The Bull Case For Ingram Micro Holding (INGM) Could Change Following $535 Million Shelf Registration Filing – Learn Why

Reviewed by Sasha Jovanovic

- Ingram Micro Holding Corporation recently filed a shelf registration for up to US$535.76 million in common stock, potentially paving the way for a significant equity offering.

- This move gives the company flexibility to access additional capital, which may raise questions about potential dilution for existing shareholders.

- We'll explore how the prospect of a substantial equity issuance shapes Ingram Micro Holding's broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Ingram Micro Holding's Investment Narrative?

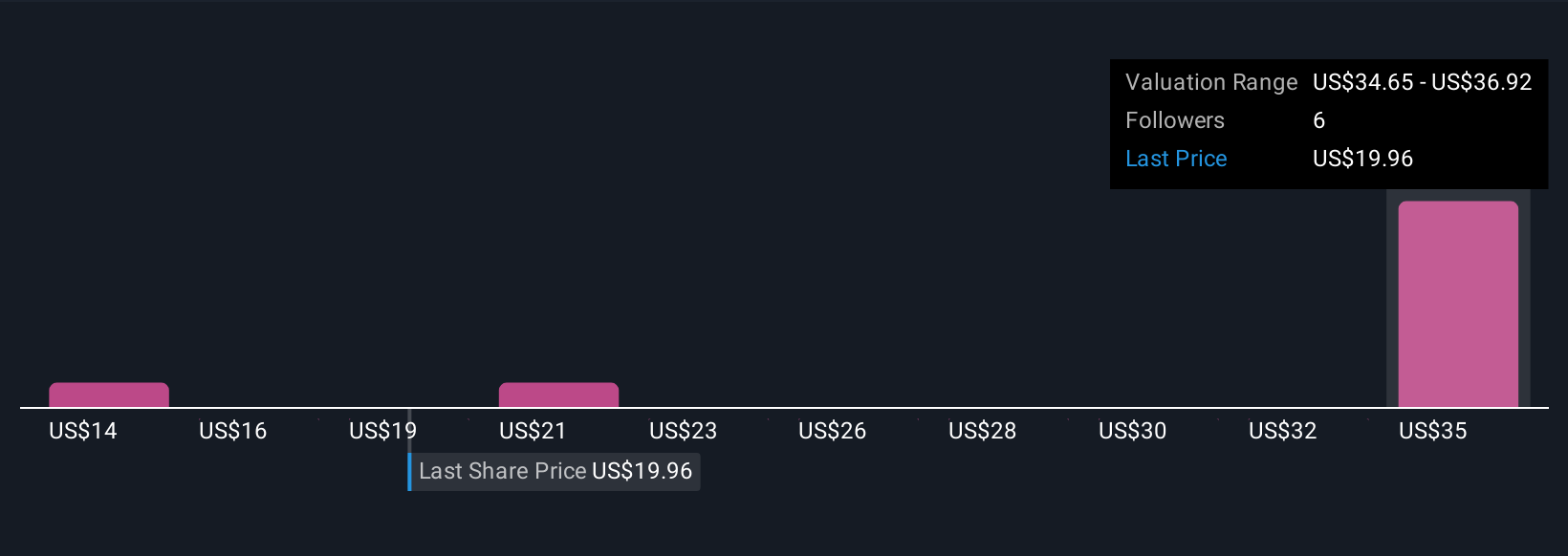

To own Ingram Micro Holding, you need confidence in its ability to convert global scale and digital innovation, like its fresh AI sales tools, into sustained earnings growth, all while managing industry pressures and shareholder expectations. The company has rewarded investors with growing dividends and posted improved earnings, but it still carries risks: its net profit margin remains slim, return on equity is low, and board turnover is high. The new US$535.76 million shelf registration adds fresh complexity. While this action provides financial flexibility, it could shift short-term focus from profitability and cash returns to questions about future dilution and the lack of buybacks. This development may amplify the importance of upcoming results and management communication, as investors weigh whether new capital will fund meaningful growth or simply dilute existing value.

On the flip side, potential dilution is a risk current shareholders should keep on their radar.

Exploring Other Perspectives

Explore 3 other fair value estimates on Ingram Micro Holding - why the stock might be worth as much as 74% more than the current price!

Build Your Own Ingram Micro Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingram Micro Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingram Micro Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingram Micro Holding's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGM

Ingram Micro Holding

Through its subsidiaries, distributes information technology products, cloud, and other services in North America, Europe, the Middle East, Africa, the Asia-Pacific, Latin America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives