Will Jabil's (JBL) AI-Driven Server Security Collaboration with Axiado Reshape Its Growth Story?

Reviewed by Sasha Jovanovic

- Earlier this month, Axiado Corporation announced a collaboration with Jabil Inc. to develop AI-driven cybersecurity and modular hardware server solutions, with both companies showcasing integrated technologies at the OCP Global Summit in October 2025.

- This partnership highlights Jabil's increasing presence in the growing AI and data center security markets, aligning its modular server platforms with advanced zero-trust security solutions.

- We will explore how Jabil’s entrance into AI-driven server security with Axiado could shape its future growth and investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Jabil Investment Narrative Recap

To be a shareholder in Jabil, you need to believe in the company’s ability to capture future growth opportunities in AI-driven, high-value manufacturing while managing volatility in traditional segments like renewables and connected consumer devices. The recent partnership with Axiado expands Jabil’s footprint in the promising data center and cybersecurity space, but doesn't materially alter the short-term catalysts, which are still primarily driven by execution in growth markets and cash flow generation; the biggest risk remains ongoing weakness in key regulated and consumer-oriented markets.

Of the recent announcements, Jabil’s continued share repurchase activity, such as the buyback of 600,000 shares for US$135 million, stands out. While not directly tied to its AI expansion, ongoing buybacks signal a focus on shareholder returns and balance sheet optimization, supporting catalysts like anticipated free cash flow and earnings growth.

Yet, on the risk side, investors should keep in mind that despite new partnerships, continued softness in regulated industries means...

Read the full narrative on Jabil (it's free!)

Jabil's narrative projects $34.3 billion in revenue and $1.3 billion in earnings by 2028. This requires 6.4% yearly revenue growth and a $723 million earnings increase from the current $577 million.

Uncover how Jabil's forecasts yield a $247.38 fair value, a 17% upside to its current price.

Exploring Other Perspectives

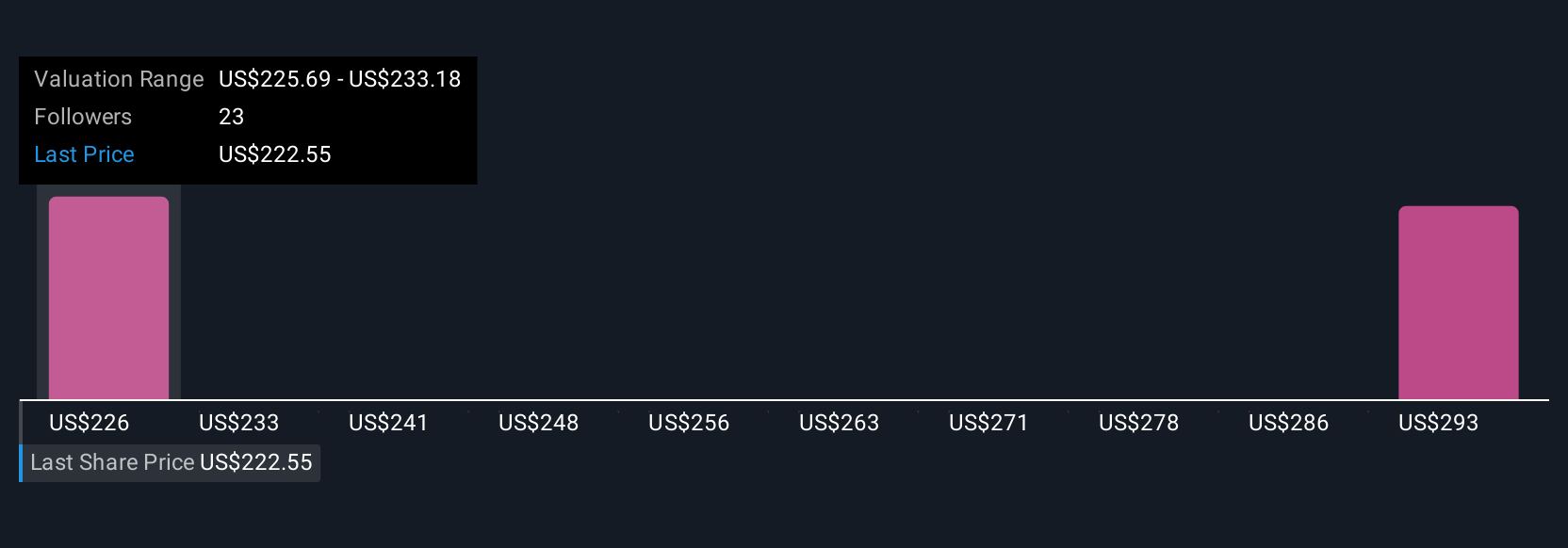

Community members provided two fair value estimates for Jabil between US$247.38 and US$257.83. You can see how these outlooks coexist with concerns about persistent revenue declines in key end markets, inviting you to explore the range of perspectives further.

Explore 2 other fair value estimates on Jabil - why the stock might be worth as much as 22% more than the current price!

Build Your Own Jabil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Jabil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jabil's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Jabil

Provides engineering, manufacturing, and supply chain solutions worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026