- United States

- /

- Tech Hardware

- /

- NYSE:KODK

Investors Still Aren't Entirely Convinced By Eastman Kodak Company's (NYSE:KODK) Revenues Despite 53% Price Jump

Eastman Kodak Company (NYSE:KODK) shareholders have had their patience rewarded with a 53% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 46%.

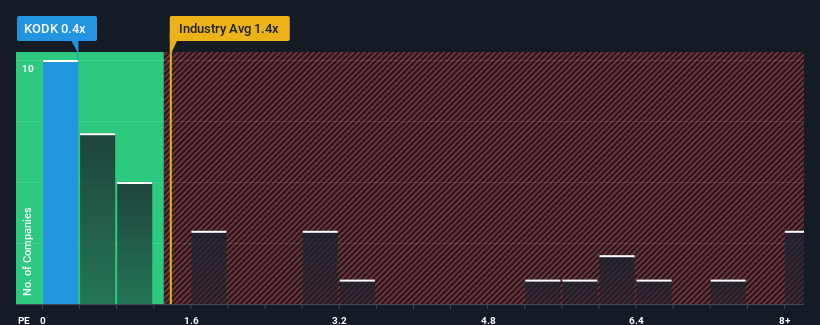

Although its price has surged higher, Eastman Kodak may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Tech industry in the United States have P/S ratios greater than 1.4x and even P/S higher than 7x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Eastman Kodak

What Does Eastman Kodak's P/S Mean For Shareholders?

For example, consider that Eastman Kodak's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Eastman Kodak will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Eastman Kodak will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Eastman Kodak's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.0%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.1% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 3.9% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that Eastman Kodak's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

Eastman Kodak's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Eastman Kodak revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

It is also worth noting that we have found 2 warning signs for Eastman Kodak that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Eastman Kodak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KODK

Eastman Kodak

Focuses on the commercial print and advanced materials and chemicals businesses worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.