CTS (CTS) Narrative Overview: Key Factors Driving Valuation

Correction: Previous versions of this article published on September 21st and 23rd incorrectly attributed an internet and broadband expansion program to CTS Corporation (NYSE:CTS). The program was undertaken by CTS Telecom (which was acquired by MetroNet in 2021). CTS Corporation is a separate and unrelated entity and was not involved in the program. We apologize for any confusion.

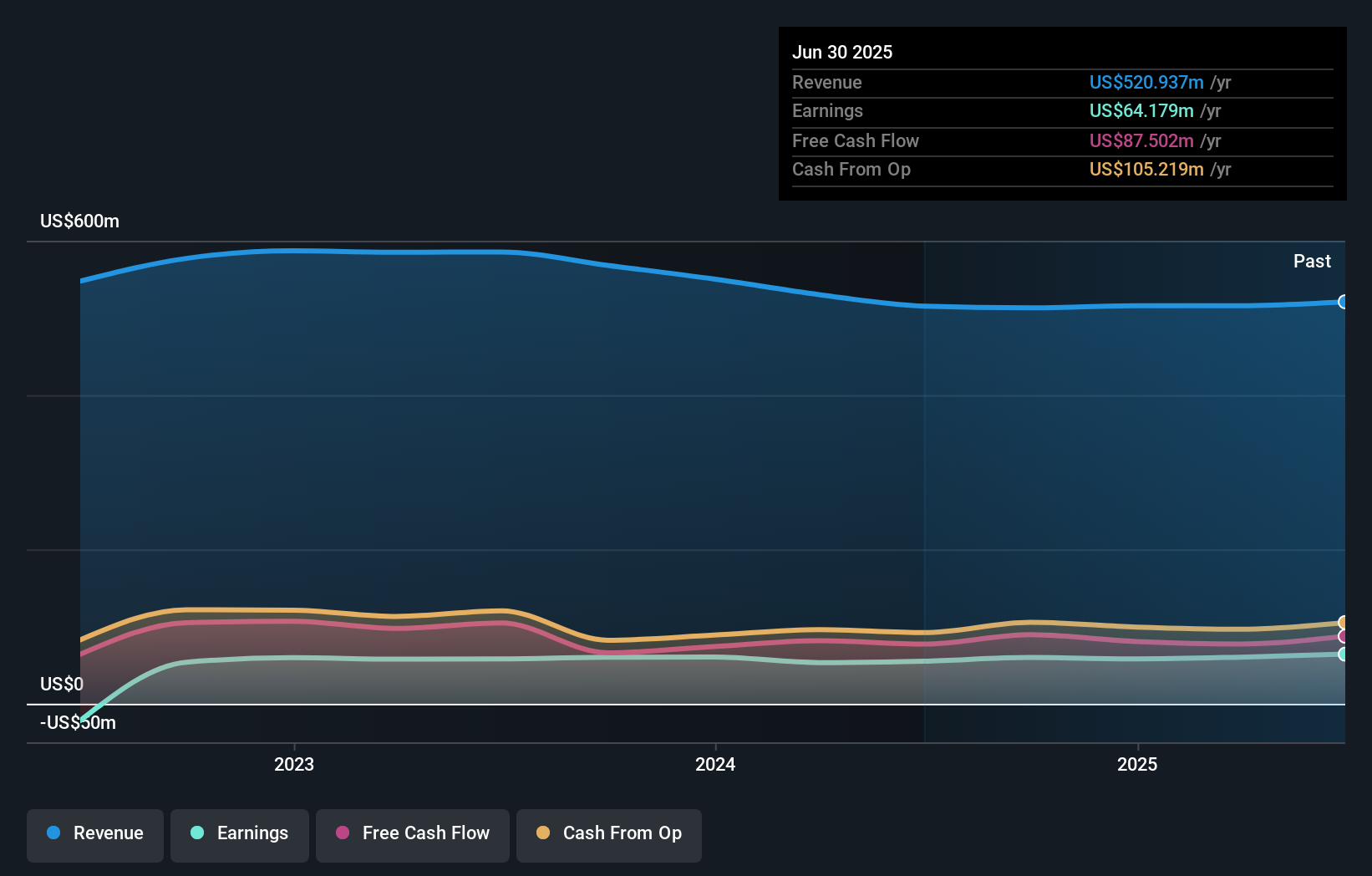

CTS is coming off a mixed year for shareholders. The stock is down about 19% in 2024 and lost 12% over the past twelve months, showing a steady, if not dramatic, drift lower. Over the past five years, though, CTS has provided a nearly ninefold return, so anyone holding long term has seen considerable upside. The company is also growing both revenue and profits annually, though the pace is steady rather than rapid.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery . The best part - they are all under $10b in market cap - there's still time to get in early.

CTS Investment Narrative Recap

The latest quarterly earnings report (July 2025) highlighted growth in both sales and earnings, reaffirming management’s confidence with a maintained full-year sales guidance of US$520 million to US$550 million.

However, investors should be careful not to overlook the impact of continued transportation market weakness...

Read the full narrative on CTS (it's free!)

CTS is expected to reach $610.6 million in revenue and $78.8 million in earnings by 2028. This outlook relies on an annual revenue growth rate of 5.4% and a $14.6 million increase in earnings from the current $64.2 million.

Uncover how CTS' forecasts yield a $43.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community valued CTS at US$43.00, leaving no range of estimates to compare. While opinions may be closely grouped, continued softness in transportation sales remains a critical factor influencing future performance and should be considered alongside these views.

Build Your Own CTS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CTS research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free CTS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CTS' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTS

CTS

Designs, manufactures, and sells sensors, connectivity components, and actuators in North America, Europe, and Asia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion