- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Is Dell a Rare Bargain After an 18% Price Pullback and AI Infrastructure Headlines?

Reviewed by Bailey Pemberton

- Wondering if Dell Technologies stock is a rare bargain or if it has become too hot to handle? Let's dig into what savvy investors should know before making their next move.

- Dell's price has seen some turbulence this year, with a solid 5.1% gain year-to-date, but recent pullbacks of 18.1% over the last month and 14.2% in just the last week leave some investors questioning if opportunity or new risks lie ahead.

- Lately, headlines have focused on Dell's role in AI infrastructure and big partnerships in the enterprise tech space. This has fueled analyst debates about its position among major tech players. Investor sentiment seems to be shifting along with industry buzz and evolving hardware trends.

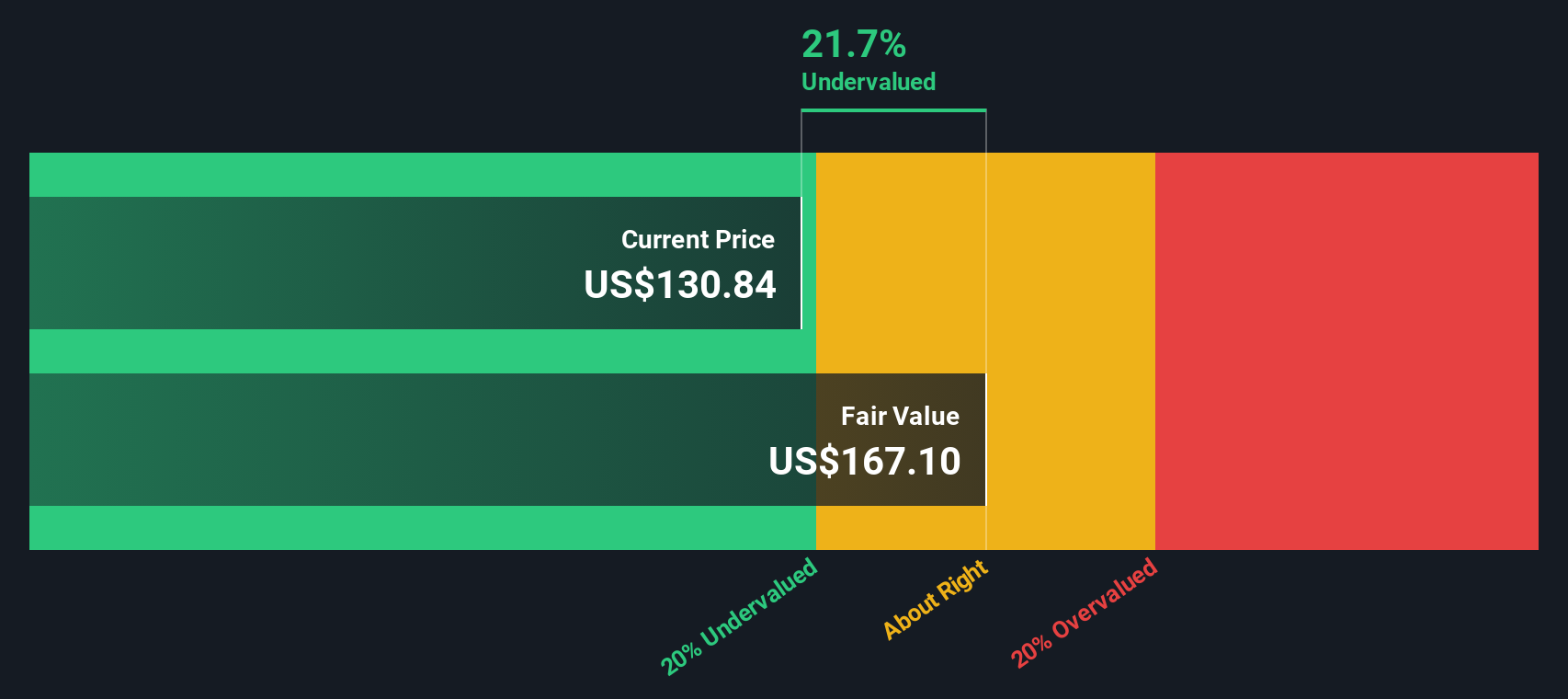

- Despite the volatility, Dell scores a perfect 6 out of 6 on our valuation checks, suggesting it is undervalued by almost every metric we track. Next, we will walk through various ways to assess Dell's fair value, and stick around for an even smarter approach that could give you the edge at the end of this article.

Find out why Dell Technologies's -8.3% return over the last year is lagging behind its peers.

Approach 1: Dell Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates Dell Technologies’ intrinsic value by projecting its future cash flows and discounting them back to their value today. This helps investors gauge a company's worth based on how much cash it is expected to generate in the future, adjusted to present-day dollars.

For Dell, current Free Cash Flow stands at $4.59 billion. Analysts project that over the next decade, this figure will grow steadily, with estimates reaching $8.52 billion by 2030. The first five years rely on direct analyst estimates, while subsequent years are projected by Simply Wall St. The DCF model here uses a 2 Stage Free Cash Flow to Equity approach, factoring in both near-term analyst projections and extrapolated longer-term growth.

Based on this methodology, Dell’s intrinsic value per share is calculated at $188.17. Compared to the stock’s current market price, this implies the shares are trading at a 34.9% discount, signaling that Dell Technologies could be significantly undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dell Technologies is undervalued by 34.9%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: Dell Technologies Price vs Earnings (P/E)

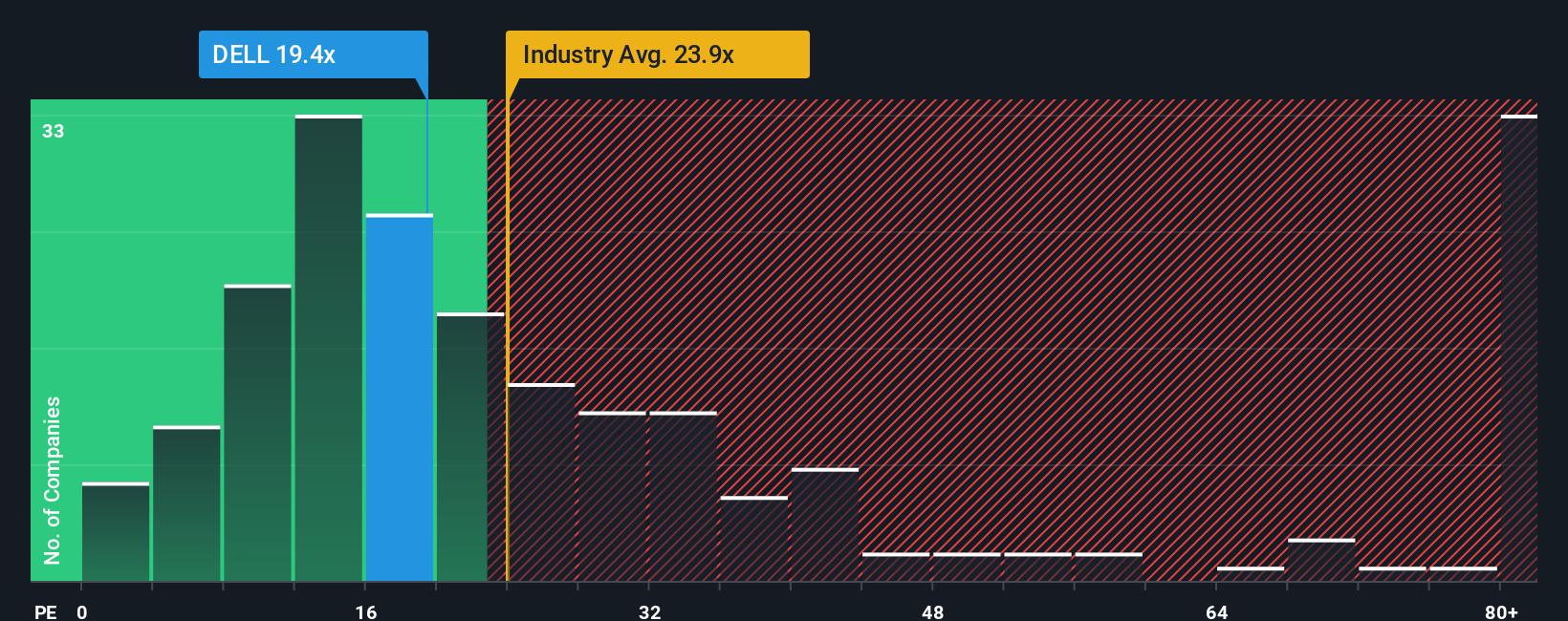

The Price-to-Earnings (P/E) ratio is a classic valuation metric that works especially well for profitable companies like Dell Technologies. It tells investors how much they are paying for each dollar of a company’s earnings, which is useful for quickly assessing whether that price makes sense given its growth profile and risks.

What counts as a “normal” or “fair” P/E ratio depends on a company’s outlook. Fast-growing companies or those with stable, predictable profits often command higher multiples, while businesses facing uncertainty or declining prospects tend to trade at lower ones. Investors look at industry averages, peer groups, and internal risk factors to decide where a company should fit.

Dell’s current P/E ratio sits at 17x. This is lower than both the Tech industry average of 22x and the average P/E ratio of its closest peers at 22x. At first glance, that suggests Dell is trading at a discount. However, Simply Wall St’s proprietary “Fair Ratio” model assigns Dell a fair P/E of 39x, which considers specifics like the company’s growth potential, profit margins, market cap, risk profile, and its position within the industry.

Unlike a simple comparison to industry averages or peers, the Fair Ratio approach delivers a smarter benchmark because it weighs the factors that matter for Dell’s unique investment case, including stable earnings, attractive margins, or a different risk outlook. This means we get a fairer view for modern investors, rather than relying strictly on broad market comparisons.

With Dell’s current P/E ratio at 17x and a Fair Ratio of 39x, shares appear to be trading well below what would be considered fair value, pointing to a potential opportunity for investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dell Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your own story about what the future holds for Dell Technologies. It is where you combine your expectations for growth, profit margins, and risks into a clear, easy-to-understand forecast that connects directly to an updated fair value.

Narratives help you bridge the gap between the numbers and what is really happening in the business by linking Dell’s story to a financial forecast and then to a fair value. Anyone can create one, and millions of investors are already using Narratives as a dynamic tool on Simply Wall St’s Community page.

This means you can compare your personal fair value to the current price, and see how your outlook stacks up against other investors. Narratives are living forecasts, automatically updated in real-time whenever new information comes in, like fresh earnings or news headlines.

For example, looking at recent analyst Narratives for Dell Technologies, the most bullish investors see a fair value as high as $180, expecting sustained AI momentum and margin expansion. More cautious investors see a fair value closer to $104, reflecting risks from competitive pressures and uncertainty in key markets.

Do you think there's more to the story for Dell Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026