Keysight Technologies (NYSE:KEYS) Secures NATO Contract for Advanced Radar and EW Testing

Reviewed by Simply Wall St

Keysight Technologies (NYSE: KEYS) experienced a 9% price increase last week following its announcement of a significant contract with NATO's Naval Forces Sensor and Weapons Accuracy Check Sites (FORACS). This contract involved modernizing radar and electronic support measures systems, placing Keysight at the forefront of military technology advancements. Amid this positive development, the broader market gained 7%, driven by heightened investor optimism and major tech earnings. While Keysight's performance was influenced by favorable market trends, the NATO contract likely reinforced investor confidence in the company's growth prospects amid the sector's overall momentum.

We've identified 1 risk for Keysight Technologies that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent contract with NATO's Naval Forces Sensor and Weapons Accuracy Check Sites boosts Keysight Technologies' market position in the defense sector, potentially enhancing both revenue and earnings forecasts. The contract positions Keysight as a key player in military technology modernization, aligning with growth opportunities in defense spending. It's a positive signal for investors regarding future contracts and revenue streams in this segment.

Over the last five years, Keysight's total shareholder return, including share price appreciation and dividends, was 54.04%. This long-term performance outpaces the company's more recent one-year relative underperformance, where it lagged behind both the US Market's 7.5% increase and the US Electronic industry's 3.7% growth. This disparity highlights the importance of evaluating stock performance across different time horizons.

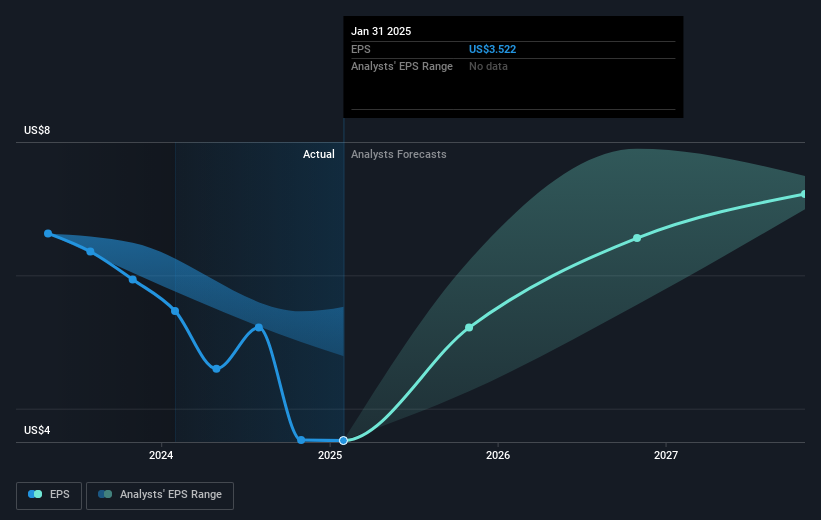

Looking forward, the impact of the NATO contract may reinforce growth expectations in the company's revenue and earnings forecasts. Analysts predict a revenue growth of approximately 6.4% annually over the next three years, with earnings projected to reach US$1.2 billion by 2028. These optimistic projections are closely tied to Keysight's strategic expansions in high-growth segments like AI data centers and advanced technology standards. The current share price of US$135.11 remains significantly below the consensus price target of US$177.16, indicating that the market anticipates potential upside in Keysight's valuation as it capitalizes on recent developments and long-term industry trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)