- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Dell Technologies (DELL) Enhances AI Data Platform With New NVIDIA Collaboration

Reviewed by Simply Wall St

Dell Technologies (DELL) announced significant enhancements to its AI Data Platform, intended to improve handling of unstructured data critical for AI workloads. This, along with the launch of new high-performance servers, showcases the company's commitment to AI innovation. The company's stock rose 28% over the last quarter, a movement likely influenced by these technological advancements amidst a broader market rally. While the S&P 500 and Nasdaq reached all-time highs driven by favorable inflation data and prospects of Fed rate cuts, Dell's product advancements likely added positive weight to its stock performance within this optimistic market context.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

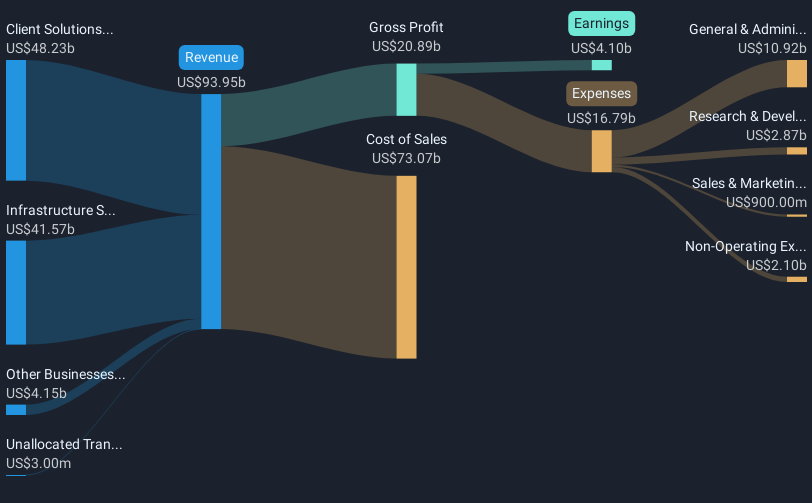

With Dell Technologies enhancing its AI Data Platform and launching high-performance servers, these developments could bolster the company's narrative of focusing on AI and storage technologies to drive revenue growth and profitability. Over the past five years, Dell's total shareholder return, including dividends, was a very large 397.92%, showcasing a substantial outperformance in the US Tech industry compared to the broader market. Over the past year, Dell exceeded the US Tech industry return of 4.7% and the US market return of 19.4%, indicating strong relative performance.

The recent advancements in AI technology potentially impact Dell's revenue and earnings forecasts positively, aligning with the anticipated increase in AI server shipments and enhanced storage solutions profitability. The strong emphasis on AI positions Dell to capitalize on growth opportunities, which may improve profit margins over time. However, risks such as competitive pricing and changes in demand need consideration as they can influence future projections.

Concerning share price, Dell's current price of $138.32 is slightly below the consensus analyst price target of $139.71 by approximately 0.01%. This marginal disparity suggests that analysts perceive Dell to be nearly fairly priced under current expectations. Investors should continue to assess evolving market dynamics and internal company developments that may impact future valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives