- United States

- /

- Communications

- /

- NYSE:MSI

Motorola Solutions (MSI): Evaluating Valuation After Major AI-Powered Public Safety Deployments and Innovation Push

Reviewed by Kshitija Bhandaru

Motorola Solutions (MSI) is in the spotlight after unveiling new AI-powered incident response technologies and landing major deployments at the University of Palermo and the Sao Paolo subway. These moves highlight the company's expanding role in public safety innovation.

See our latest analysis for Motorola Solutions.

With these major deployments and a steady push into AI-driven security, Motorola Solutions has kept up its strong long-term momentum. Its total shareholder return over the past three years is just under 98%. Recent news and innovation seem to be fueling optimism around the company’s growth trajectory.

If Motorola’s surge in public safety tech has you interested in broader trends, now’s the perfect moment to discover See the full list for free.

But with Motorola Solutions trading near all-time highs and a recent surge in innovation, investors are left wondering if the current price reflects all future growth or if a value opportunity still remains.

Most Popular Narrative: 11% Undervalued

With Motorola Solutions closing at $448.03, the most popular analyst narrative places fair value near $503.75. This highlights a notable gap between market sentiment and fundamentals that could attract attention.

The rapid adoption of integrated smart technologies—including AI-enhanced video security, spectrum monitoring, and advanced mesh networking through offerings like SVX and Silvus Mobile Ad Hoc Networks—is positioning Motorola to capitalize on the proliferation of smart cities and next-gen public safety applications. This is enabling high double-digit growth in software and services and supports higher-margin, recurring revenue streams.

Wondering what financial backbone justifies this bullish target? One crucial assumption in the narrative centers on expanding high-margin software, a growth lever that could redefine earnings power if it plays out. If you want to uncover which bold projections drive this model and where analysts see things heading, the full narrative reveals it all.

Result: Fair Value of $503.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Motorola Solutions faces risks from increased competition and possible slow adoption of its recurring software. These factors could challenge long-term growth projections.

Find out about the key risks to this Motorola Solutions narrative.

Another View: Market Ratios Raise Questions

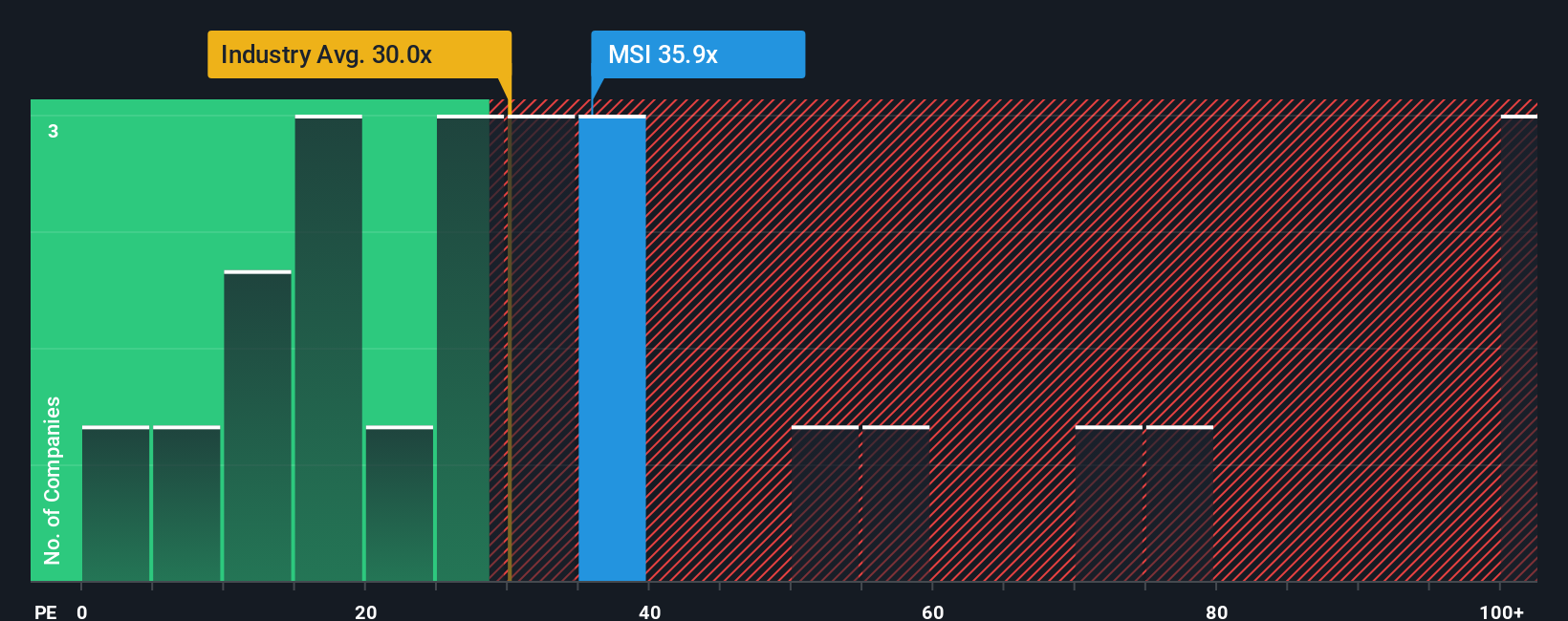

Looking from a different angle, Motorola Solutions currently trades at a price-to-earnings ratio of 35.3x, which is above the US Communications industry average of 29.9x and the fair ratio of 29.4x. While it appears cheaper than peer averages, paying above industry norms could signal future valuation risk. Does this signal a premium that is justified or a warning for cautious investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Motorola Solutions Narrative

If you’re not convinced by the consensus or want to dive deeper into the numbers, there’s nothing stopping you from building your own perspective in just minutes. Go ahead and Do it your way.

A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors know that looking beyond the headlines unlocks hidden gems. Expand your approach with screens that highlight promising trends, disruptive sectors, and high-yield potential.

- Tap into the world of high-yield investments by checking out these 19 dividend stocks with yields > 3% offering solid returns from established dividend payers.

- Uncover top innovators in artificial intelligence by powering through these 24 AI penny stocks. These companies are shaping tomorrow’s digital landscape.

- Spot businesses with stronger financials and growth potential in undervalued corners of the market thanks to these 907 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives