Evaluating Coherent (COHR) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Coherent.

Coherent’s recent share price surge adds to an already strong year. Momentum has accelerated in recent weeks, bringing its year-to-date share price return up to nearly 20%, with a total shareholder return over the past year of 24%. That combination of short-term gains and robust long-term performance suggests investors are responding to renewed optimism about the company’s future, perhaps reassessing its growth prospects and risk profile.

If Coherent’s upward trajectory has you curious about what else is gaining ground, this is the perfect moment to broaden your search and discover See the full list for free..

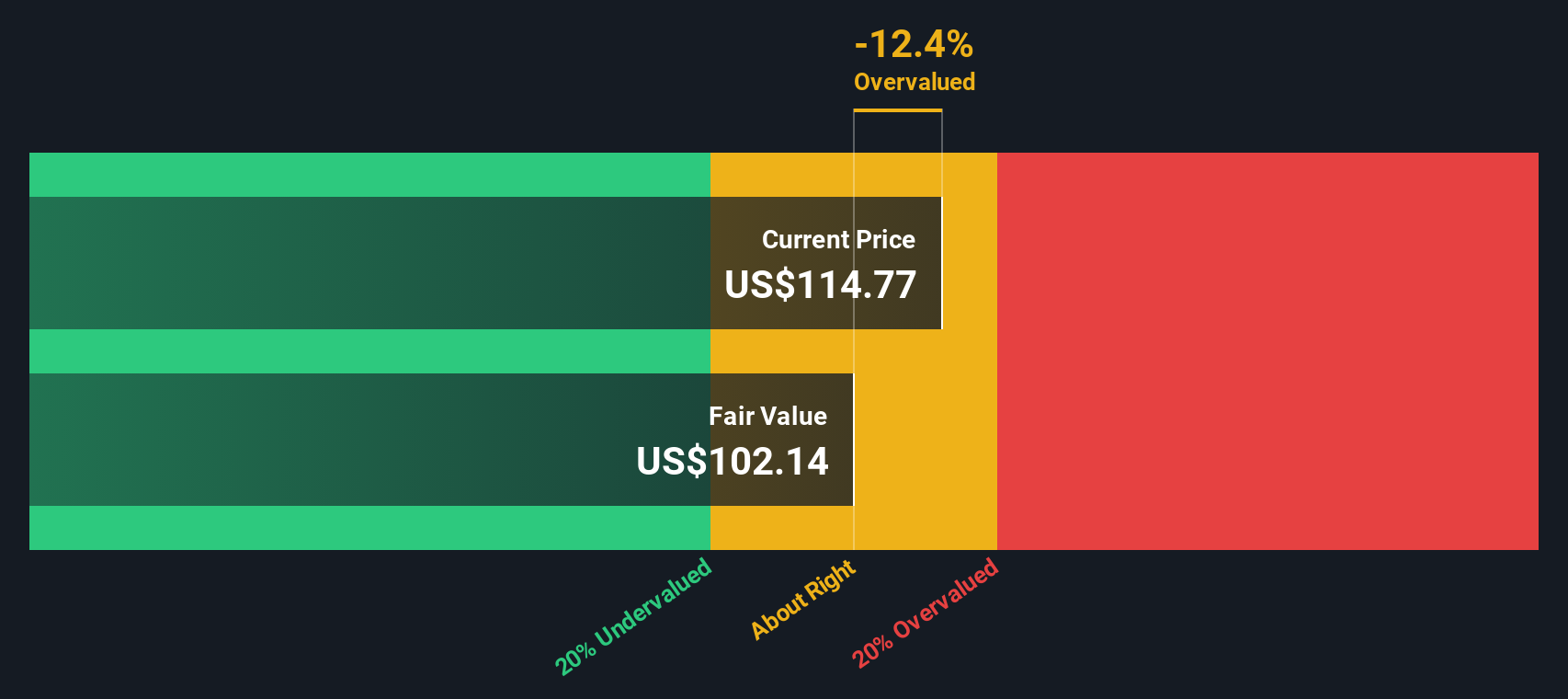

But with shares climbing higher, is Coherent still trading at an attractive valuation, or have recent gains brought its price in line with future expectations? Investors must ask whether there is genuine upside left or if the market has already priced in the company’s next chapter.

Most Popular Narrative: 4.5% Overvalued

With Coherent closing at $120.20 per share, the most widely-followed narrative consensus pins its fair value slightly lower. This highlights a modest disconnect between recent optimism and calculated fundamentals and sets the stage for a closer look at the drivers and expectations supporting this view.

The ongoing expansion of AI datacenter infrastructure and high-performance computing is propelling structural growth in demand for advanced optical transceivers (800G, 1.6T, and beyond), optical circuit switches, and related photonics components. This is fueling robust sequential order growth and sustained revenue momentum in Coherent's datacom and communications business.

What is the secret sauce behind Coherent’s punchy valuation? The narrative leans into aggressive profit turnaround forecasts and a major boost in margins, all hinging on future tech demand and transformation. Want a peek at the precise assumptions and bold targets that justify this price? Find out what really powers this fair value outlook.

Result: Fair Value of $115 (OVERVALUE D)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained competition from low-cost rivals and potential revenue volatility in key segments could quickly challenge Coherent’s bullish narrative.

Find out about the key risks to this Coherent narrative.

Another View: Discounted Cash Flow Points to Upside

While the consensus narrative sees Coherent as 4.5% overvalued based on future earnings expectations, our SWS DCF model suggests the shares may actually be undervalued. The stock is currently trading about 7% below its estimated fair value of $129.35. Could the longer-term cash flow picture be more attractive than headline multiples indicate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coherent for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coherent Narrative

There’s always room for your own perspective. If you’re unconvinced by the latest consensus, dive into the numbers and shape your own thesis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Coherent.

Looking for More Investment Ideas?

Seize the opportunity to get ahead of the market with handpicked strategies that put tomorrow's winners at your fingertips. Don’t miss out. Step beyond the obvious and tap into these powerful trends today:

- Take advantage of unique growth opportunities by uncovering these 24 AI penny stocks driving innovation and shaping disruptive technology trends in artificial intelligence.

- Boost your potential returns with these 876 undervalued stocks based on cash flows that are flying under the radar and priced below their true worth, ready for savvy investors.

- Lock in reliable passive income streams by selecting these 17 dividend stocks with yields > 3% offering yields above 3%, perfect for building wealth while the market moves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion