- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Is It the Right Moment for Hewlett Packard Enterprise After This Year's 20% Share Price Rise?

Reviewed by Bailey Pemberton

If you have been watching Hewlett Packard Enterprise stock lately, it is fair to wonder if now is the right time to take action. On the one hand, the company’s share price has taken investors on a real journey, notching an impressive 207.8% gain in five years and climbing 83% over three years. Looking closer, the past year alone brought a solid 20.2% boost. Yet, in the most recent stretches, the momentum has cooled, with the stock dropping 6.9% over the past week and month. These swings have made it even more important for current and prospective investors to reevaluate whether HPE is actually undervalued or has simply run out of steam.

Much of this excitement, and some jitters, have been tied to Hewlett Packard Enterprise’s strategic pivots. The company’s focus on edge computing, hybrid cloud, and the rapid rollout of AI-driven solutions has attracted waves of both optimism and scrutiny. Partnerships with industry leaders and expansion into high-margin offerings have shaped expectations, occasionally triggering sharp moves in the stock as the market digests HPE’s evolving position in competitive tech sectors.

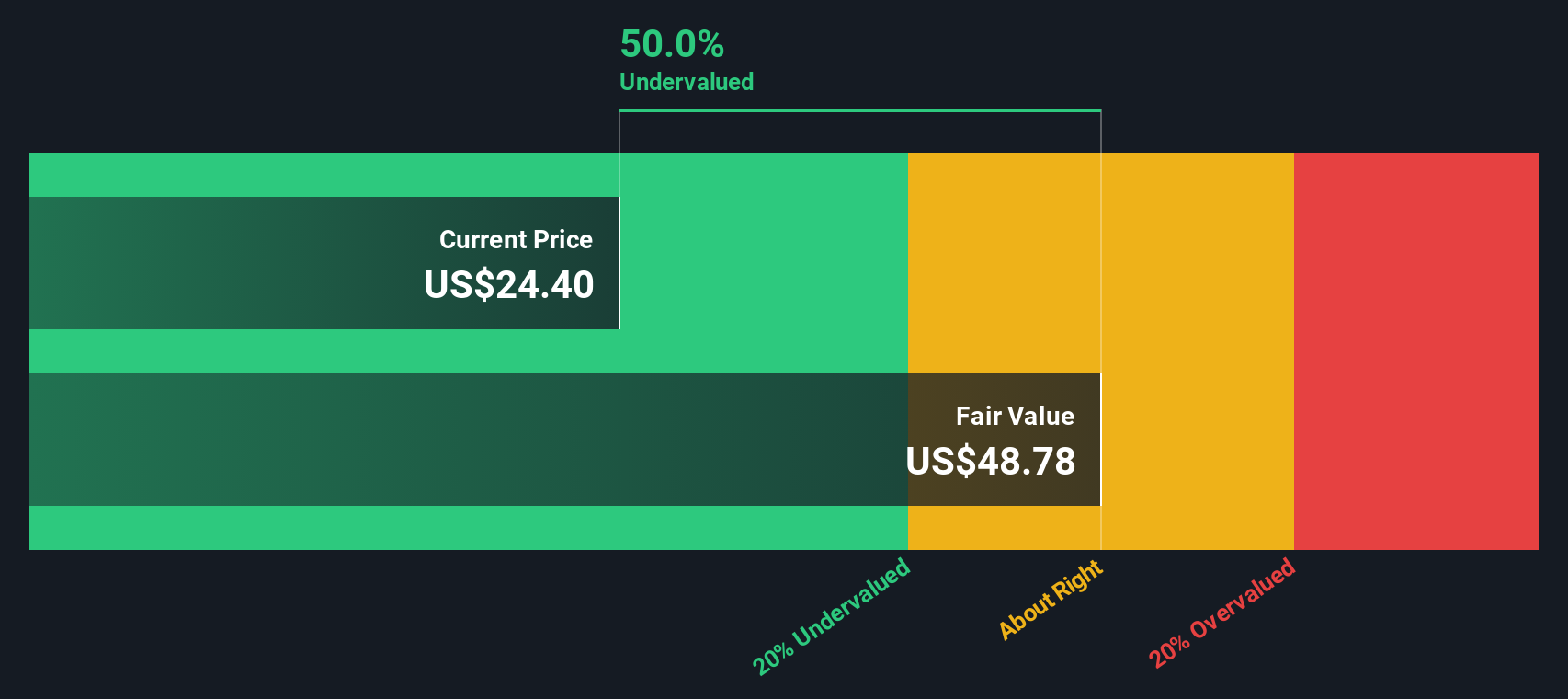

So how does the current value stack up? According to a blend of six common valuation checks, HPE registers a value score of 3, meaning it ticks the box for being undervalued in three of the six key categories. That is promising, but is it enough to call the stock a bargain?

Next, let’s dig into how these valuation metrics break down, and stick around, as we will wrap up with an even smarter way to think about valuation beyond the standard playbook.

Approach 1: Hewlett Packard Enterprise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and then discounting them back to today’s value. This approach attempts to capture the intrinsic value of Hewlett Packard Enterprise by focusing on anticipated earning power rather than just current market sentiment.

According to the latest DCF analysis for Hewlett Packard Enterprise, the company’s most recent reported Free Cash Flow (FCF) is -$344.4 Million. However, looking ahead, analysts expect the company’s annual cash flows to improve significantly. In particular, projections show FCF reaching around $3.6 Billion by 2029. Over a ten-year period, forecasts continue to climb, ultimately pointing to ongoing growth in cash generation. It is worth mentioning that estimates beyond 2029 are model-based extrapolations by Simply Wall St rather than direct analyst forecasts.

Based on these projections, the DCF model values Hewlett Packard Enterprise shares at $34.94 each. With the model indicating a 33.4% discount compared to the current market price, the stock appears to be substantially undervalued according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hewlett Packard Enterprise is undervalued by 33.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hewlett Packard Enterprise Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most popular methods for valuing profitable companies like Hewlett Packard Enterprise. Since it compares a company’s current share price to its earnings per share, it gives investors a quick sense of how much they are paying for $1 of the company's earnings. A lower PE can mean a company is undervalued relative to its profits, although growth prospects and risks play a big part in what ratio is truly fair.

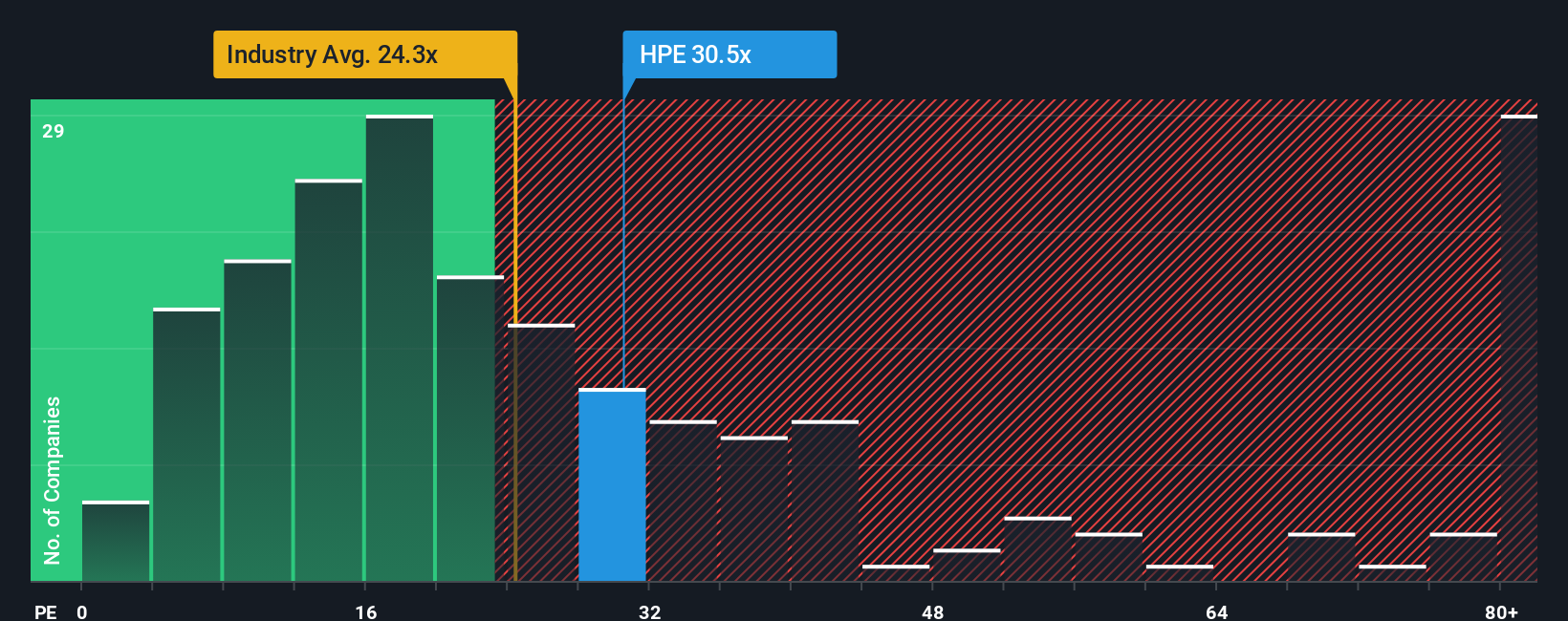

The right PE ratio for any stock depends on the outlook for its earnings growth and how much uncertainty or risk surrounds those future profits. All else being equal, investors are willing to pay a higher PE for companies with faster expected growth and stable earnings. In contrast, riskier or slower-growing firms typically command a discount. For Hewlett Packard Enterprise, the current PE ratio stands at 27x. Compared to the tech industry’s average of 23.9x and a peer average of 21.8x, HPE trades at a noticeable premium.

Simply Wall St’s "Fair Ratio" takes this analysis a step further by factoring in much more than industry averages or what other companies are trading at. It is a tailored benchmark that considers Hewlett Packard Enterprise’s own profit margins, future earnings potential, market cap, risk profile, and its position in the tech landscape. In this case, the Fair Ratio sits at 47x, much higher than both the actual PE and industry benchmarks. This suggests that, given the company’s characteristics, investors could justifiably pay more for HPE than the market currently does. This indicates undervaluation based on this more holistic assessment.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hewlett Packard Enterprise Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story about Hewlett Packard Enterprise, an easy way to combine your perspective on what is driving the business with your own numbers for future revenue, margins, and fair value.

Instead of just relying on traditional ratios, Narratives let you connect the dots between the company’s latest news, your expectations (bullish or bearish), and exactly how those beliefs impact what you think the shares are worth. You can build your own Narrative using Simply Wall St’s Community page, just like millions of other investors, and see your fair value update automatically whenever new information comes in, so you are never out of the loop.

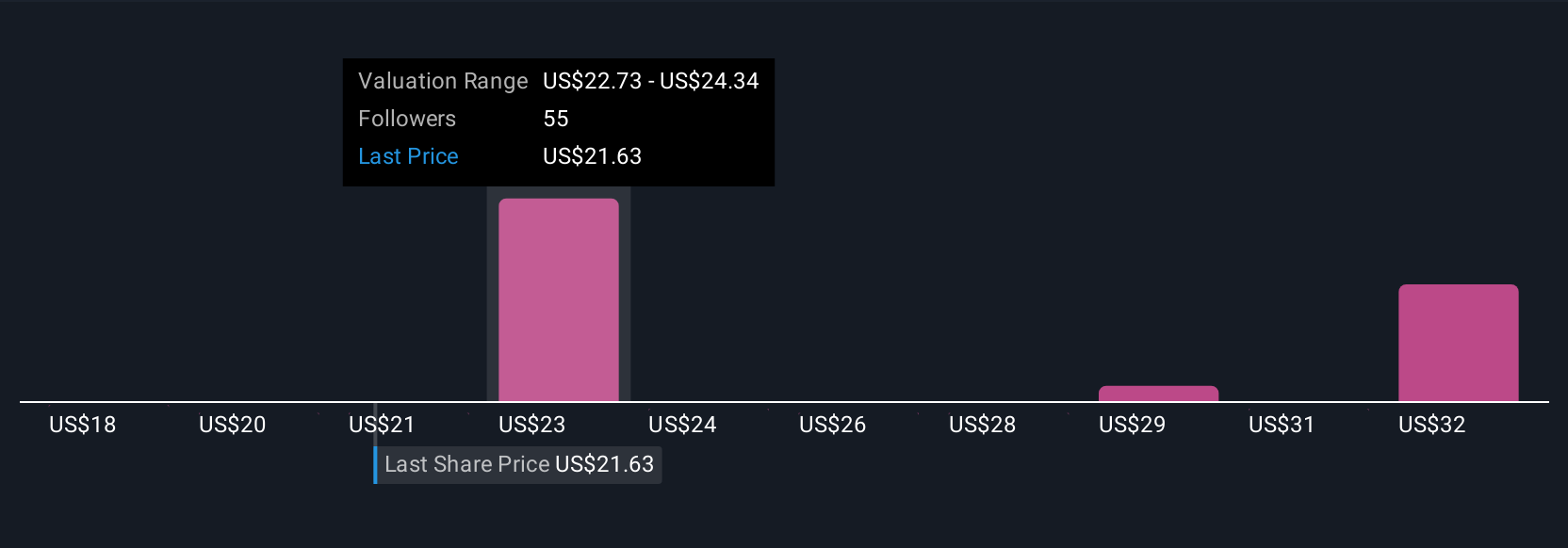

This helps you decide if it is time to buy or sell by showing you how your fair value compares to the current price, making your investment process more grounded and objective. For example, one investor might believe HPE’s new AI and cloud services will outpace expectations, setting a fair value as high as $30, while another, worried about execution and competition, sees the fair value closer to $19.

Do you think there's more to the story for Hewlett Packard Enterprise? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives