- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (NYSE:HPE) Stock Surges 11% Over Past Week

Reviewed by Simply Wall St

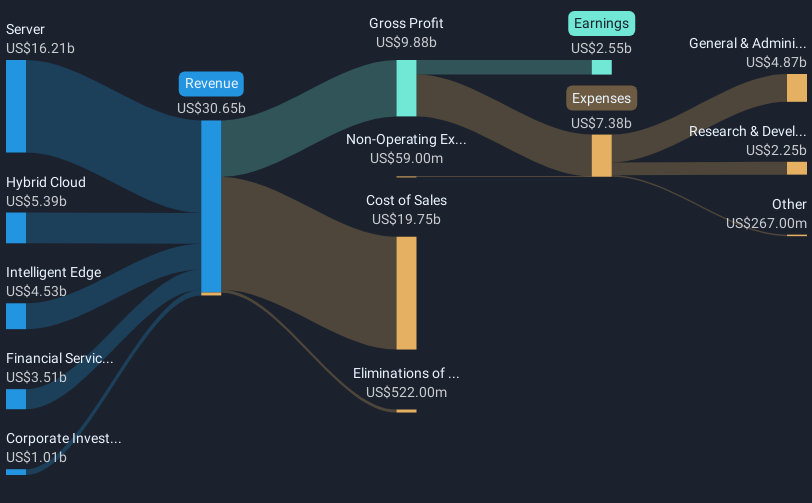

Hewlett Packard Enterprise (NYSE:HPE) recently expanded its HPE Aruba Networking Central solutions, introducing new deployment options like virtual private cloud and on-premises solutions. This move comes alongside the launch of private cloud AI solutions in collaboration with NVIDIA. During the same period, the stock price increased by 11%, slightly outpacing the market's 5% climb. These product-related announcements likely bolstered investor confidence, aligning with recent growth trends shown by Hewlett Packard Enterprise as part of its strategic shift towards AI-driven and compliance-focused solutions. However, the broader market strength is also a likely contributor to this price movement.

We've spotted 1 warning sign for Hewlett Packard Enterprise you should be aware of.

Hewlett Packard Enterprise's recent expansion of its Aruba Networking Central solutions and collaboration with NVIDIA could enhance its AI and compliance-focused offerings, supporting its strategic direction in these growth areas. This product innovation is expected to positively influence revenue prospects, particularly through capturing high-margin AI workloads, which align with current shifts in digital infrastructure needs. As such, these developments may impact the narrative centered on HPE's shift towards high-margin businesses and operational efficiency improvements.

Over a five-year period, HPE's total shareholder return of 71.27% reflects a robust performance. The stock price rise in the short term is notably higher than the market's growth, suggesting favorable investor reception of recent strategic initiatives. However, over the past year, HPE underperformed the US Tech industry, which returned 9.6%, partially highlighting challenges in maintaining consistent growth momentum.

The introduction of AI solutions and potential synergies from the Juniper acquisition may enhance revenue and earnings forecasts, though these are contingent on overcoming regulatory challenges and competitive pressures. Analysts have expressed divergent opinions regarding HPE's valuation, with a consensus price target of US$19.48, indicating a significant premium above the current share price of US$12.51. This substantial discount to the price target suggests a possibly undervalued position, assuming successful integration of strategic priorities alongside improved operational efficiencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives