- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OUST

Revenues Tell The Story For Ouster, Inc. (NYSE:OUST) As Its Stock Soars 27%

Ouster, Inc. (NYSE:OUST) shares have continued their recent momentum with a 27% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

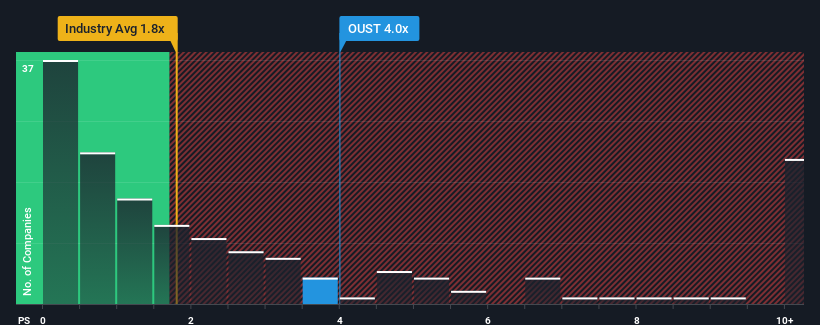

After such a large jump in price, you could be forgiven for thinking Ouster is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 1.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ouster

How Ouster Has Been Performing

Recent times have been advantageous for Ouster as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ouster.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ouster's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 66%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 56% each year as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 21% each year growth forecast for the broader industry.

In light of this, it's understandable that Ouster's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Ouster's P/S

Shares in Ouster have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Ouster shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 6 warning signs for Ouster (2 are potentially serious!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OUST

Ouster

Provides lidar sensors for the automotive, industrial, robotics, and smart infrastructure industries in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives