- United States

- /

- Tech Hardware

- /

- NYSE:HPQ

Does HP’s 20% Share Price Drop Signal a Value Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if HP stock is really worth your attention right now? Let's examine what might make it stand out as either a hidden value or a risky bet.

- HP's share price has experienced some turbulence lately, falling 7.6% over the last week and 20.1% so far this year. This could indicate either an opportunity or a warning for investors watching for momentum shifts.

- Recent headlines have highlighted the company's strategic efforts to revitalize its core business, such as expanding into new product lines and increasing partnerships in emerging markets. These moves are receiving attention as investors consider HP's next phase of growth alongside broader industry challenges.

- The key question is how HP measures up on value. The company scores 5 out of 6 on our valuation checks. We'll break down what that really means, compare a few approaches, and discuss a smarter way to look at valuation by the end of this article.

Find out why HP's -26.3% return over the last year is lagging behind its peers.

Approach 1: HP Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to what they are worth today. This method helps investors gauge whether the current share price reflects the company’s true underlying value.

HP’s most recent Free Cash Flow stands at $3.01 Billion. Analyst estimates project this to grow over the next five years, with the expectation that HP's Free Cash Flow will reach $3.30 Billion by 2029. The first few years of these projections are based on analyst forecasts, while figures beyond that are extrapolated by Simply Wall St to provide a full decade of outlook.

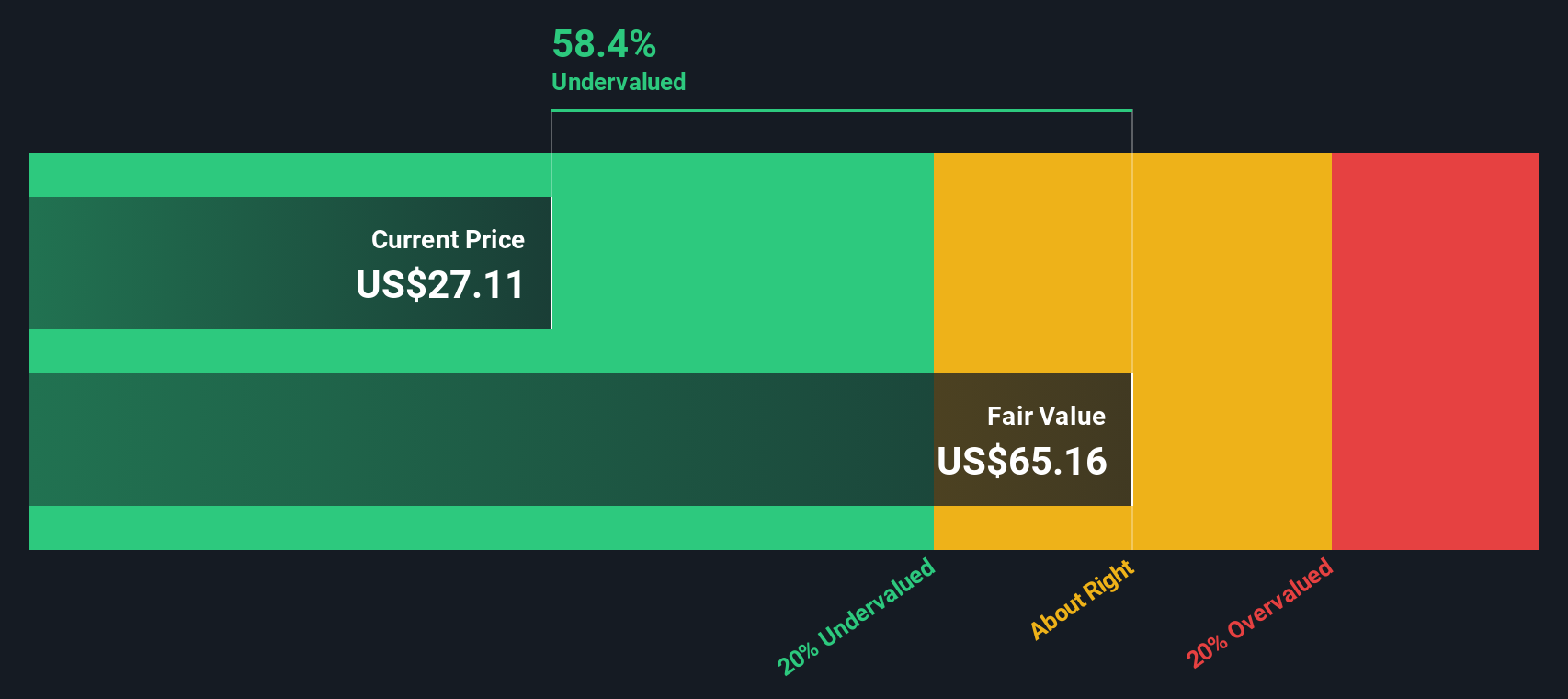

Using its established 2 Stage Free Cash Flow to Equity DCF model, HP’s intrinsic value is estimated at $50.10 per share. Compared to the current share price, this suggests HP stock is trading at a 48.2% discount to its projected value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests HP is undervalued by 48.2%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

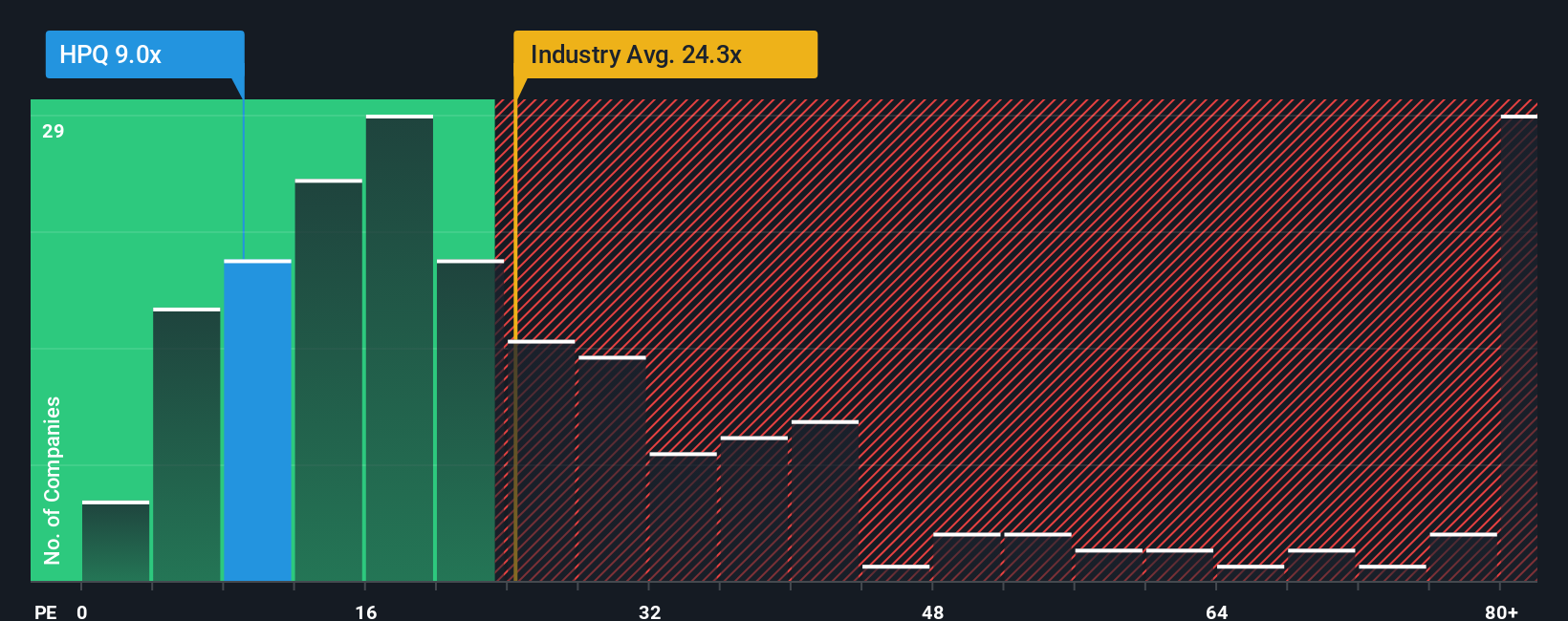

Approach 2: HP Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies like HP because it highlights how much investors are willing to pay for each dollar of earnings. It is particularly useful when comparing established firms with a solid track record of generating profit, providing a quick snapshot of market sentiment around future growth and company stability.

What counts as a “normal” or “fair” PE ratio is not set in stone. It tends to be higher for companies with strong growth expectations or lower perceived risk, and lower for those with slower growth or more uncertainty. That is why looking at the benchmarks is helpful.

HP currently trades at a PE ratio of 9.2x. By comparison, the average PE across its Tech industry is 23.2x, while the peer average is even higher at 24.5x. On the surface, this looks like HP is trading at a significant discount versus its competitors.

This is where the “Fair Ratio” from Simply Wall St comes in. The Fair Ratio, calculated at 27.2x for HP, considers a broader set of factors including the company’s earnings growth outlook, profit margins, market cap, industry positioning, and risk profile. Unlike a simple peer or industry comparison, this approach is more tailored and holistic, offering a more nuanced view of whether the stock’s valuation makes sense given its unique business profile.

Given HP’s actual PE of 9.2x versus its Fair Ratio of 27.2x, the shares appear to be significantly undervalued relative to what would be expected after considering all relevant factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HP Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your story about a company, connecting the reasons behind your financial expectations with the numbers themselves, such as your assumptions on future revenue, profits, and margins. These elements then flow through to your estimate of fair value.

Narratives bridge the gap between a company’s business story and its financial forecast, allowing you to clearly link what you believe about HP’s market position, industry trends, and strategy to concrete price targets and actionable decisions. This powerful approach is easy to use and available right on Simply Wall St’s Community page, where millions of investors share and refine their perspectives.

With Narratives, you can quickly see if your fair value, based on your view, suggests a buy, sell, or hold when compared to today’s market price, making your investment choices more transparent and data-driven. Because Narratives are kept up-to-date as soon as new information like earnings reports or news is released, your decisions adapt in real time alongside the company.

For HP, recent Narratives from the Community reflect both optimistic and cautious viewpoints. Some investors, pointing to growth in AI PCs and recurring digital services, see a fair value as high as $30. Others, concerned about long-term print declines and margin pressures, estimate a more conservative value of $25.

Do you think there's more to the story for HP? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPQ

HP

Provides personal computing, printing, 3D printing, hybrid work, gaming, and other related technologies in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives