- United States

- /

- Tech Hardware

- /

- OTCPK:DBDQ.Q

Easy Come, Easy Go: How Diebold Nixdorf (NYSE:DBD) Shareholders Got Unlucky And Saw 75% Of Their Cash Evaporate

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Diebold Nixdorf, Incorporated (NYSE:DBD) for five whole years - as the share price tanked 75%. And it's not just long term holders hurting, because the stock is down 21% in the last year. Even worse, it's down 9.8% in about a month, which isn't fun at all. But this could be related to poor market conditions -- stocks are down 5.5% in the same time.

Check out our latest analysis for Diebold Nixdorf

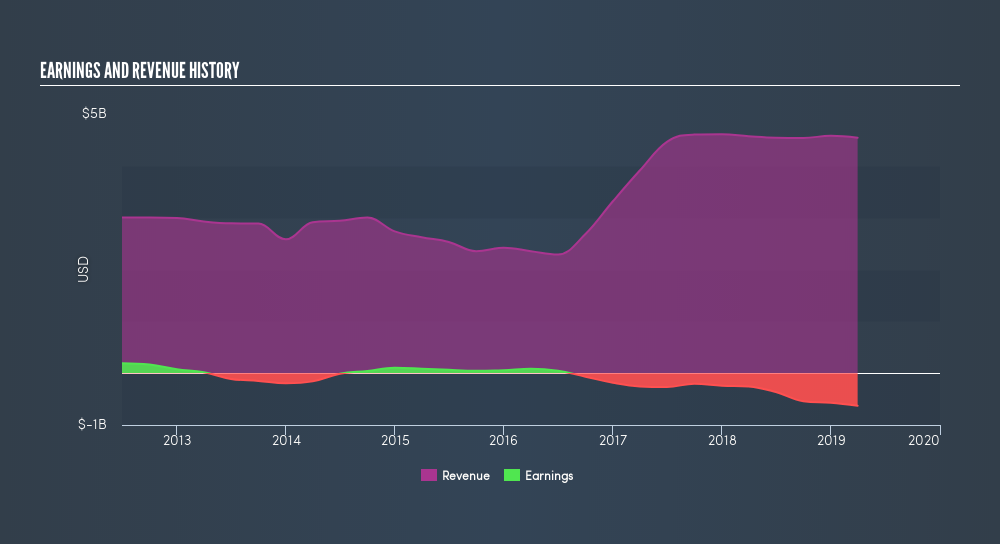

Given that Diebold Nixdorf didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Diebold Nixdorf grew its revenue at 15% per year. That's a fairly respectable growth rate. So the stock price fall of 25% per year seems pretty steep. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Diebold Nixdorf will earn in the future (free profit forecasts).

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. In some ways, TSR is a better measure of how well an investment has performed. Over the last 5 years, Diebold Nixdorf generated a TSR of -73%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

Diebold Nixdorf shareholders are down 21% for the year, but the market itself is up 2.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 23% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:DBDQ.Q

Diebold Nixdorf

Engages in the automating, digitizing, and transforming the way people bank and shop worldwide.

Undervalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives