- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (NYSE:IONQ) Explores Quantum Applications In Logistics With Einride Partnership

Reviewed by Simply Wall St

IonQ (NYSE:IONQ) recently announced significant agreements, including a partnership with the Korea Institute of Science and Technology Information to integrate quantum systems in South Korea and an alliance with Einride to explore quantum applications in logistics. These initiatives align with IonQ's broader efforts to expand its quantum computing footprint, coupled with plans for a global satellite quantum key distribution network. During the quarter, the company's stock soared 91%, outpacing the tech sector's performance as noted by a general tech rally, fuelled by Nvidia's strong results highlighting demand in AI technology. These developments enhanced IonQ's market position in an increasingly competitive landscape.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

IonQ's shares have experienced a very large total return over the past three years, showcasing significant investor interest and optimism surrounding its growth prospects in the quantum computing sector. This impressive performance highlights the company's potential within the rapidly evolving tech industry. In comparison, over the past year, IonQ has not only exceeded the 11.5% return of the broader U.S. market but also outperformed the U.S. tech industry's 4% return, further underscoring its robust market position.

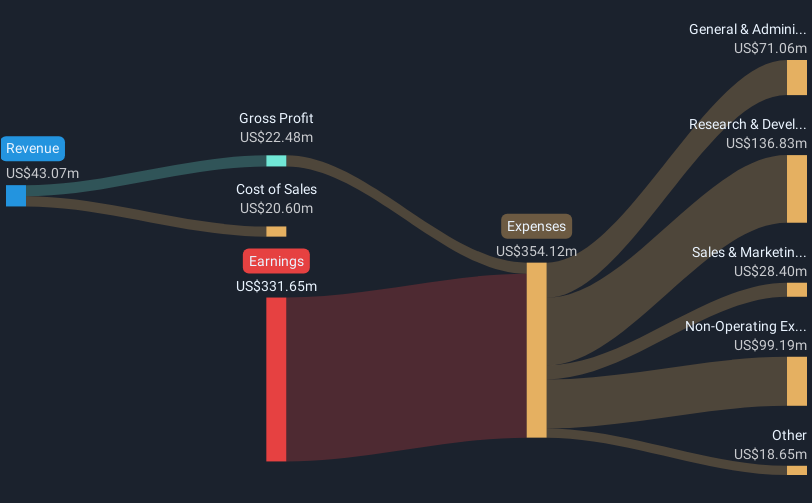

The strategic partnerships and technological advancements alluded to in the introduction could drive IonQ’s revenue growth, forecasted at 41% annually, albeit from a relatively modest base, as the upcoming projects target diverse sectors like logistics and energy. However, despite these growth initiatives, IonQ remains unprofitable, with earnings expected to decline by an average of 2.2% annually over the next three years. The company's share price is currently below consensus analyst price targets of US$40, suggesting a potential discount relative to market expectations.

The valuation report we've compiled suggests that IonQ's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion