- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (IONQ) Names Quantum Pioneer Marco Pistoia As Senior Vice President

Reviewed by Simply Wall St

IonQ (IONQ) recently experienced a significant price move of approximately 51% over the last quarter, potentially influenced by key executive appointments and strategic alliances. The addition of Dr. Marco Pistoia as Senior Vice President of Industry Relations could bolster IonQ's leadership in the quantum computing sector. Meanwhile, a collaboration with Emergence Quantum aims to enhance ion trap technology, and partnerships with AstraZeneca and AWS signify advancements in quantum-accelerated workflows. These developments align with broader market trends, as the S&P 500 and Nasdaq have reached record highs, supported by strong corporate results and economic data.

Over the last three years, IonQ's shares delivered a very large total return of over 700%. This impressive performance is set against the backdrop of the company's strategic efforts in expanding its quantum computing capabilities. Against the broader US Market's return of 17.7% in the past year, IonQ offered remarkable returns, although its earnings remain unprofitable, highlighting the high-growth expectations investors hold for this sector. Compared to the US Tech industry's 1.6% decline, IonQ's returns also stand out significantly over the past year.

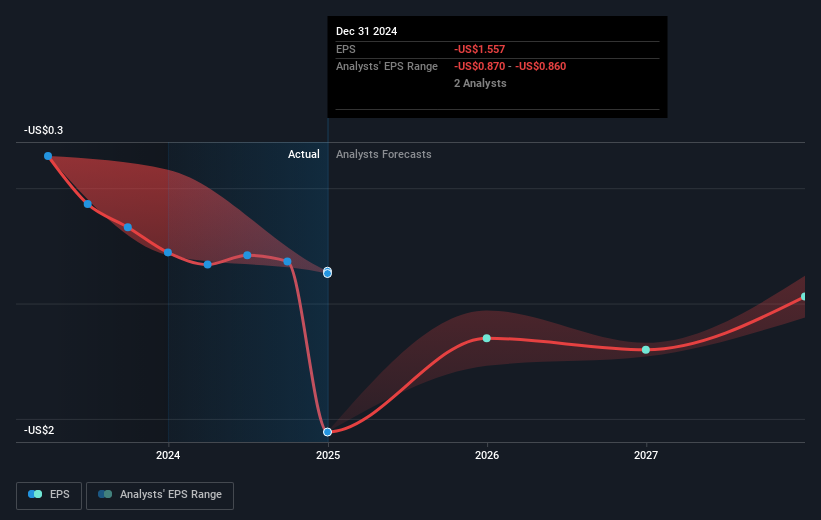

The recent key executive appointments, particularly Dr. Marco Pistoia, along with strategic collaborations with firms like Emergence Quantum and AstraZeneca, could support IonQ's revenue growth, forecast at 40.3% annually. However, the company's projected earnings are expected to decline by an average of 2.1% over the next three years, with profitability not anticipated in the near future. The current share price of US$42.34 is slightly below the consensus analyst price target of US$44.17, suggesting that the stock's recent 51% rise over the last quarter is closely aligned with market expectations but still implies a small opportunity for further upside.

Take a closer look at IonQ's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives