Keysight Technologies (NYSE:KEYS) Faces DoJ Antitrust Hurdle in US$1.57 Billion Spirent Deal

Reviewed by Simply Wall St

Keysight Technologies (NYSE:KEYS) has been navigating significant regulatory and financial events recently. On June 3, the U.S. Department of Justice mandated the divestment of key assets in order to proceed with Keysight's acquisition of Spirent Communications, aiming to maintain fair competition in the telecommunications testing market. Concurrently, Keysight reported strong financial results for the second quarter, with sales and net income showing substantial year-over-year growth. These developments likely influenced Keysight's share price, which rose 7% over the last month, outpacing the market's more moderate increases during the same period.

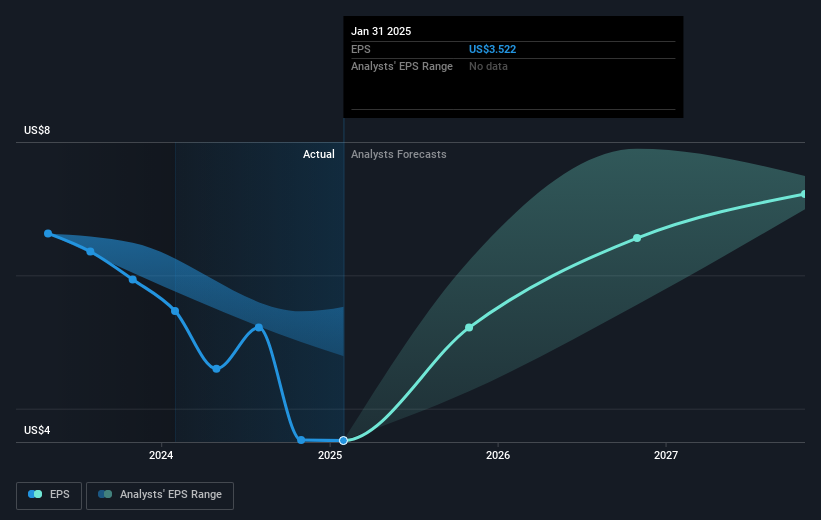

The recent mandate by the U.S. Department of Justice for Keysight Technologies to divest certain assets could influence the company's strategic direction and competitive positioning in the telco testing market. This, coupled with the robust financial results for the second quarter, aligns with the growth narrative driven by AI, high-speed data, and next-gen wireless standards. The requirement to divest assets could alter Keysight's revenue and earnings projections, potentially affecting its R&D activities and market expansion strategies. Despite these regulatory challenges, the company's expansion into software-centric and recurring revenue streams shows resilience and might continue supporting its market share and earnings stability.

Keysight's long-term shareholder returns stand at 53.94% over five years, reflecting strong growth compared to broader market trends. Over the past year, Keysight's performance has outpaced both the U.S. market, which returned 11.5%, and the U.S. Electronic industry, which returned 13.3%. This outperformance is noteworthy given the macroeconomic and geopolitical uncertainties impacting technology markets.

Regarding analyst projections and valuation, the company's share price movement—currently at US$162.26—compared to the consensus price target of US$183.39 suggests an upward potential of 11.5%. However, the impact of divestment and future revenue streams should be considered when evaluating these targets. As Keysight continues to focus on areas such as AI-driven infrastructure and 5G-Advanced expansion, any deviation from earnings forecasts or increased tariff expenses could lead to adjustments in these projections.

Evaluate Keysight Technologies' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Offers electronic design and test solutions worldwide.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives