- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Hewlett Packard Enterprise (HPE): TTM Net Loss Challenges Bullish Margin-Recovery Narrative

Reviewed by Simply Wall St

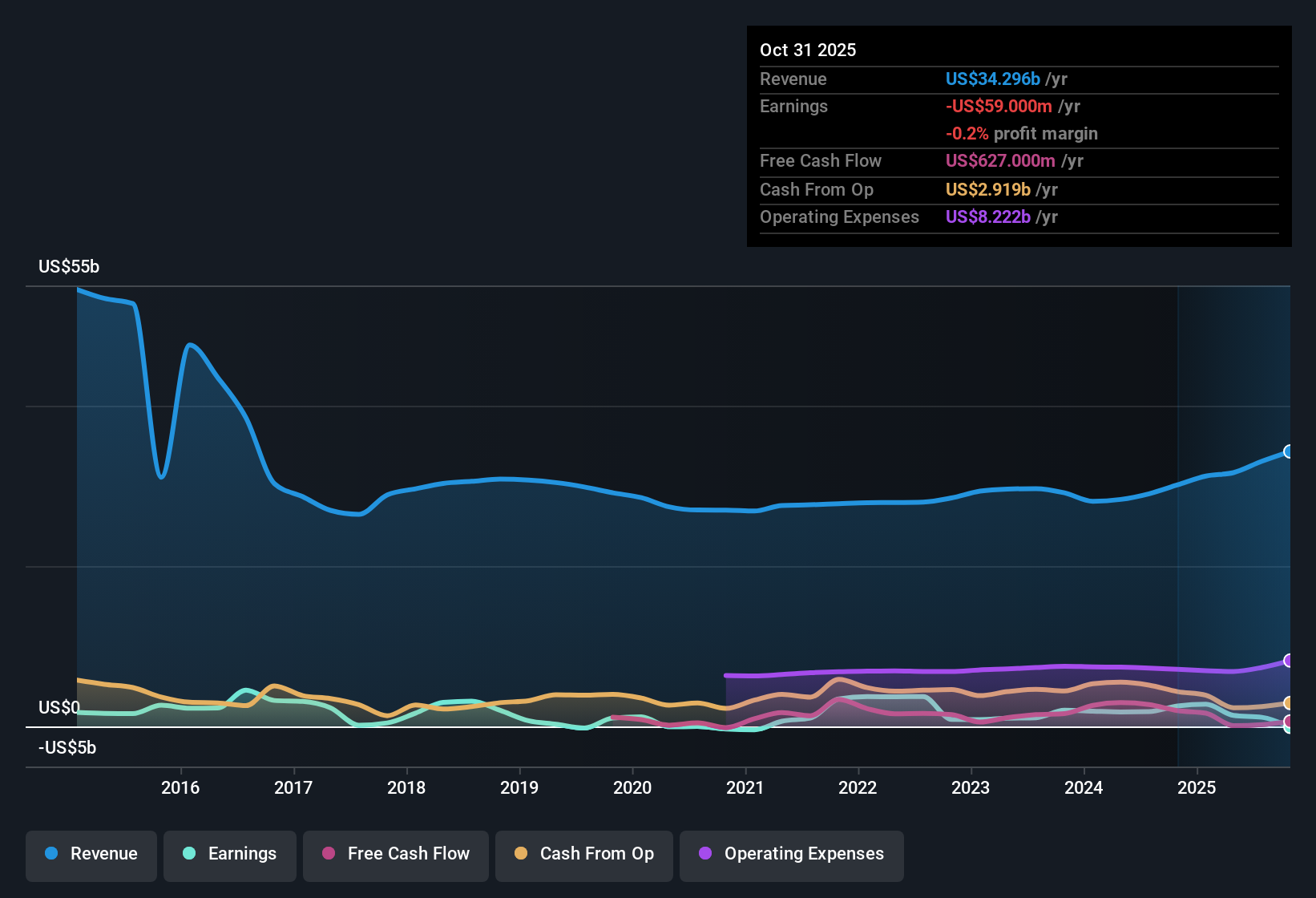

Hewlett Packard Enterprise (HPE) has wrapped up FY 2025 with fourth quarter revenue of $9.7 billion, Basic EPS of $0.11, and net income of $146 million, putting a spotlight on how its margins are holding up late in the fiscal year. The company has seen revenue move from $8.5 billion and Basic EPS of $1.02 in Q4 2024 to $9.7 billion and $0.11 in Q4 2025. Over the same period, trailing twelve month EPS has swung from $1.95 to slightly negative, setting up a nuanced debate around the trade off between top line scale and bottom line pressure. For investors, the latest print centers on how effectively HPE is converting that larger revenue base into sustainable profitability, with margins very much under the microscope.

See our full analysis for Hewlett Packard Enterprise.With the headline numbers on the table, the next step is to see how they line up with the dominant stories around HPE, highlighting where the fresh data backs the narrative and where it starts to push back.

See what the community is saying about Hewlett Packard Enterprise

TTM slips into a small $59 million loss

- On a trailing twelve month basis, HPE went from $2.6 billion net income in FY 2024 to a modest $59 million loss in FY 2025, even as revenue increased from $30.1 billion to $34.3 billion.

- Analysts' consensus narrative expects higher margin, recurring revenue to drive earnings recovery, yet the move from $2.6 billion profit to a slight loss highlights how the transition is still bumpy in the short term.

- Consensus points to margin expansion over time. However, FY 2025 net income dropping from $1.3 billion in Q4 2024 to $146 million in Q4 2025 shows profitability is not yet stable.

- The shift toward AI and cloud services is meant to enhance earnings quality, but current unprofitability on a TTM basis means those benefits are not fully visible in the reported numbers yet.

Volatile EPS masks steady top line

- Quarterly revenue climbed from $7.7 billion in Q3 2024 to $9.7 billion in Q4 2025, while Basic EPS swung from a Q2 2025 low of negative $0.82 to $0.11 in Q4 2025 and turned slightly negative at negative $0.04 on a trailing twelve month basis.

- Bulls see the forecast 43.18 percent annual earnings growth as proof that current EPS volatility is temporary, but the wide range from negative $0.82 in Q2 2025 to $1.02 in Q4 2024 shows how sensitive profits are to costs and one off items.

- Supporters argue that operational efficiencies and cost programs will smooth this out. Yet the TTM EPS drop from $1.95 in Q4 2024 to negative $0.04 in Q4 2025 underscores how much work remains.

- Expected margin gains from AI, networking and services need to translate into more consistent quarterly EPS before that bullish path looks fully backed by the reported figures.

Cheap on sales, but cash coverage is thin

- At a share price of $23.33, HPE trades at about 0.9 times sales and roughly 33 percent below a DCF fair value of $34.91, while still being unprofitable on a trailing twelve month basis.

- Bears focus on the fact that dividends and debt are not well covered by earnings or operating cash flow, and the combination of a $59 million TTM loss with a 2.23 percent dividend yield supports that concern.

- Critics point out that weak debt coverage by operating cash flow limits flexibility, even if the stock screens as inexpensive on price to sales versus the tech industry and peers.

- Recent insider selling over the past three months adds another caution flag for those who worry that leverage and cash coverage could constrain how quickly HPE can convert its strategic bets into durable shareholder returns.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hewlett Packard Enterprise on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on the latest figures, shape a concise story in just a few minutes, and Do it your way.

A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

HPE's thin cash coverage, unstable profitability and recent insider selling raise questions about how resilient its balance sheet is through the next cycle.

If that level of strain feels uncomfortable, use our solid balance sheet and fundamentals stocks screener (1941 results) today to quickly zero in on businesses with stronger finances and more dependable cushions against downturns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026