- United States

- /

- Biotech

- /

- NasdaqGS:LEGN

High Growth Tech Stocks in the United States to Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped by 1.0%, but it has experienced a robust growth of 30% over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that can capitalize on technological advancements and maintain strong performance despite short-term market fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Sarepta Therapeutics | 23.90% | 42.65% | ★★★★★★ |

| Clene | 78.50% | 60.70% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Blueprint Medicines | 25.47% | 68.62% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 249 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

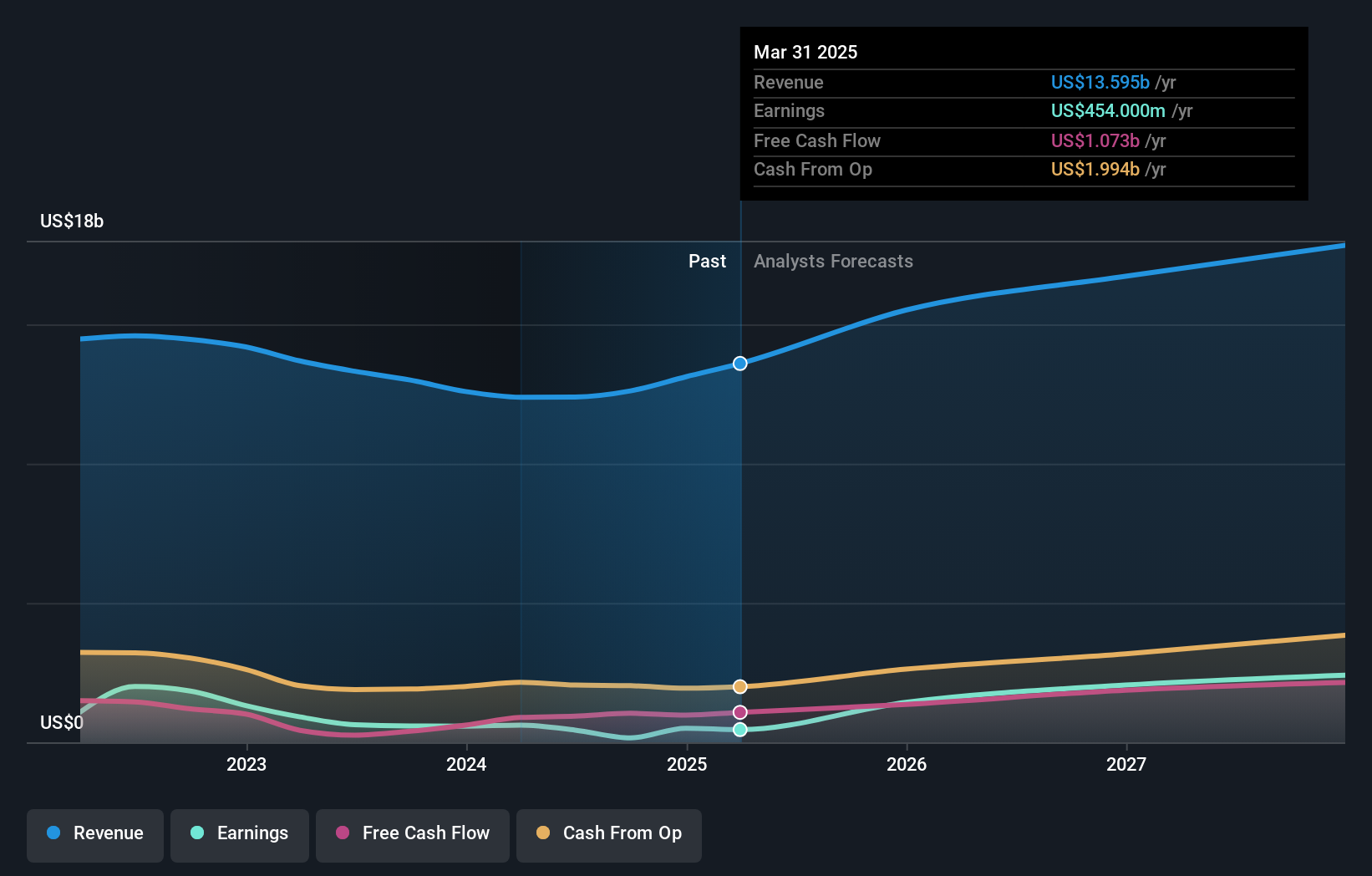

Legend Biotech (NasdaqGS:LEGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Legend Biotech Corporation is a clinical-stage biopharmaceutical company focused on discovering, developing, manufacturing, and commercializing novel cell therapies for oncology and other indications globally, with a market cap of approximately $7.04 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $520.18 million. Its operations span the United States, China, and other international markets.

Legend Biotech's commitment to innovation is underscored by its recent establishment of a new R&D facility in Philadelphia, signaling an expansion in its capabilities to advance next-generation cell therapies. This move complements the company's robust investment in research, with R&D expenses constituting a significant portion of revenue, reflecting a strategic focus on sustaining its pipeline's growth and addressing complex medical needs. Despite reporting a net loss, Legend Biotech has shown remarkable revenue growth from $205.68 million to $440.72 million year-over-year, demonstrating potential in its operational scaling and market penetration. The approval and success of CARVYKTI® further illustrate Legend’s pivotal role in transforming treatment paradigms for multiple myeloma through advanced cell therapy technologies.

- Click here and access our complete health analysis report to understand the dynamics of Legend Biotech.

Explore historical data to track Legend Biotech's performance over time in our Past section.

Corning (NYSE:GLW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corning Incorporated operates in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences sectors globally and has a market capitalization of approximately $40.49 billion.

Operations: Corning generates revenue primarily from five segments: optical communications ($4.19 billion), display technologies ($3.77 billion), specialty materials ($1.98 billion), environmental technologies ($1.70 billion), and life sciences ($971 million). The company's diverse operations span across multiple industries, contributing to its substantial market presence globally.

Corning's strategic focus on R&D, with a notable 9.9% of revenue directed towards these efforts, underscores its commitment to technological advancement and market competitiveness. This investment has propelled a forecasted annual earnings growth of 41.9%, positioning the company well above the industry norm. Additionally, Corning's recent agreement with AT&T to supply cutting-edge fiber solutions for broadband expansion reflects its pivotal role in supporting next-gen telecommunications infrastructure, aligning with broader industry shifts towards enhanced connectivity solutions. Despite a challenging financial year marked by significant one-off losses and a net profit margin contraction to 1.2%, these developments suggest robust potential for recovery and growth driven by innovation and strategic partnerships.

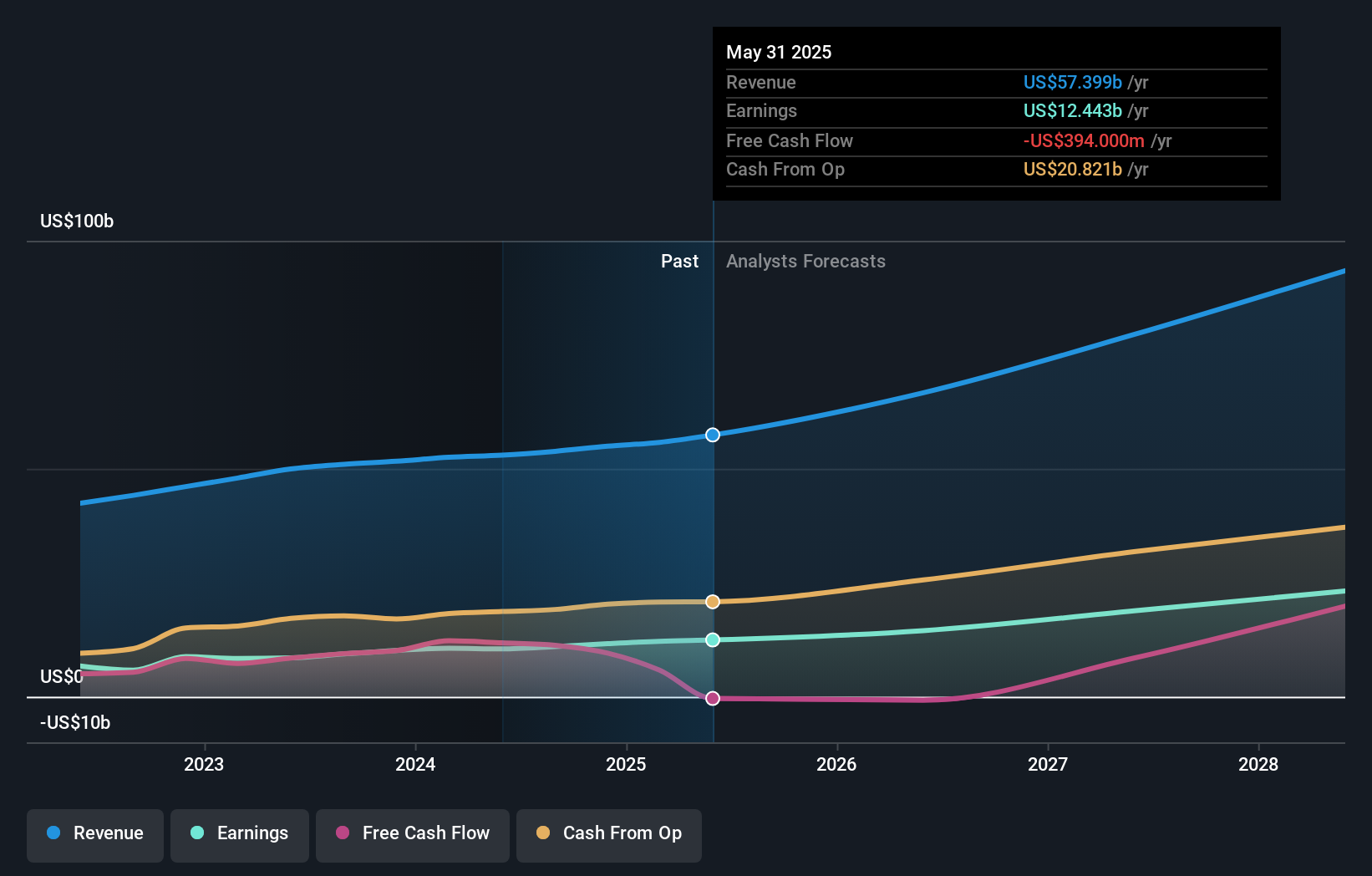

Oracle (NYSE:ORCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oracle Corporation provides a range of products and services for enterprise information technology environments globally, with a market capitalization of $523.45 billion.

Operations: The company generates revenue through three primary segments: Cloud and License ($45.50 billion), Services ($5.31 billion), and Hardware ($3.01 billion). The Cloud and License segment is the largest contributor to its revenue stream.

Oracle's strategic emphasis on cloud migration and AI integration, as evidenced by its extensive global expansion of Oracle Database@Azure, underscores its commitment to innovation and market adaptability. With R&D expenses reaching 16.5% of revenue, the company not only enhances its product offerings but also secures a competitive edge in the tech landscape. Moreover, Oracle's recent client acquisitions like Vodafone highlight its capability to meet complex data needs across industries, positioning it favorably for sustained growth in diverse markets.

- Click to explore a detailed breakdown of our findings in Oracle's health report.

Examine Oracle's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Delve into our full catalog of 249 US High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LEGN

Legend Biotech

A clinical-stage biopharmaceutical company, through its subsidiaries, engages in the discovery, development, manufacturing, and commercialization of novel cell therapies for oncology and other indications in the United States, China, and internationally.

High growth potential and good value.