Keysight Technologies (KEYS): Evaluating Valuation After New Satellite Handover Demo and AI-Powered FieldFox Launch

Keysight Technologies (KEYS) just grabbed attention with a landmark non terrestrial network handover demo alongside KT SAT, validating multi orbit mobility in Ku band while also rolling out its AI infused N99xxD FieldFox handheld RF analyzer.

See our latest analysis for Keysight Technologies.

These milestones come as Keysight shares trade at around $208.81, with a strong 30 day share price return of 16.61 percent and a 90 day share price return of 21.35 percent, signaling building momentum on top of a solid 1 year total shareholder return of 22.20 percent.

If Keysight’s mix of wireless, satellite, and automotive innovation is on your radar, this could be a good moment to also explore high growth tech and AI stocks for other potential growth names.

Yet with the stock now near its price target after a strong run, are investors still getting Keysight’s growth in wireless, satellite, and automotive at a reasonable valuation, or is the market already pricing in the next leg higher?

Most Popular Narrative Narrative: 3.1% Undervalued

With Keysight closing at $208.81 versus a most popular narrative fair value near $216, the story leans toward modest undervaluation driven by long term growth levers.

Expansion of software and recurring service offerings, now comprising 36% and 28% of total revenue respectively, increases gross and net margins by enhancing revenue stability, improving product mix, and reducing cyclicality from traditional hardware segments.

Curious how steady software revenue, higher margins, and richer earnings multiples combine into that fair value call? The narrative connects these factors in unexpected ways.

Result: Fair Value of $216 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, newly imposed tariffs and a potential slowdown in AI infrastructure spending could squeeze margins and temper the growth embedded in today’s valuation narrative.

Find out about the key risks to this Keysight Technologies narrative.

Another Lens On Value

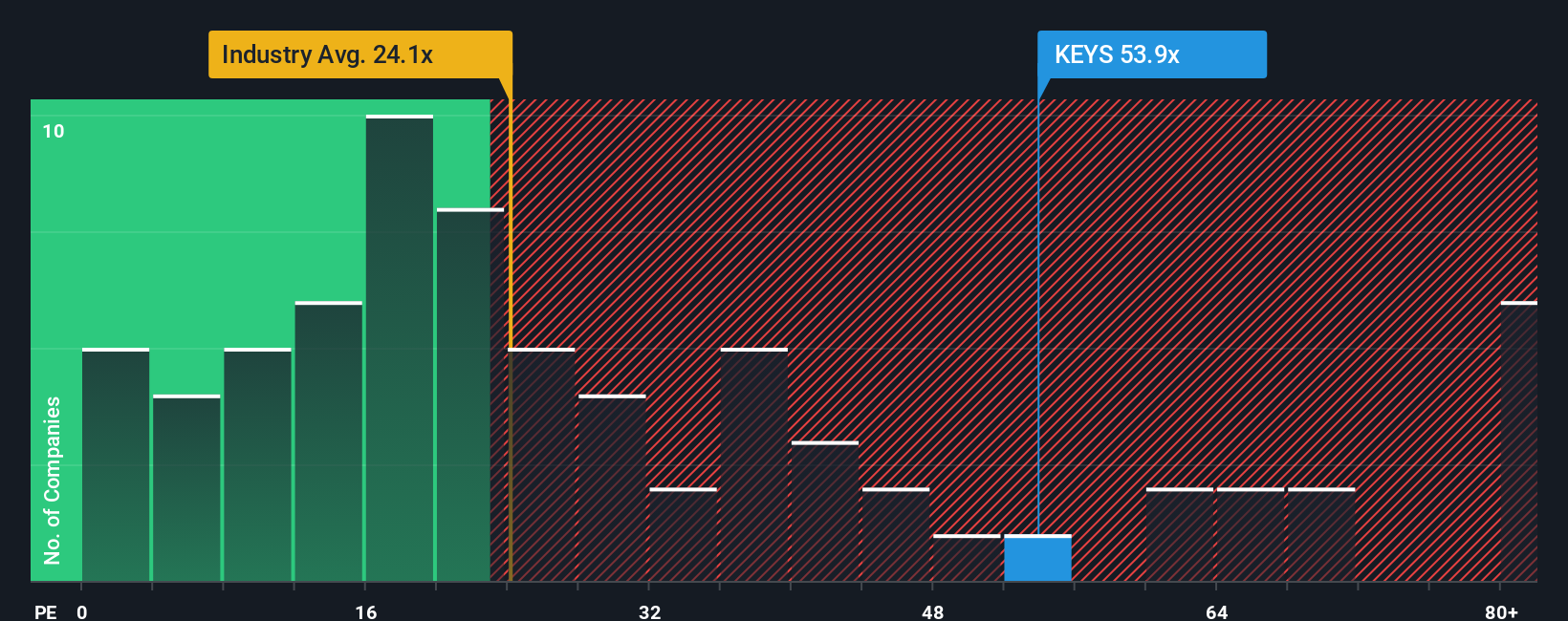

Most popular narratives see Keysight as modestly undervalued, but our price to earnings work paints a tougher picture. At 41.1 times earnings versus a fair ratio of 27.9 times and an industry average of 24.8 times, the shares look richly priced and vulnerable if growth expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keysight Technologies Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh Keysight thesis in minutes: Do it your way.

A great starting point for your Keysight Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before the market moves on without you, put Simply Wall St to work and line up your next potential winner using focused, data driven stock screens.

- Target steady cash generators by reviewing these 13 dividend stocks with yields > 3% that can support portfolios with reliable income and potential capital growth over time.

- Capitalize on early stage disruption by scanning these 26 AI penny stocks that are harnessing artificial intelligence to build scalable, high margin business models.

- Pursue mispriced opportunities through these 909 undervalued stocks based on cash flows where strong cash flows and fundamentals are not yet fully recognized by the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

The Compound Effect: From Acquisition to Integration

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.