- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

Can IonQ’s (IONQ) Acquisition Strategy and University Partnerships Offset Ongoing Profitability Challenges?

Reviewed by Sasha Jovanovic

- IonQ reported exceptionally strong third-quarter results, driven by a sharp increase in revenue that largely reflects contributions from recent acquisitions and major new partnerships, such as its agreement to establish a dedicated quantum research center with the University of Chicago.

- This heightened growth, however, has brought increased scrutiny as analysts and investors debate the sustainability of relying on acquisition-fueled momentum amid continued operating losses and high customer concentration.

- We'll explore what IonQ's combination of rapid acquisition-driven growth and major university partnerships means for its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is IonQ's Investment Narrative?

Being a shareholder in IonQ means buying into a story of long-term quantum technology leadership, rapid revenue growth, and expanding global partnerships. The groundbreaking University of Chicago alliance and DARPA project selection reinforce IonQ’s focus on advancing fundamental quantum capabilities and building influence across the commercial, academic, and government sectors. These news events could drive near-term optimism, as they bolster IonQ’s credentials and might open doors to new use cases and revenue streams. However, the immediate impact may be limited, as IonQ’s core risks, heavy reliance on acquisitions, continued operating losses, cash burn, and customer concentration, remain front and center, and the stock has recently faced sharp declines. The fresh partnerships slightly shift the narrative by highlighting IonQ’s commitment to deep tech and academic roots, but investors will still grapple with questions around sustainability, dilution, and valuation in the short term.

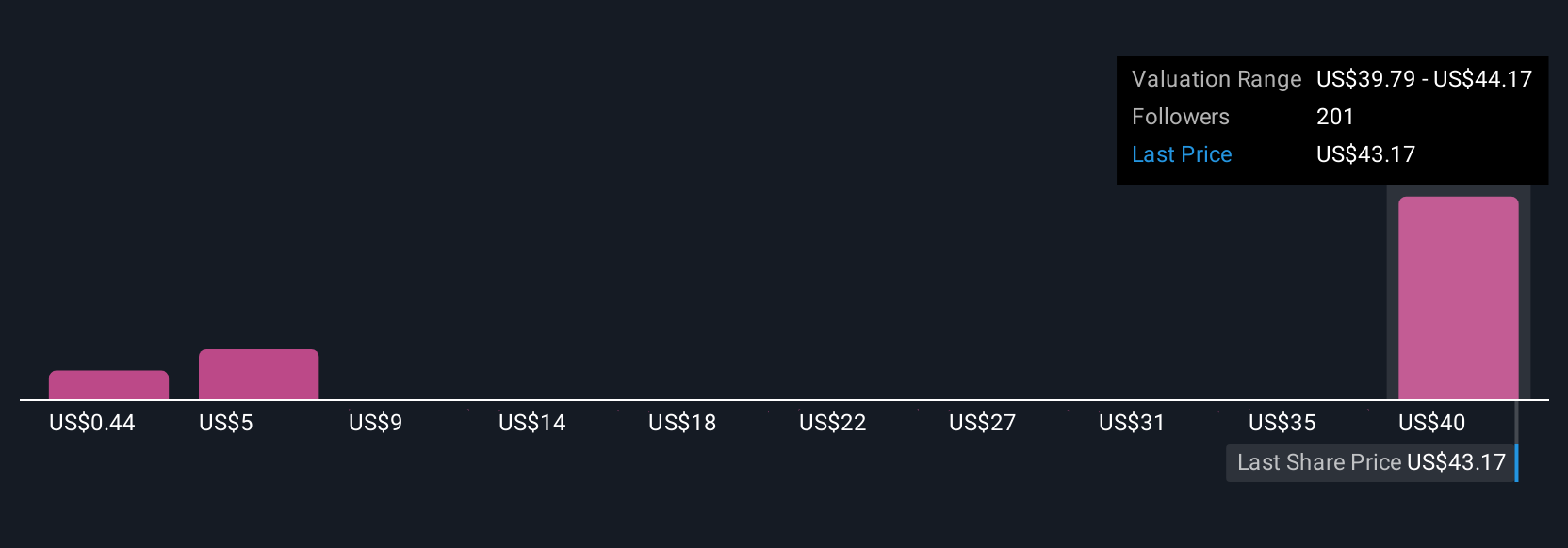

On the other hand, high cash burn and customer concentration remain issues investors should watch. Insights from our recent valuation report point to the potential overvaluation of IonQ shares in the market.Exploring Other Perspectives

Explore 65 other fair value estimates on IonQ - why the stock might be worth as much as 80% more than the current price!

Build Your Own IonQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IonQ research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free IonQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IonQ's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives