Jabil (JBL): Revisiting Valuation After Expansion in India and Key Pharma Acquisition

Reviewed by Kshitija Bhandaru

Jabil (JBL) is making moves that could reshape its growth path. The company is expanding its photonics operation in Gujarat, India, and is also acquiring Pharmaceutics International, Inc. to tap into a large pharmaceutical market. These steps point to a clear revenue growth focus.

See our latest analysis for Jabil.

Jabil’s share price dipped 5% over the last week, reflecting recent volatility after its latest earnings and acquisition news. However, looking at a broader timeframe, the momentum is clear with a 43% year-to-date share price return and a 67% total shareholder return over the past 12 months. This trend becomes even more noticeable over multiple years, with total shareholder returns up 249% over three years and nearly 477% over five years, highlighting sustained value creation during a period of expansion and new market moves.

If you’re watching how tech manufacturers are adapting and want to see even more opportunities in this space, check out fast growing stocks with high insider ownership.

With Jabil’s shares up impressively over multiple years, but recent sales headwinds and a 21% discount to analyst targets, the question stands: Is the stock undervalued at today’s prices, or is the market already pricing in its next phase of growth?

Most Popular Narrative: 17.2% Undervalued

Jabil's most widely followed narrative places fair value well above the latest closing price. This suggests meaningful upside based on future earnings projections and margin expansion potential.

Strong demand in AI-related markets, with expected revenue growth of 40% year on year, indicates significant potential to drive future revenue and improve operating margins through an expanded share of high-growth technology sectors.

Want to know what profit and revenue transformations drive this bold price target? The real story is in high-stakes forecasts: bigger margins, shrinking share count, and a growth formula that reimagines Jabil as a tech heavyweight. Curious which financial levers make this narrative stand out? You’ll have to dig into the full breakdown to get the numbers that matter most.

Result: Fair Value of $247.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in renewable energy and challenges in inventory management could put pressure on Jabil’s profitability and test the strength of its growth story.

Find out about the key risks to this Jabil narrative.

Another View: Multiples Signal a Premium

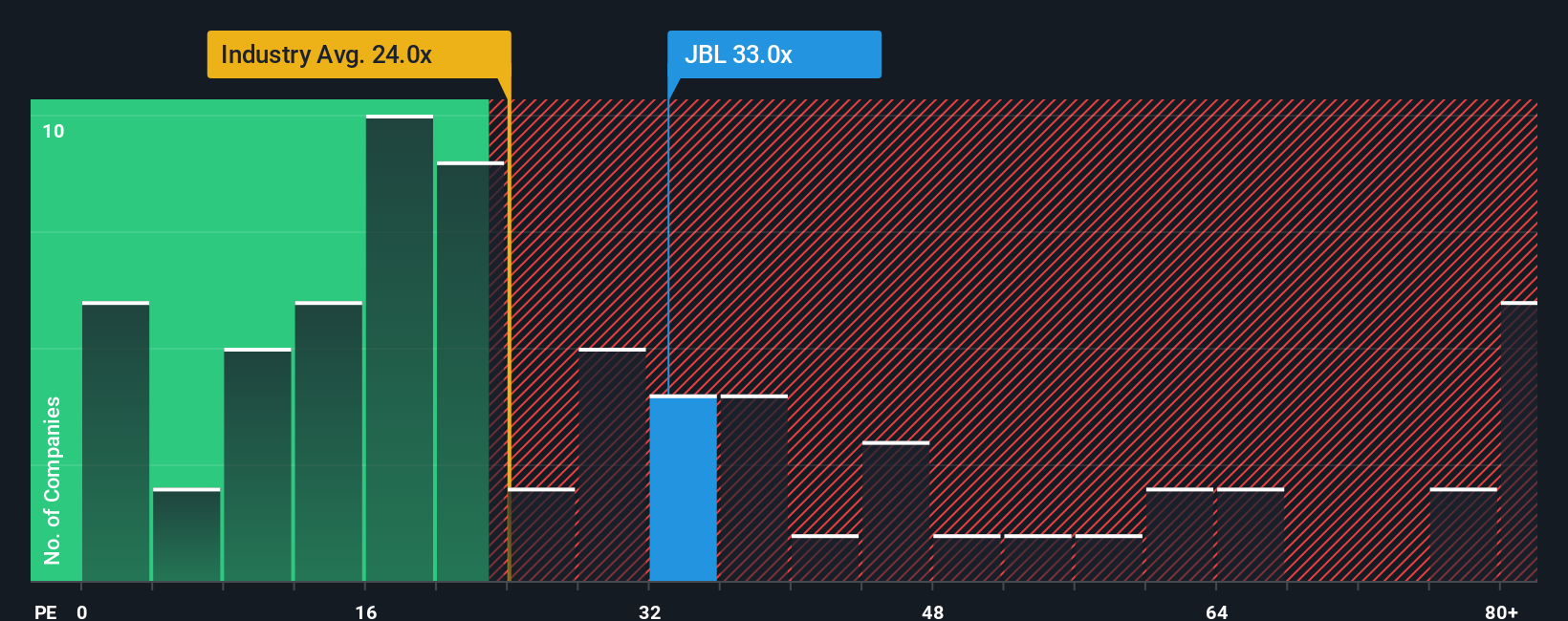

While our DCF model points to Jabil trading below fair value, the picture shifts when we focus on the price-to-earnings ratio. Jabil's ratio of 33.4x is above the industry average of 25.5x, and only just below its peer average and our calculated fair ratio. This suggests investors are paying a premium for future growth, which raises the stakes if expectations are not met. Does this premium reflect robust opportunity, or could it mean valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jabil Narrative

If you'd rather draw your own conclusions from the numbers, you can take a fresh look at the data and build a unique view in just minutes: Do it your way.

A great starting point for your Jabil research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

Why stop with Jabil? Set yourself up for smart investment moves by using the Simply Wall Street Screener to zero in on powerful trends and opportunities you won’t want to miss.

- Target reliable income streams by reviewing these 18 dividend stocks with yields > 3%. This includes stocks with strong yields and steady cash flow for investors seeking consistent returns.

- Tap into tomorrow’s breakthroughs by checking out these 25 AI penny stocks. Discover companies pioneering artificial intelligence to stay on the front lines of innovation.

- Catch undervalued gems before the crowd by researching these 888 undervalued stocks based on cash flows. Spot potential bargains trading below their cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Jabil

Provides engineering, manufacturing, and supply chain solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026