- United States

- /

- Tech Hardware

- /

- NYSE:KODK

Here's Why Eastman Kodak (NYSE:KODK) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Eastman Kodak (NYSE:KODK), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Eastman Kodak

How Fast Is Eastman Kodak Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Eastman Kodak's EPS went from US$0.038 to US$0.57 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. This approach makes Eastman Kodak look pretty good, on balance; although revenue is flattish, EBIT margins improved from 4.7% to 9.4% in the last year. That's a real positive.

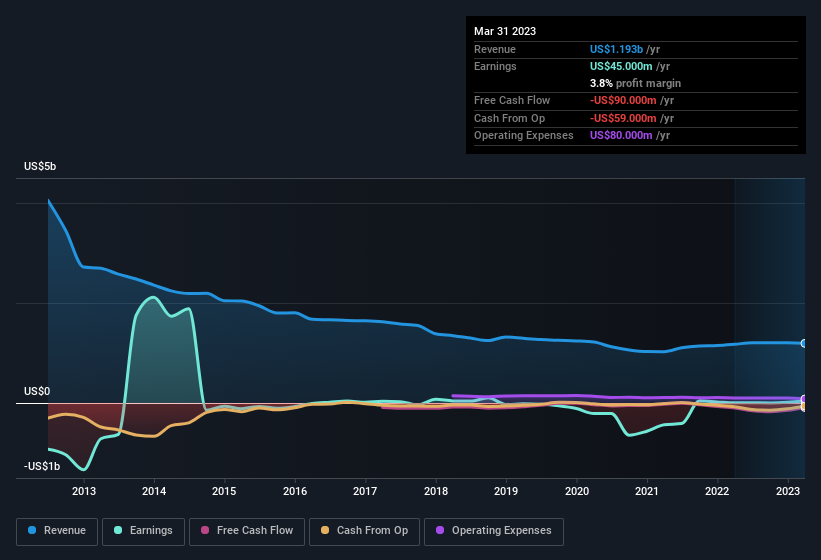

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Eastman Kodak Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Eastman Kodak insiders spent US$118k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Independent Director Michael Sileck for US$66k worth of shares, at about US$4.39 per share.

Along with the insider buying, another encouraging sign for Eastman Kodak is that insiders, as a group, have a considerable shareholding. To be specific, they have US$28m worth of shares. This considerable investment should help drive long-term value in the business. That amounts to 7.8% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Eastman Kodak Deserve A Spot On Your Watchlist?

Eastman Kodak's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Eastman Kodak belongs near the top of your watchlist. Before you take the next step you should know about the 1 warning sign for Eastman Kodak that we have uncovered.

The good news is that Eastman Kodak is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eastman Kodak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KODK

Eastman Kodak

Focuses on the commercial print and advanced materials and chemicals businesses worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion