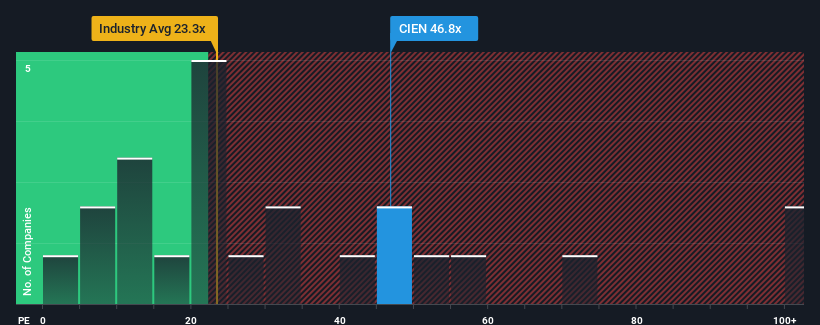

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Ciena Corporation (NYSE:CIEN) as a stock to avoid entirely with its 46.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Ciena has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Ciena

Is There Enough Growth For Ciena?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Ciena's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 55% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 34% each year as estimated by the analysts watching the company. With the market only predicted to deliver 10% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Ciena's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Ciena's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ciena maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Ciena with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Ciena. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives