- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

Why IonQ (IONQ) Is Up 11.2% After Einride Partnership and New Leadership Appointments And What's Next

Reviewed by Simply Wall St

- IonQ recently announced a partnership with Swedish company Einride to develop quantum solutions for fleet routing, logistics optimization, and supply chain management, while also unveiling new leadership by appointing Paul T. Dacier as Chief Legal Officer.

- This series of moves, combined with heightened optimism in the quantum computing sector following a competitor’s technical breakthrough, highlights IonQ’s ambition to become a leading force in commercial quantum applications.

- We’ll explore how IonQ’s expansion into logistics quantum solutions could influence its future investment narrative and growth prospects.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

What Is IonQ's Investment Narrative?

Owning IonQ stock has always required a belief in the potential of quantum computing to become a new foundation of enterprise technology, and a trust that IonQ can take the lead despite intense competition and ongoing financial losses. The company’s recent moves, including a nearly $1 billion equity raise, securing primary technology provider status for South Korea’s quantum center, a new logistics-focused partnership with Einride, and the appointment of an accomplished Chief Legal Officer, now add fresh wrinkles to its near-term outlook. These headlines could help shift the most important short-term catalysts toward large-scale international contract wins and the successful commercial rollout of quantum-based logistics solutions. Yet, they also bring attention to the risks tied to aggressive expansion and shareholder dilution, especially as IonQ remains unprofitable and faces an inexperienced management team. For now, share price momentum appears strong, but investors will need to keep a close watch on execution and cash burn. On the flip side, significant dilution risk is an issue investors should be aware of.

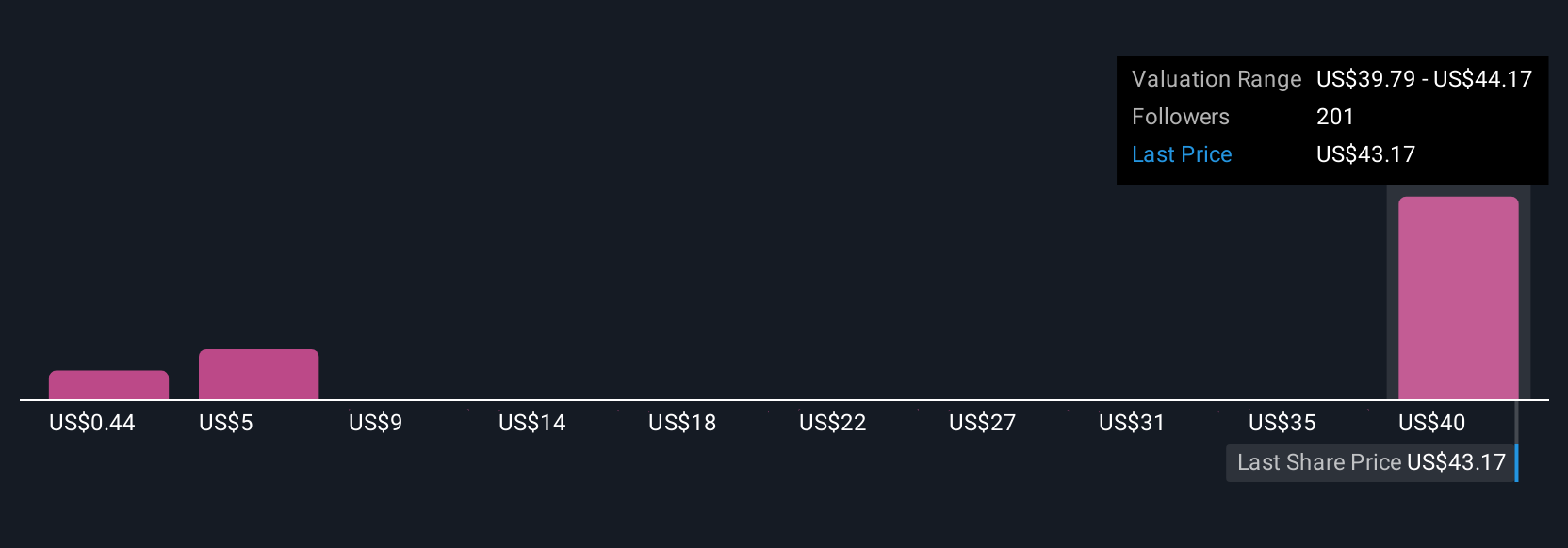

Insights from our recent valuation report point to the potential overvaluation of IonQ shares in the market.Exploring Other Perspectives

Explore 49 other fair value estimates on IonQ - why the stock might be worth as much as $44.17!

Build Your Own IonQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IonQ research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free IonQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IonQ's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion