- United States

- /

- Communications

- /

- NYSE:MSI

Motorola Solutions (MSI) Valuation Check as New 911 Live-Video Collaboration with Google Gains Attention

Reviewed by Simply Wall St

Motorola Solutions (MSI) is back in the spotlight after teaming up with Google to let Android users stream live video directly to 911 call handlers, a practical upgrade to its already entrenched public safety platform.

See our latest analysis for Motorola Solutions.

That kind of real world innovation is arriving just as sentiment is resetting. The latest 1 day share price return of 2.93 percent has lifted Motorola Solutions to 374.49 dollars after a tough stretch that has seen a 90 day share price return of negative 21.36 percent, but a still impressive 51.62 percent three year total shareholder return and 136.23 percent five year total shareholder return. This suggests long term momentum is intact even as shorter term enthusiasm has cooled.

If this public safety upgrade has you thinking more broadly about digital infrastructure, it could be worth exploring other high growth tech and AI names via high growth tech and AI stocks.

Yet with earnings still growing, the stock sitting nearly 31 percent below the average analyst target and only a hair above some intrinsic value estimates, investors now face a harder question: is this a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 24.1% Undervalued

With Motorola Solutions last closing at $374.49 against a narrative fair value near $494, the gap hinges on a few powerful growth levers.

The transition toward a greater mix of software and managed/recurring services, especially in command center and video solutions, continues to drive operating leverage and net margin expansion. This shift is further supported by strong attachment rates on new hardware (e.g., APX NEXT and SVX) and growing international SaaS/cloud deployments, boosting long term earnings growth.

Want to see the math behind that confidence gap? The narrative leans on steadily rising revenues, expanding margins, and a premium earnings multiple that rivals sector leaders. Curious how those moving parts stack up into a near five hundred dollar fair value? Dive in to see which assumptions really carry the story.

Result: Fair Value of $493.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on smooth execution, and any prolonged slowdown in government budgets or weaker adoption of software services could undercut the thesis.

Find out about the key risks to this Motorola Solutions narrative.

Another View: What Multiples Are Saying

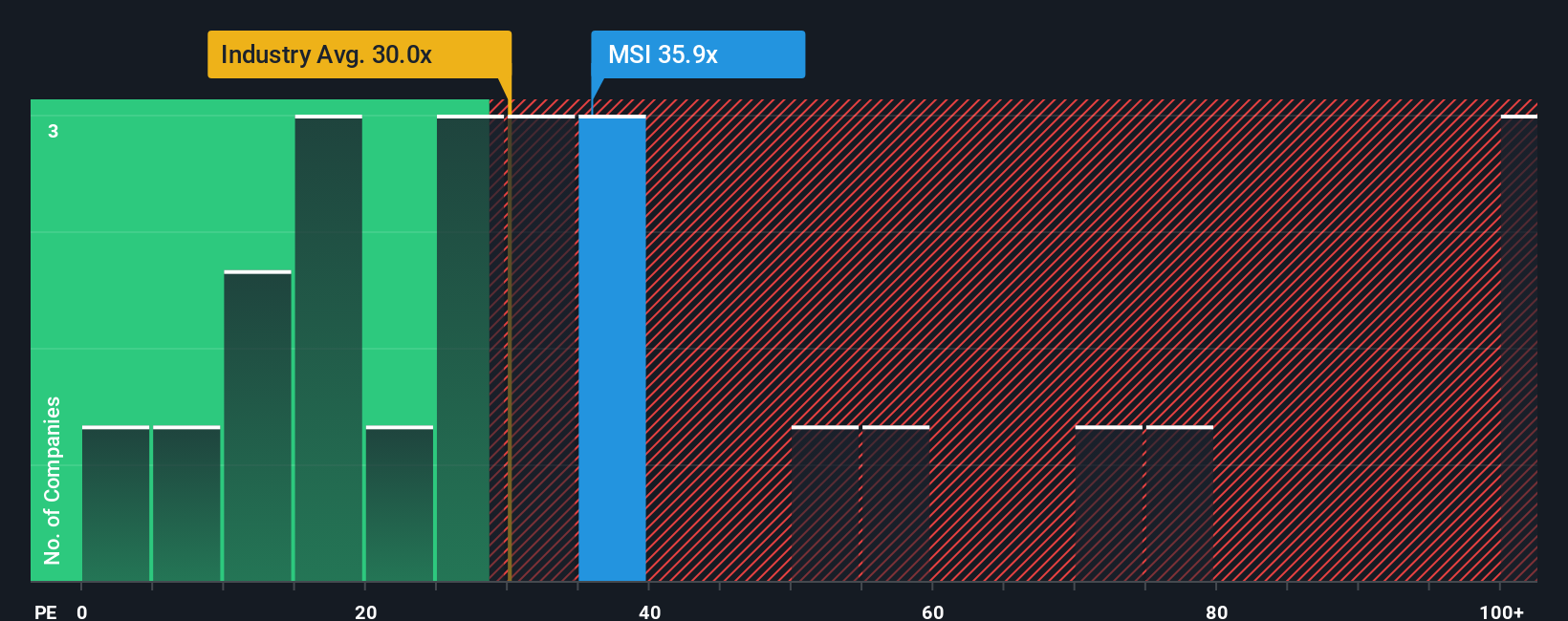

Price signals tell a more cautious story. At 29.5 times earnings, Motorola Solutions trades slightly below the US Communications industry at 30.7 times and below peers at 34.5 times, yet above its 25.5 times fair ratio, which hints that any stumble could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Motorola Solutions Narrative

If you see the story differently or want to stress test these assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your Motorola Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction investment ideas?

Before you move on, lock in your next move by scanning fresh opportunities on Simply Wall Street’s screener so potential winners never slip past you again.

- Capture early stage momentum by targeting growth names trading at accessible prices through these 3636 penny stocks with strong financials that still show solid fundamentals.

- Ride powerful secular trends by focusing on AI innovators shaping tomorrow’s technology landscape with these 24 AI penny stocks that already have real world traction.

- Lock in value upside by hunting for quality businesses priced below their cash flow potential using these 915 undervalued stocks based on cash flows tailored to long term investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion