Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Diebold Nixdorf, Incorporated (NYSE:DBD) shareholders will doubtless be very grateful to see the share price up 134% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Like a ship taking on water, the share price has sunk 77% in that time. While the recent increase might be a green shoot, we're certainly hesitant. The fundamental business performance will ultimately determine if the turnaround can be sustained.

View our latest analysis for Diebold Nixdorf

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed, is to compare the earnings per share (EPS) with the share price.

Over five years Diebold Nixdorf improved its earnings per share from a loss-making position. That would generally be considered a positive, so we are surprised to see the share price is down.

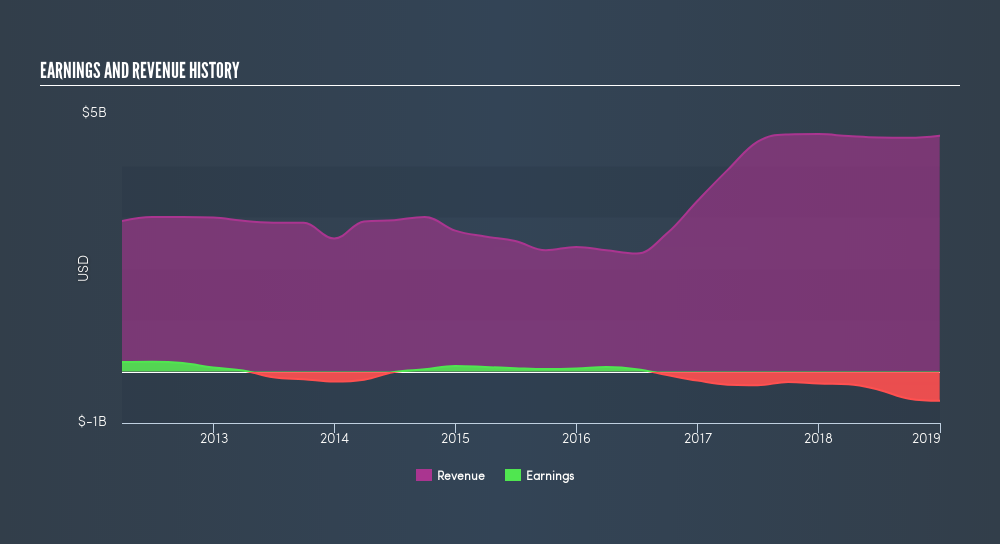

In contrast to the share price, revenue has actually increased by 15% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Diebold Nixdorf will earn in the future (free profit forecasts)

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Over the last 5 years, Diebold Nixdorf generated a TSR of -74%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

Investors in Diebold Nixdorf had a tough year, with a total loss of 41%, against a market gain of about 4.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 24% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Diebold Nixdorf by clicking this link.

Diebold Nixdorf is not the only stock insiders are buying. So take a peek at this freelist of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:DBDQ.Q

Diebold Nixdorf

Engages in the automating, digitizing, and transforming the way people bank and shop worldwide.

Undervalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives