Corning (NYSE:GLW) Announces US$0.28 Quarterly Dividend Payment

Reviewed by Simply Wall St

Corning (NYSE:GLW) has reaffirmed its commitment to shareholders by declaring a quarterly dividend of $0.28 per share, set for payment on September 29, 2025. This announcement aligns with the company’s 10% share price increase over the last quarter. The rise can be viewed in the context of broader market trends, where an overall 12% market uptick in the past year frames Corning's performance. Notably, collaborations with Broadcom and Samsung, as well as a strategic share buyback plan, have contributed positively, supporting the company's progression and stability amidst favorable market conditions.

Corning has 5 warning signs we think you should know about.

Corning's recent dividend announcement underscores its commitment to shareholder returns, evidenced by a 131.03% total return over the past five years. The dividend aligns with a 10% quarterly share price rise amid a 12% year-on-year market increase. Over the past year, Corning outperformed both the US Electronic industry, which returned 22.2%, and the broader US market, which returned 12%. This signals robust shareholder confidence and positive sentiment.

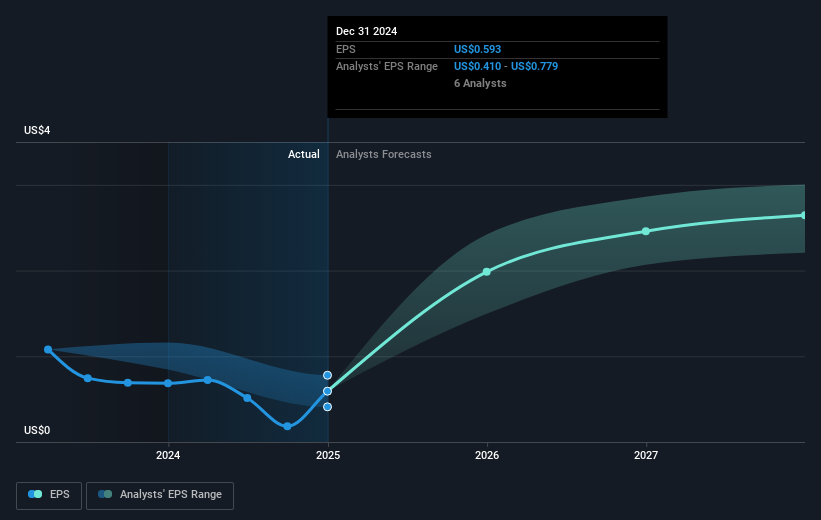

The company's moves in the Optical Communications and Solar sectors suggest strong revenue growth potential. Collaborations with Broadcom and Samsung, and an aggressive share buyback plan, corroborate its growth objectives. Analysts expect annual revenue growth of 10.7% over the next three years and an increase in profit margins from 3.3% to 12.7%, indicating a positive earnings outlook. The interplay of these expectations with market trends supports the narrative that Corning is poised for continued growth.

However, the current share price of US$44.76 is trading at a discount to the consensus price target of US$51.99, reflecting a potential upside of 13.9%. It implies that market participants see room for future revaluation based on expected earnings improvements and strategic initiatives. Corning's projected earnings gains offer a pathway towards achieving the analysts' price target, contingent on maintaining forecasted revenue and profitability metrics. Investors should carefully monitor how these developments unfold relative to the broader market and industry conditions.

Our valuation report here indicates Corning may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Engages in the optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally.

High growth potential moderate and pays a dividend.

Similar Companies

Market Insights

Community Narratives