- United States

- /

- Tech Hardware

- /

- NYSE:HPE

We Discuss Why Hewlett Packard Enterprise Company's (NYSE:HPE) CEO Will Find It Hard To Get A Pay Rise From Shareholders This Year

The anaemic share price growth at Hewlett Packard Enterprise Company (NYSE:HPE) over the past few years has probably not impressed shareholders and may be due to earnings not growing over that period. The upcoming AGM on 14 April 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for Hewlett Packard Enterprise

How Does Total Compensation For Antonio Neri Compare With Other Companies In The Industry?

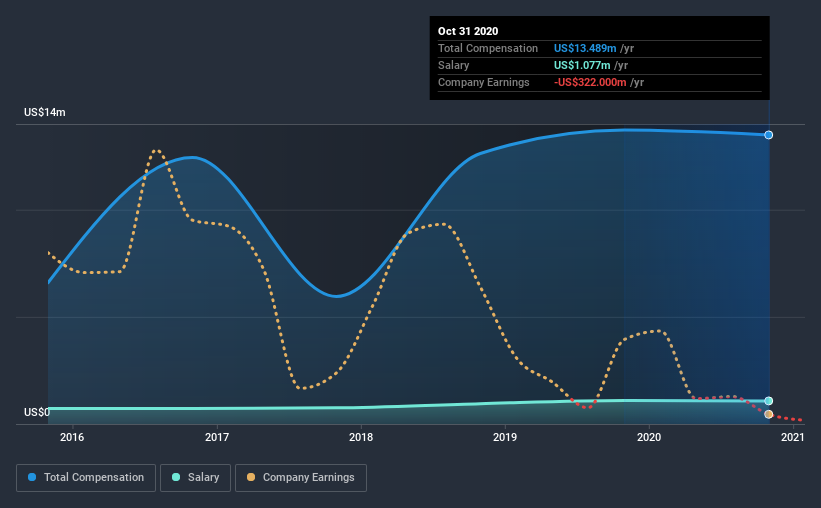

At the time of writing, our data shows that Hewlett Packard Enterprise Company has a market capitalization of US$21b, and reported total annual CEO compensation of US$13m for the year to October 2020. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.1m.

For comparison, other companies in the industry with market capitalizations above US$8.0b, reported a median total CEO compensation of US$13m. So it looks like Hewlett Packard Enterprise compensates Antonio Neri in line with the median for the industry. Furthermore, Antonio Neri directly owns US$11m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$1.1m | US$1.1m | 8% |

| Other | US$12m | US$13m | 92% |

| Total Compensation | US$13m | US$14m | 100% |

On an industry level, roughly 20% of total compensation represents salary and 80% is other remuneration. Hewlett Packard Enterprise sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Hewlett Packard Enterprise Company's Growth

Over the last three years, Hewlett Packard Enterprise Company has shrunk its earnings per share by 90% per year. It saw its revenue drop 5.8% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Hewlett Packard Enterprise Company Been A Good Investment?

With a total shareholder return of 2.3% over three years, Hewlett Packard Enterprise Company has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

While it's true that the share price growth hasn't been bad, it's hard to overlook the lack of earnings growth and this makes us question whether there will be any strong catalyst for the stock to improve. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for Hewlett Packard Enterprise (1 is significant!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Hewlett Packard Enterprise or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives