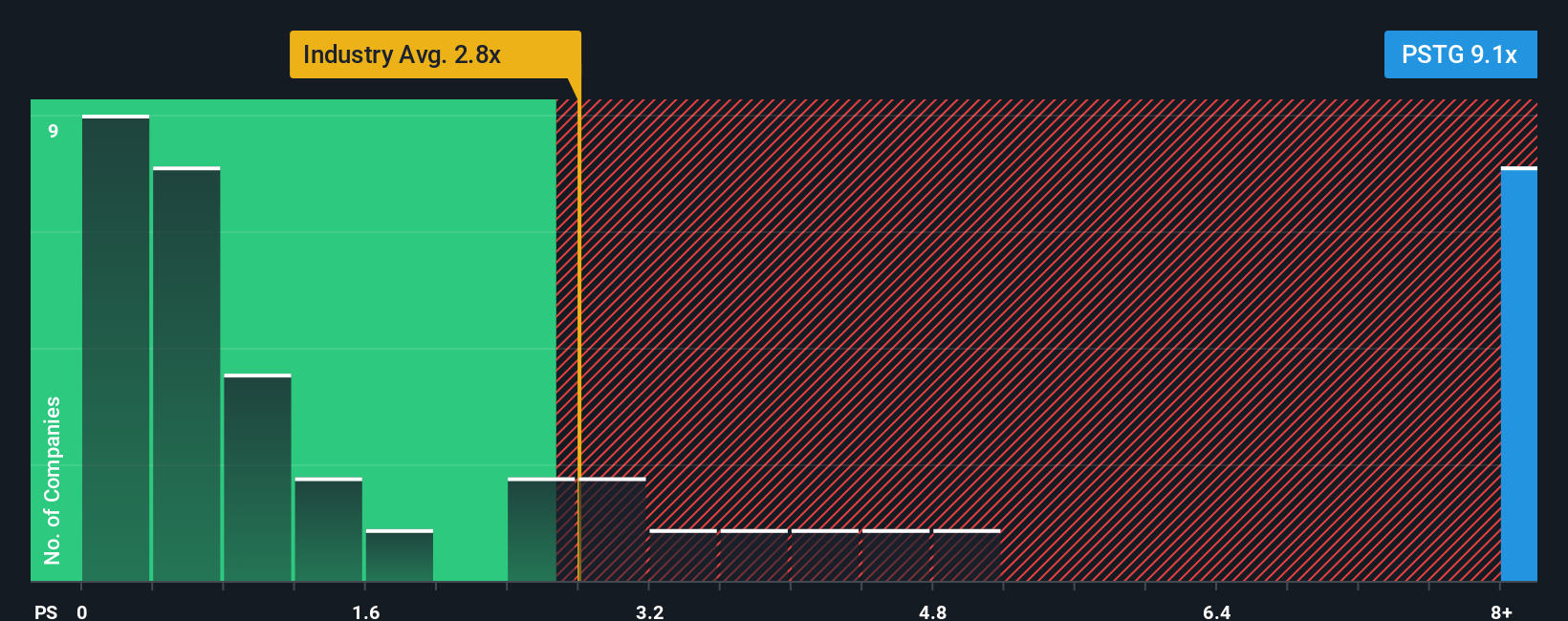

The Price-to-Sales (P/S) ratio is often the preferred valuation metric for rapidly growing technology companies like Pure Storage, where consistent profitability is still developing and revenue growth is a key driver. For these companies, focusing on sales provides a more stable and relevant benchmark than earnings-based multiples, which can be distorted during periods of reinvestment and expansion.

A company’s “normal” or “fair” P/S multiple often reflects expectations for future growth, profitability, and business risks. Higher growth prospects or stronger margins typically justify a higher multiple. In contrast, greater risks or slower industry trends might point toward a lower one.

Pure Storage’s current P/S ratio is 8.52x. This is substantially higher than the technology sector’s average of 2.24x, and also well above its peer average of 1.89x. However, Simply Wall St’s proprietary Fair Ratio for Pure Storage is 12.38x. This ratio is derived from a holistic consideration of growth rates, margins, market cap, and industry factors, rather than just a simple average.

While comparing to industry averages is helpful, the Fair Ratio is more instructive because it takes into account Pure Storage’s unique strengths, business model, risk profile, and forward growth potential. As a result, it offers a more tailored view of what a reasonable valuation should be for the company.

With Pure Storage’s actual P/S multiple at 8.52x and its Fair Ratio at 12.38x, this suggests the stock is undervalued relative to where one might expect it to trade given its specific characteristics and future prospects.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pure Storage Narrative

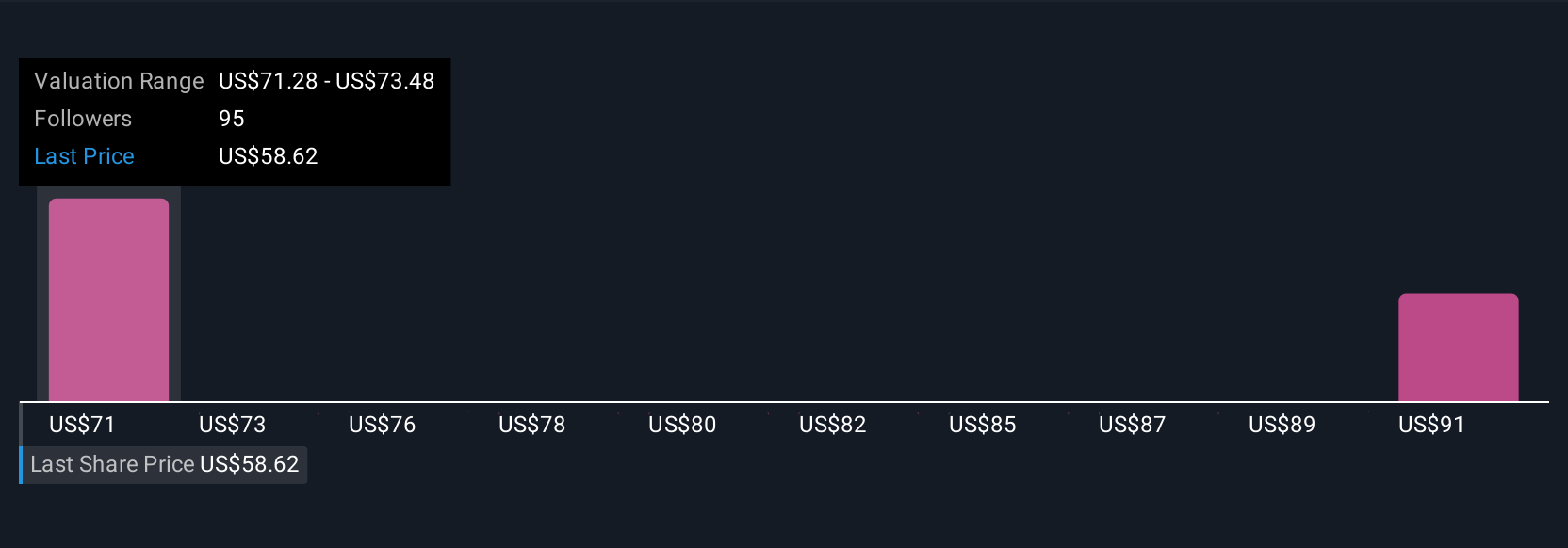

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, dynamic story that you create about a company by combining your view of the business with your financial assumptions, such as fair value, expected revenue growth, and margins. By connecting how you see Pure Storage's business evolving with what those numbers mean for the share price, Narratives move past static ratios and offer a living, breathing investment thesis.

This approach is available on Simply Wall St’s Community page, making it accessible to millions of investors. Narratives help you figure out whether to buy, hold, or sell by comparing your calculated Fair Value to the current market Price, so every decision is tied to your unique view. Plus, as news or earnings come in, your Narrative updates in real time to keep your investment case always relevant.

For example, a bullish investor might build a Narrative forecasting aggressive revenue growth (15%+ annually) and expanding profit margins, leading to an optimistic fair value well above $90 per share. On the other hand, a cautious investor may focus on margin risks, competitive threats, and more moderate growth, resulting in a fair value closer to $55. Narratives let you decide which story matches your outlook and act with clarity and confidence.

Do you think there's more to the story for Pure Storage? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives