Does Jabil’s Stock Pullback Signal a New Opportunity in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Jabil stock? You are not alone. With the share price closing yesterday at $202.08, it is easy to see why investors are paying close attention. Jabil’s stock has been on quite the journey, declining 6.4% over the past week and 3.8% over the last 30 days, after a powerful rally earlier in the year. Despite the recent pullback, the stock is still up an impressive 41.5% year to date and an even more notable 66.4% over the last twelve months. Looking even further back, the gains become even more striking: 238.6% over three years and 467.3% across five years.

What is behind all of this momentum and volatility? Some of the moves are tied to a changing market landscape, including shifting supply chain dynamics and the ongoing transformation of electronics manufacturing. For Jabil, whose business intersects with fast-growing tech segments, these shifts can bring opportunities as well as risks, often reflected in the stock price.

But the real question everyone wants answered is whether Jabil remains a good option after such significant growth. That is where valuation comes into play, and our latest analysis gives Jabil a value score of 4 out of 6, suggesting the company is undervalued in four major ways. In the next section, we will explore what those valuation checks actually mean, as well as the traditional metrics investors often watch. And just when you think you have valuation figured out, we will introduce a perspective you will not want to miss.

Approach 1: Jabil Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future free cash flows and discounting them back to today’s dollars. This approach gives investors a sense of what a business is intrinsically worth based on expected performance, rather than market mood swings.

For Jabil, the latest trailing twelve months free cash flow stands at $911.76 million. Analysts have forecast that free cash flow will rise steadily over the years, with estimates reaching $1.35 billion in 2026 and approximately $1.51 billion in 2028. Beyond these analyst estimates, Simply Wall St extrapolates further growth and projects free cash flow to surpass $2.1 billion by 2035. All projections and figures are based in US dollars.

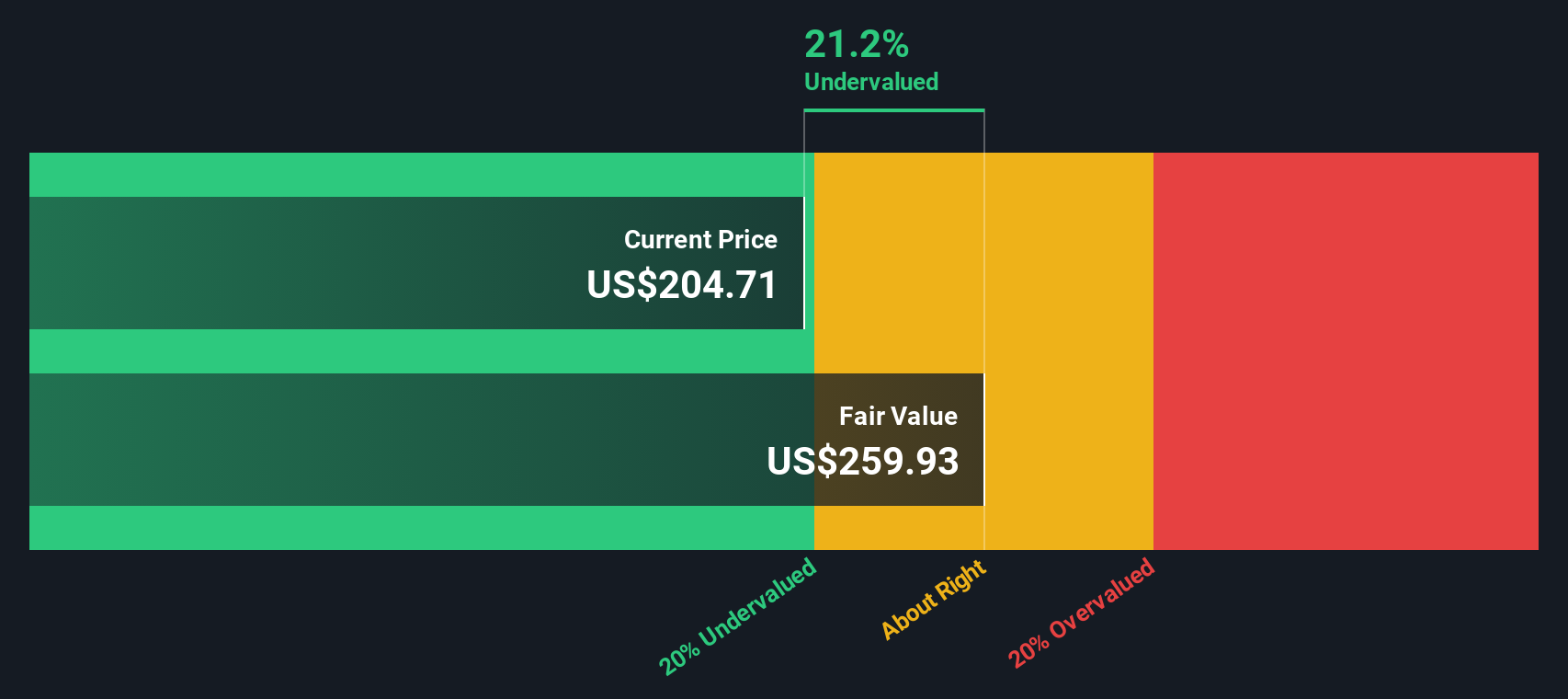

Running these cash flows through a 2 Stage Free Cash Flow to Equity DCF model results in an intrinsic value of $259.85 per share. This valuation suggests Jabil is trading at a 22.2% discount to its estimated fair value, indicating the stock is currently undervalued compared to its underlying cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Jabil is undervalued by 22.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Jabil Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to measure for valuing profitable companies like Jabil because it relates a company’s share price to its actual earnings. This offers investors a sense of how much they are paying for each dollar of profit. For businesses with steady revenues and consistent earnings, the PE ratio provides a straightforward benchmark for value.

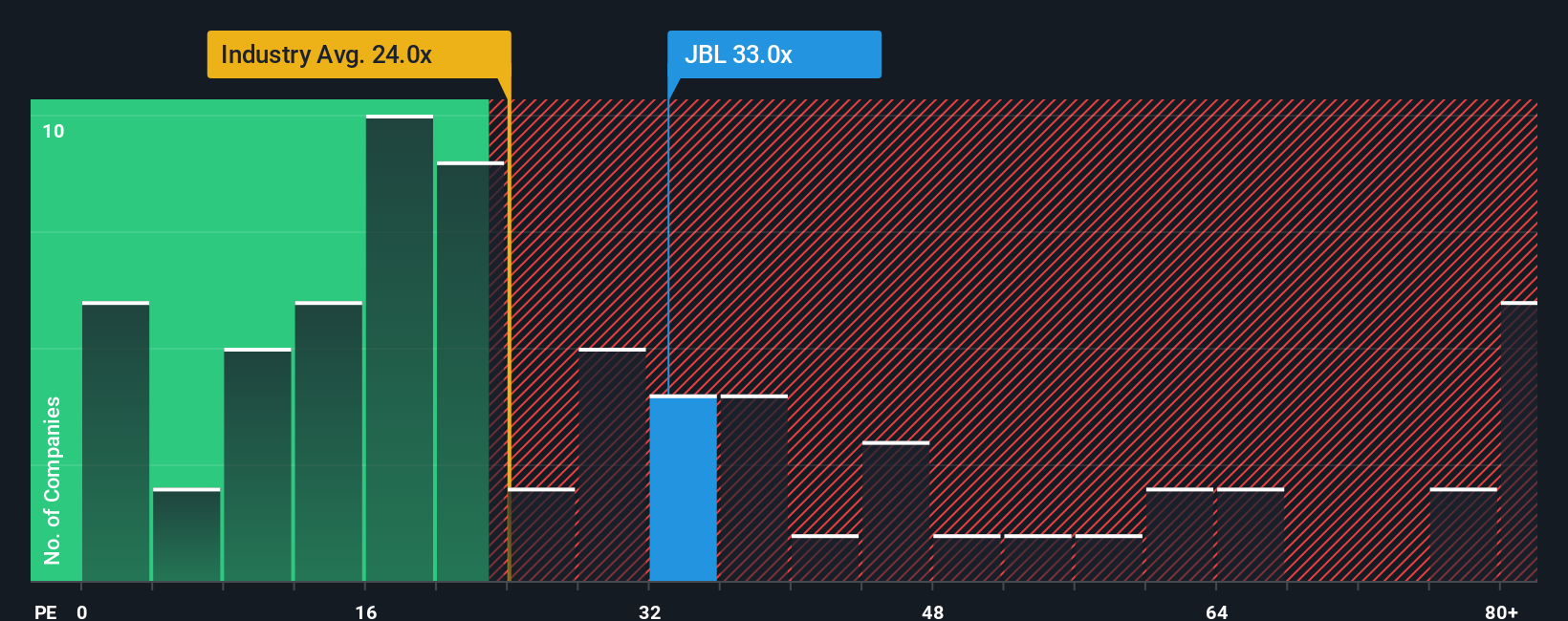

However, what counts as a “normal” or “fair” PE ratio depends on expectations for growth as well as risk. Companies with higher expected earnings growth or lower risk typically trade at higher PE ratios, while riskier or slower-growing firms warrant a discount. As of now, Jabil’s PE ratio stands at 33.0x. This is almost identical to the average for its immediate peers at 32.8x. However, it stands notably above the industry average of 24.0x, reflecting potentially stronger growth or profitability than the sector overall.

Simply Wall St’s proprietary Fair Ratio for Jabil is calculated at 35.1x. Unlike a simple comparison with peers or industry averages, the Fair Ratio considers a wider range of company-specific factors such as growth potential, profit margins, risks, industry positioning, and market cap. This makes it a more tailored benchmark for assessing valuation. With Jabil’s current PE ratio of 33.0x just below its Fair Ratio of 35.1x, the stock appears to be trading at about the right level based on these factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jabil Narrative

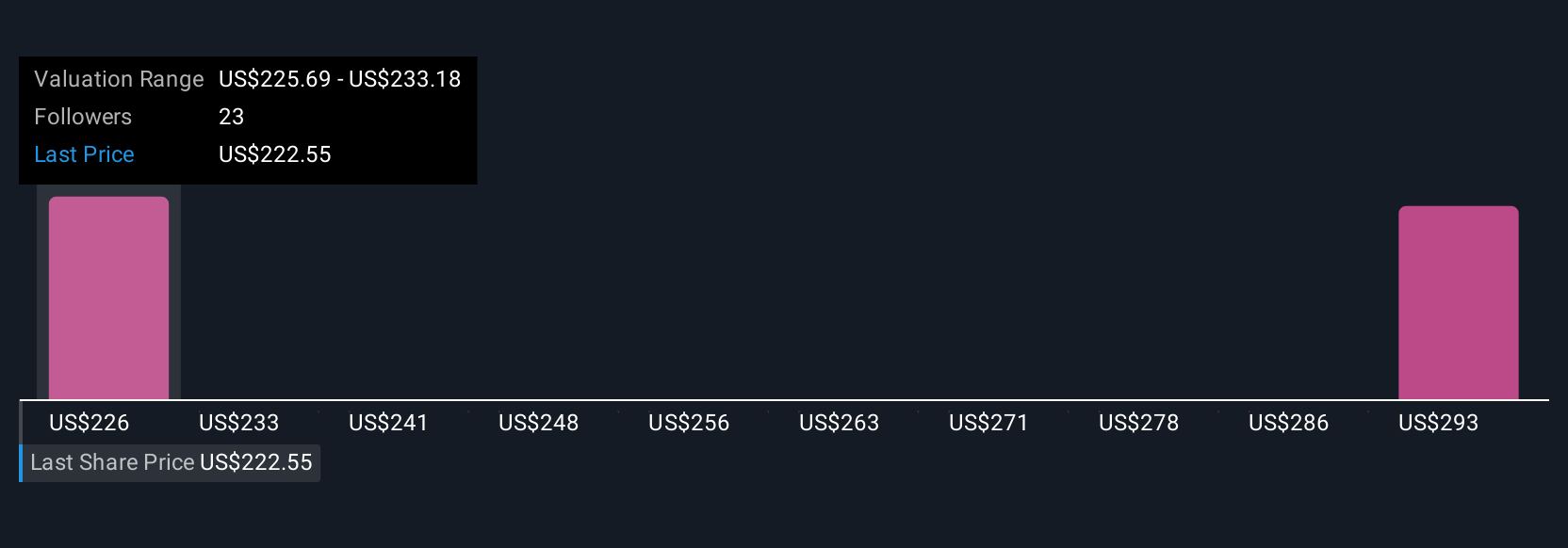

Earlier, we mentioned there is a more powerful way to think about valuation, so let us introduce you to Narratives. A Narrative is simply your story about a stock, combining your own view of Jabil’s opportunities and risks with your expectations for future revenue, earnings, and margins. By linking the company’s story to a financial forecast and translating that into a Fair Value, Narratives make it easy for anyone to clearly see how personal perspective drives investing decisions.

Narratives are available right now on Simply Wall St’s Community page, where millions of investors bring their best ideas and assumptions to life. With Narratives, you can decide if now is the right time to buy or sell by comparing the Fair Value from your Narrative against the current price. Plus, your Narrative updates automatically whenever fresh news or earnings arrive, keeping you in control.

For example, some investors believe Jabil’s expansion into the U.S. and India, new AI and pharmaceutical market entry, and strong cash flow generation justify a Fair Value as high as $256.00 per share. Others focus on risks from weakening market segments, tariffs, and margin pressure, resulting in a lower Fair Value like $176.00. Narratives help you see both sides, so you can make smarter, more confident investment decisions.

Do you think there's more to the story for Jabil? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives