- United States

- /

- Communications

- /

- NYSE:CIEN

Does Ciena’s Nubis Acquisition and Meta Partnership Redefine Its AI Ambitions for CIEN?

Reviewed by Sasha Jovanovic

- Ciena recently hosted its Investor Innovation Day, highlighting its expanded role in powering cloud and AI infrastructure, and announced the acquisition of Nubis Communications to further enhance its capabilities in scalable, low-latency data center environments.

- Partnership developments, such as the adoption of Ciena’s DCOM technology by Meta and hyperscalers' increasing interest, underscore the company’s growing influence within the AI-driven connectivity landscape.

- We'll examine how the Nubis acquisition and technology partnerships could strengthen Ciena's investment narrative amid surging cloud and AI network demand.

Find companies with promising cash flow potential yet trading below their fair value.

Ciena Investment Narrative Recap

To be a shareholder in Ciena today, you have to believe in the company's ability to capitalize on soaring demand for cloud and AI-driven networking, powered by deep relationships with hyperscalers. While the Nubis acquisition gives Ciena enhanced capabilities inside data centers, a short-term catalyst, its heavy revenue concentration among a handful of large cloud customers remains the most prominent risk, with order reductions or competitive displacement posing outsized threats to near-term results. The impact of the Nubis acquisition does not fundamentally alter this customer risk for now.

The co-design agreement with Meta for Ciena's DCOM technology, which delivers significant space and power savings across new Meta facilities, stands out as a key recent announcement that aligns with the major cloud investment cycle. This development could reinforce Ciena's share of large hyperscaler contracts, highlighting its relevance as new requirements for efficient, high-capacity interconnects fuel market expansion.

But even with these promising wins and new deals, investors should pay close attention to the risks stemming from revenue concentration among just a few hyperscaler customers...

Read the full narrative on Ciena (it's free!)

Ciena's outlook anticipates $6.5 billion in revenue and $590.5 million in earnings by 2028. This requires 12.5% annual revenue growth and a $449.6 million increase in earnings from the current level of $140.9 million.

Uncover how Ciena's forecasts yield a $127.22 fair value, a 10% downside to its current price.

Exploring Other Perspectives

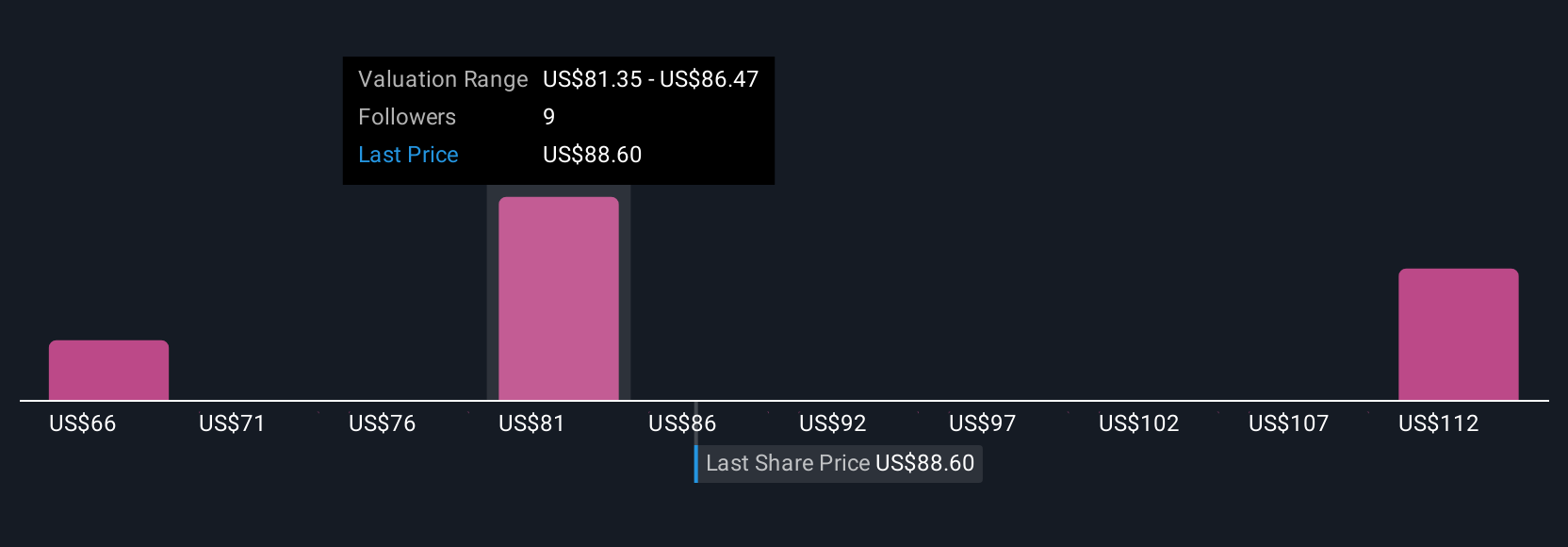

Five private investor fair value estimates from the Simply Wall St Community range from US$67.93 to US$127.22 per share. As you consider these diverse views, remember that Ciena’s exposure to large cloud customers could mean performance swings if their spending habits change.

Explore 5 other fair value estimates on Ciena - why the stock might be worth as much as $127.22!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion