Jabil (JBL): $300M One-Off Loss Drives Margin Decline, Testing Profit Recovery Narrative

Reviewed by Simply Wall St

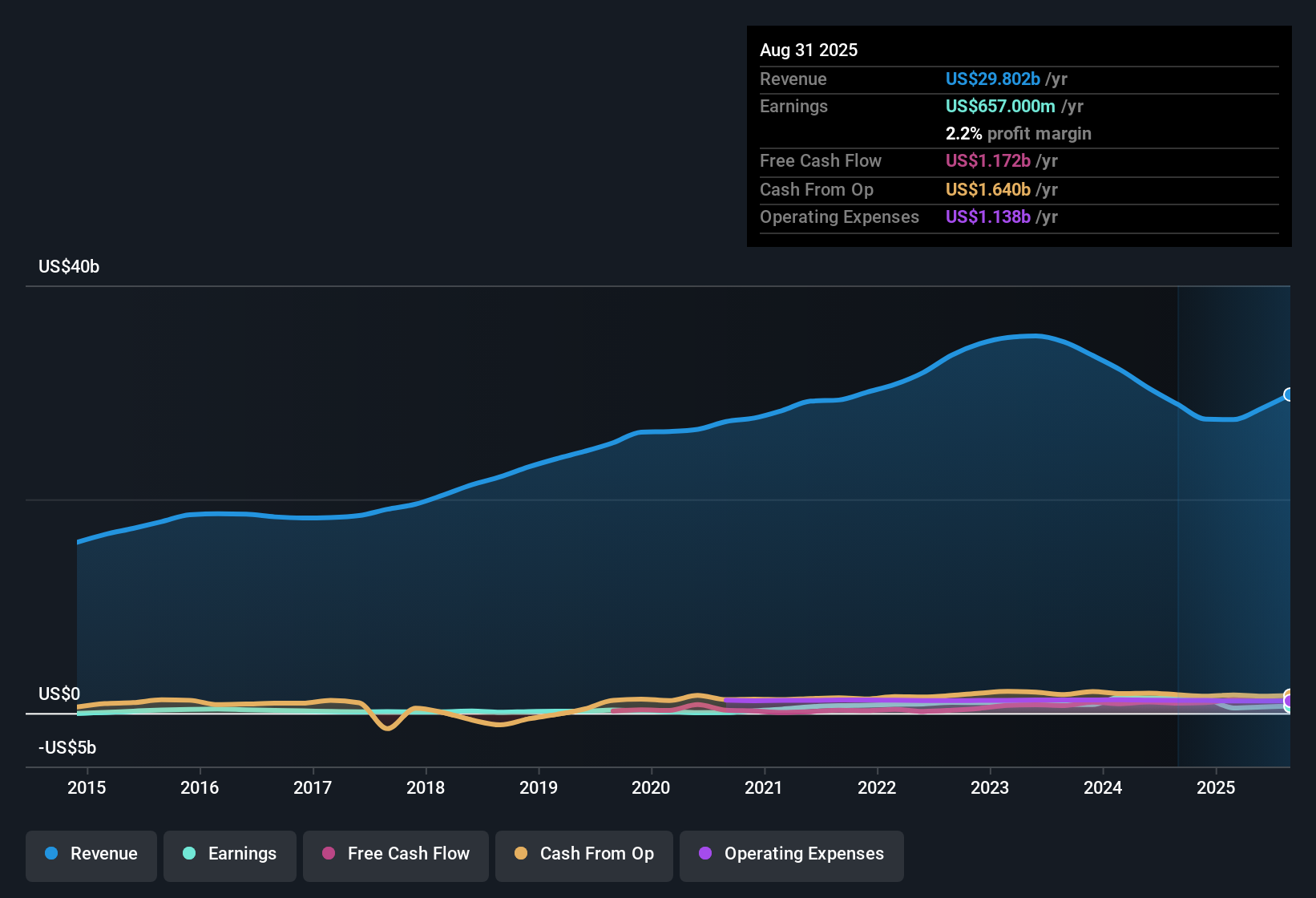

Jabil (JBL) delivered a net profit margin of 2.2% in the latest period, down from 4.8% the year before, driven by a significant $300 million one-off loss impacting recent financials. Revenue is projected to grow at 5.8% per year, lagging behind the broader US market's 10.1% pace. The company’s EPS is expected to jump 20.27% annually, surpassing the US market average of 15.6%. Despite margin pressure, analysts are looking for a rebound in profitability and the potential for Jabil’s strong projected earnings growth to improve sentiment around the stock.

See our full analysis for Jabil.Next, we’ll dig into how these headline results stack up against the major narratives shaping investor expectations, including which stories might need an update.

See what the community is saying about Jabil

Margins Recover as Profitability Forecast Climbs

- Analysts expect Jabil’s profit margins to rise from 2.0% today to 3.7% in three years, reversing the recent drop tied to one-off charges and hinting at long-term operational improvement.

- According to the analysts' consensus view, the margin recovery is seen as achievable due to:

- Planned expansions in India and AI sectors targeting higher-growth end markets, and

- New pharmaceutical acquisitions opening access to a $20 billion market, both supporting above-average profitability growth even after recent setbacks are accounted for.

- Consensus narrative suggests Jabil is poised for a rebound in margins if catalysts deliver as anticipated. Read the full consensus for a deeper dive. 📊 Read the full Jabil Consensus Narrative.

Peer Valuation Discount Widens

- Jabil’s current P/E ratio of 34.2x sits below peers’ average (35.5x) despite surpassing the broader US electronics sector average of 26.2x, with the stock trading at $209.34 compared to a DCF fair value estimate of $259.90. This signals a discount to intrinsic worth and select peers.

- The consensus narrative highlights this value gap by underscoring that:

- The share price remains 19% under DCF fair value and 8% below the average analyst price target of $247.38,

- Analyst targets imply not just upside but confidence that Jabil’s projected margin and growth recovery will close the valuation gap, even as short-term results lag the industry average.

Segment Setbacks Pressure Growth Profile

- Revenue declines in specific business areas are material: the Regulated Industries segment saw revenues fall 8% year over year and the Connected Living & Digital Commerce business contracted 13%, mainly from divestitures and softer consumer demand.

- Consensus narrative flags that these setbacks temper bullish expectations, noting:

- Inventory days ticked slightly above target, raising cash flow pressure,

- Ongoing market weakness in EV and renewables sectors could stall anticipated gains unless these segments recover or new verticals deliver projected growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Jabil on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Interpret the latest figures your way, and shape your own take on Jabil's outlook in just a few minutes. Do it your way

A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Jabil’s uneven performance, especially recent segment revenue declines and margin pressures, highlights vulnerability to volatile demand and execution risk in key markets.

If you want to focus on companies showing consistent, reliable earnings and revenue growth regardless of industry swings, check out stable growth stocks screener (2084 results) with your next investment idea in mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Jabil

Provides engineering, manufacturing, and supply chain solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026