- United States

- /

- Tech Hardware

- /

- NYSE:DBD

How Investors Are Reacting To Diebold Nixdorf (DBD) Leadership Reshuffle Amid Geopolitical Uncertainty

Reviewed by Sasha Jovanovic

- In early October 2025, Diebold Nixdorf announced a series of executive leadership changes, including Frank Baur's upcoming appointment as Chief Operating Officer, the creation of a chief revenue officer role for Joe Myers, and expanded administrative responsibilities for Lisa Radigan.

- This leadership restructuring comes at a time of heightened geopolitical uncertainty, as global technology companies face both supply chain challenges and opportunities for accelerated innovation.

- With new senior leaders stepping in while US-China trade tensions escalate, we'll explore how these developments may shape Diebold Nixdorf's investment outlook.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Diebold Nixdorf Investment Narrative Recap

To be a Diebold Nixdorf shareholder, you need to believe in the company’s ability to expand recurring software and services revenue while maintaining leadership in physical banking and retail automation solutions. Recent leadership changes signal a push for operational efficiency and sales acceleration, but the most important short-term catalyst remains the November 5 earnings report. The biggest immediate risk is supply chain or margin pressures from escalating US-China trade tensions; the executive appointments themselves are not likely to materially change this risk or near-term performance drivers.

The appointment of Joe Myers as Chief Revenue Officer stands out, since his focus will be on expanding the global sales pipeline, a direct link to Diebold Nixdorf’s efforts to drive recurring, higher-margin contracts in both banking and retail automation. While renewed tariffs and trade-related uncertainty may pressure hardware margins or delay institutional contract wins, these operational adjustments aim to put the company in a stronger position to weather external shocks and take advantage of market opportunities.

Yet, against these operational efforts, investors should also be aware that rising geopolitical risks could still...

Read the full narrative on Diebold Nixdorf (it's free!)

Diebold Nixdorf's narrative projects $4.2 billion revenue and $312.7 million earnings by 2028. This requires 4.3% yearly revenue growth and a $325.6 million increase in earnings from the current -$12.9 million.

Uncover how Diebold Nixdorf's forecasts yield a $75.67 fair value, a 32% upside to its current price.

Exploring Other Perspectives

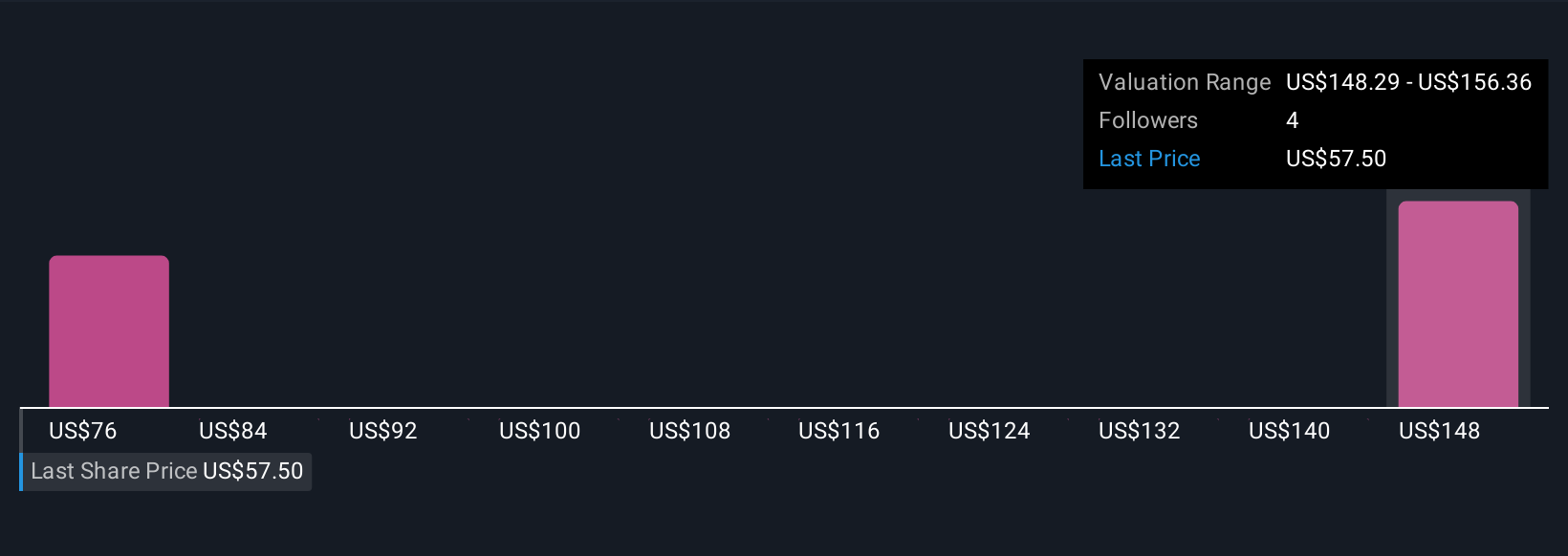

Community members at Simply Wall St posted fair value estimates for Diebold Nixdorf ranging from US$75.67 to US$156.04 across two opinions. While many see long-term catalysts in automation and services, a key risk cited is the accelerating shift to branchless digital banking, which may limit growth in physical channel solutions. Explore their alternative views to broaden your outlook.

Explore 2 other fair value estimates on Diebold Nixdorf - why the stock might be worth over 2x more than the current price!

Build Your Own Diebold Nixdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diebold Nixdorf research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Diebold Nixdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diebold Nixdorf's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBD

Diebold Nixdorf

Engages in the automating, digitizing, and transforming the way people bank and shop worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives