- United States

- /

- Communications

- /

- NYSE:MSI

How AI Security Push and Blue Eye Deal At Motorola Solutions (MSI) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Motorola Solutions recently reported stronger-than-expected third-quarter 2025 earnings and announced the acquisition of AI-powered video monitoring firm Blue Eye, bolstering its public safety and security technology portfolio.

- Together with a busy slate of industry and investor conference appearances, these developments highlight Motorola Solutions’ push to deepen its role in real-time, AI-enhanced security operations.

- Next, we’ll examine how the Blue Eye acquisition and AI-driven security focus influence Motorola Solutions’ existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Motorola Solutions Investment Narrative Recap

To own Motorola Solutions, you need to believe in the long-term demand for integrated public safety and security platforms that blend LMR, broadband, and AI-enabled video. The Blue Eye acquisition and stronger-than-expected Q3 2025 earnings support the near-term catalyst of expanding higher-margin, AI-driven software and services, while the biggest ongoing risk remains pressure on legacy LMR systems as broadband and interoperable alternatives gain traction. At this stage, the latest news does not materially change that core risk.

Among recent announcements, the acquisition of Blue Eye looks most closely aligned with Motorola Solutions’ push into AI-enhanced video security. By bolstering its real-time remote monitoring and threat detection capabilities, the deal ties directly into the company’s effort to grow recurring software and services revenue, a key catalyst that could help offset any longer-term headwinds facing traditional LMR and infrastructure refresh cycles.

Yet even as AI and software grow, investors should be aware of how rising broadband alternatives could eventually pressure Motorola Solutions’ core...

Read the full narrative on Motorola Solutions (it's free!)

Motorola Solutions' narrative projects $13.8 billion revenue and $2.8 billion earnings by 2028. This requires 7.5% yearly revenue growth and a roughly $0.7 billion earnings increase from $2.1 billion today.

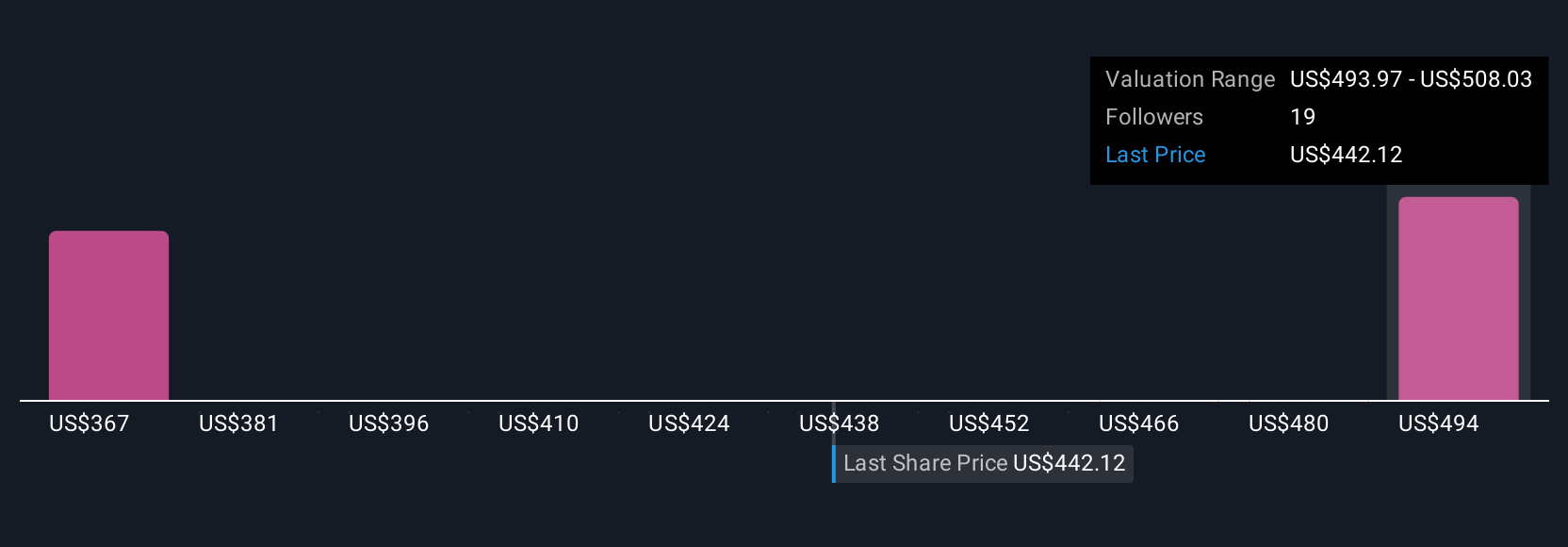

Uncover how Motorola Solutions' forecasts yield a $498.44 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$374.68 to US$498.44, showing how far opinions can stretch on Motorola Solutions’ worth. Against that backdrop, the company’s push into AI-powered video security and recurring services may be a key factor you weigh when comparing these very different views on its future performance.

Explore 4 other fair value estimates on Motorola Solutions - why the stock might be worth just $374.68!

Build Your Own Motorola Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Motorola Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Motorola Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Motorola Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026