- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Did Changing Sentiment Drive Hewlett Packard Enterprise's Share Price Down By 14%?

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Hewlett Packard Enterprise Company (NYSE:HPE) share price is down 14% in the last year. That's well bellow the market return of 5.3%. On the bright side, the stock is actually up 2.6% in the last three years. There was little comfort for shareholders in the last week as the price declined a further 2.3%.

View our latest analysis for Hewlett Packard Enterprise

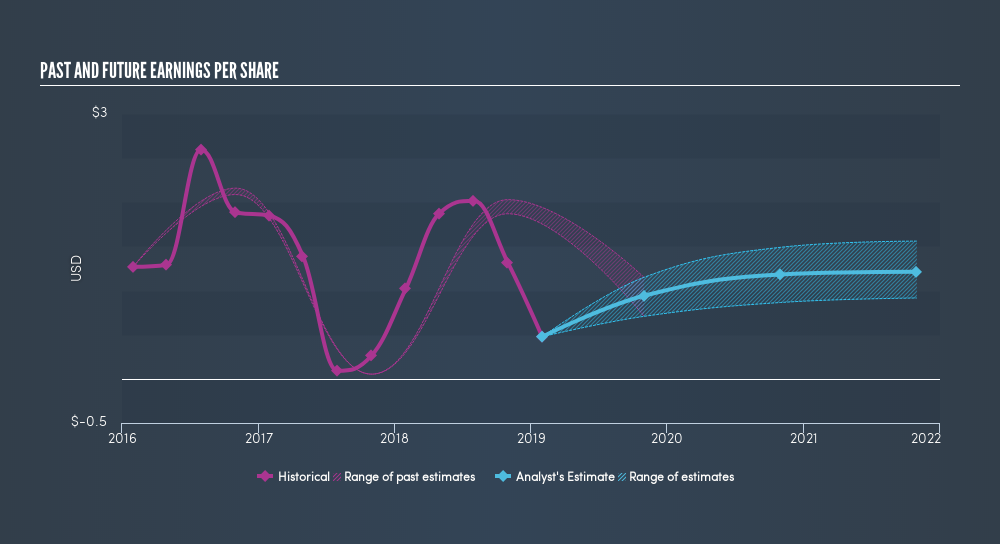

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unhappily, Hewlett Packard Enterprise had to report a 53% decline in EPS over the last year. This fall in the EPS is significantly worse than the 14% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our freereport on Hewlett Packard Enterprise's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Hewlett Packard Enterprise's TSR for the last year was -11%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Over the last year, Hewlett Packard Enterprise shareholders took a loss of 11%, including dividends. In contrast the market gained about 5.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 23% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before forming an opinion on Hewlett Packard Enterprise you might want to consider these 3 valuation metrics.

We will like Hewlett Packard Enterprise better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives