- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

Will IonQ’s (IONQ) Grid Optimization Milestone Unlock Broader Quantum Advantage or Raise New Hurdles?

Reviewed by Simply Wall St

- IonQ, in partnership with Oak Ridge National Laboratory and the U.S. Department of Energy, recently achieved a breakthrough using its hybrid quantum-classical approach to tackle the energy sector’s complex Unit Commitment problem, a critical challenge for efficient power grid operation.

- This milestone positions IonQ’s quantum computing technology as a promising solution for large-scale optimization tasks, not only in energy but also across logistics, scheduling, and finance.

- We'll examine how IonQ’s collaboration on quantum-powered grid optimization could reshape the company’s investment narrative amid rising industry interest.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is IonQ's Investment Narrative?

For investors considering IonQ, the essential belief is that quantum computing will mature into a commercially viable technology and IonQ’s trapped-ion systems will secure a meaningful slice of this future market. The recent joint project with Oak Ridge National Laboratory and the U.S. Department of Energy stands out, but is unlikely to materially move the dial for IonQ’s near-term catalysts, namely, revenue acceleration, new commercial contracts, and progress on scaling qubit hardware. While the technical success adds credibility and catch the interest of potential industry partners, the company’s main risks remain unchanged: commercial adoption timelines are still very much in question, profitability remains distant, share price is volatile, and high cash burn continues. Analyst price targets and the stock's sharp multi-month swings also signal caution despite the apparent technological lead and ongoing government collaborations.

However, this optimism about breakthrough technology comes with the real risk of delayed commercial revenues.

Exploring Other Perspectives

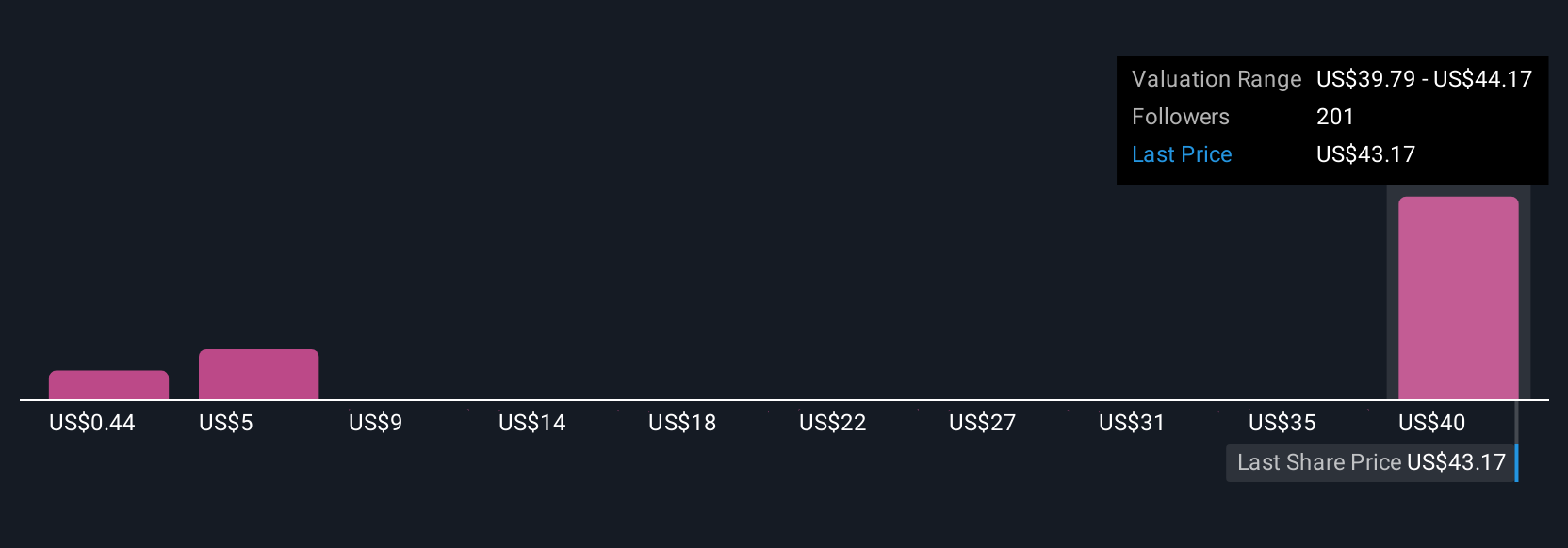

Explore 52 other fair value estimates on IonQ - why the stock might be worth as much as 24% more than the current price!

Build Your Own IonQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IonQ research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free IonQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IonQ's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion