Can Coherent (COHR) Leverage AI Data Center Demand to Redefine Its Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- Coherent Corp. recently announced it would release its financial results for the quarter ended September 30, 2025, on November 5 after the New York Stock Exchange closes, followed by a live audio webcast to discuss the results.

- An important insight from recent developments is Coherent's emergence as a critical supplier of fiber-optic transceivers and lasers for AI-driven data center infrastructure, spotlighting its rapid segment growth and alignment with major technology trends.

- We'll explore how Coherent's rising role in AI infrastructure demand may influence its long-term investment narrative and growth expectations.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coherent Investment Narrative Recap

To own shares in Coherent, you have to believe in the company's ability to capture ongoing AI datacenter growth and sustain its lead in advanced photonics, despite margin risks from aggressive Asian competitors. The announcement of an upcoming earnings call doesn’t materially change the core catalysts or the biggest risks, especially pricing pressure and product commoditization, which remain at the forefront for near-term performance.

Coherent’s roll-out of new optical technologies, including the dual laser QSFP28 DCO module and major upgrades to its multi-rail technology platform, continues to support the main catalyst of AI-driven datacenter demand. These product launches reinforce the company’s positioning but do not diminish the importance of monitoring margin resilience as industry competition heats up.

But before getting too comfortable, keep in mind that one risk every investor should be aware of is the threat from low-cost Asian competitors who...

Read the full narrative on Coherent (it's free!)

Coherent's outlook anticipates $7.7 billion in revenue and $732.0 million in earnings by 2028. This scenario assumes revenue grows 9.8% annually, with earnings rising by $812.6 million from the current level of -$80.6 million.

Uncover how Coherent's forecasts yield a $120.63 fair value, a 7% downside to its current price.

Exploring Other Perspectives

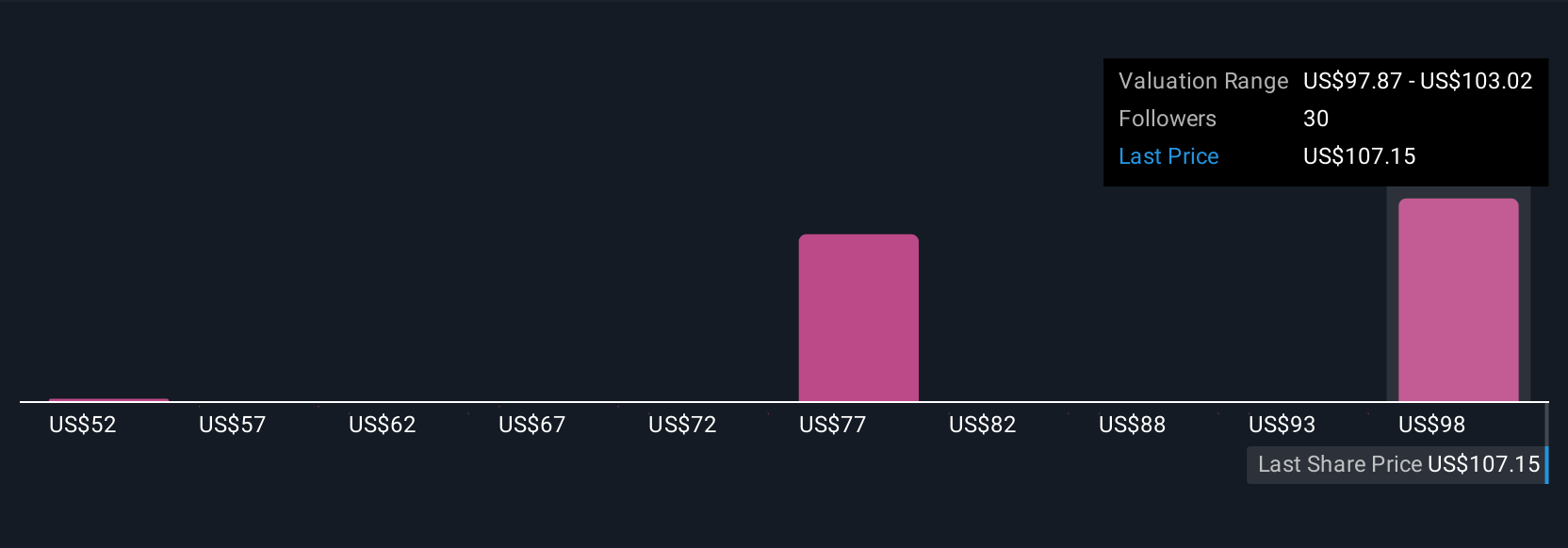

Six members of the Simply Wall St Community estimate Coherent’s fair value from US$51.56 to US$129.22 per share. Against mixed analyst projections and signs of margin compression, these differing views show how performance expectations can sharply vary, consider browsing these perspectives before deciding for yourself.

Explore 6 other fair value estimates on Coherent - why the stock might be worth as much as $129.22!

Build Your Own Coherent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coherent research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Coherent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coherent's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives